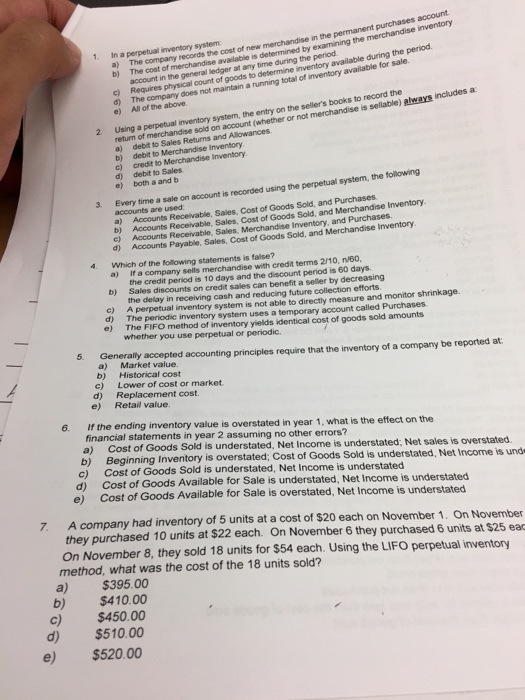

In a perpetual inventory system: The company records the cost of new merchandise in the permanent purchases account. The cost of merchandise available is determined by examining the merchandise inventory account in the general ledger at any time during the period. Requires physical count of goods to determine inventory available during the period. The company does not maintain a running total of inventory available for sale. All of the above. Using a perpetual inventory system, the entry on the seller's books to record the return of merchandise sold on account (whether or not merchandise is sellable) always includes a: debit to Sales Returns and Allowances debit to Merchandise Inventory. credit to Merchandise inventory. debit to Sales. both a and b. Every time a sale on account is recorded using the perpetual system, the following accounts are used: Accounts Receivable, Sales, Cost of Goods Sold, and Purchases. Accounts Receivable, Sales, Cost of Goods Sold, and Merchandise Inventory. Accounts Receivable, Sales, Merchandise Inventory, and Purchases. Accounts Payable, Sales, Cost of Goods sold, and Merchandise Inventory. Which of the following statements is false? If a company sells merchandise with credit terms 2/10, n/60, the credit period is 10 days and the discount period is 60 days. Sales discounts on credit sales can benefit a seller by decreasing the delay in receiving cash and reducing future collection efforts. A perpetual inventory system is not able to directly measure and monitor shrinkage. The periodic inventory system uses a temporary account called Purchases. The FIFO method of inventory yields identical cost of goods sold amounts whether you use perpetual or periodic. Generally accepted accounting principles require that the inventory of a company be reported at: Market value. Historical cost Lower of cost or market. Replacement cost. Retail value. If the ending inventory value is overstated in year 1, what is the effect on the financial statements in year 2 assuming no other errors? Cost of Goods Sold is understated, Net Income is understated; Net sales is overstated. Beginning Inventory is overstated; Cost of Goods Sold is understated, Net Income is Cost of Goods Sold is understated, Net Income is understated Cost of Goods Available for Sale is understated, Net Income is understated Cost of Goods Available for Sale is overstated, Net Income is understated A company had inventory of 5 units at a cost of $20 each on November 1. On November they purchased 10 units at $22 each. On November 6 they purchased 6 units at $25 On November 8, they sold 18 units for $54 each. Using the LIFO perpetual inventory method, what was the cost of the 18 units sold? $395.00 $410.00 $450.00 $510.00 $520.00