Question

In 2019, Fairfield Food plc acquired a popular brand name. At 31 December 2020, the brand represented 20% of non-current assets. The remaining 80% of

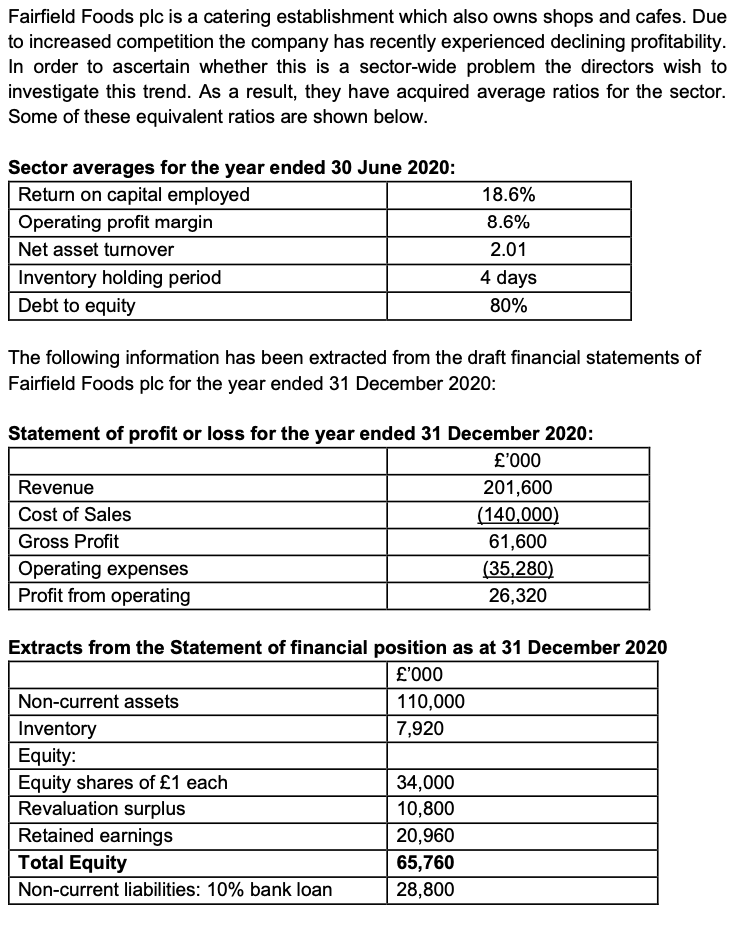

In 2019, Fairfield Food plc acquired a popular brand name. At 31 December 2020, the brand represented 20% of non-current assets. The remaining 80% of non-current assets comprises the property from which Fairfield Foods operates and its shops and cafes. This property is owned by Fairfield Foods plc and has no directly associated finance. The property was revalued in 2019.

In January 2021, it was decided to discount some slow-moving seasonal inventory which had a selling price of 3m. Under normal circumstances these would have a gross margin of 20%. The inventory was sold in January 2021 for 50% of what it had cost to produce. The financial statements for the year ended 31 December 2020 were authorised for issue on 15 March 2021.

Required:

-To adjust for the information on discounted inventories in note 2 above, and calculate the 2020 sector average equivalent ratios for Fairfield Foods plc.

-Using the information calculated in (a) above, comment and compare the financial performance and position of Fairfield Foods plc for the year ended 31 December 2020 in comparison with the sector average ratios.

-Briefly consider possible limitations of the comparison between Fairfield Foods plc

and the equivalent sector average ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started