Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Facilities Investment problem, you need to figure out what variables you should keep and why. In other words, the model is sensitive to some

In Facilities Investment problem, you need to figure out what variables you should keep and why. In other words, the model is sensitive to some of the variables. What are those variables? You dont need to do any calculations.

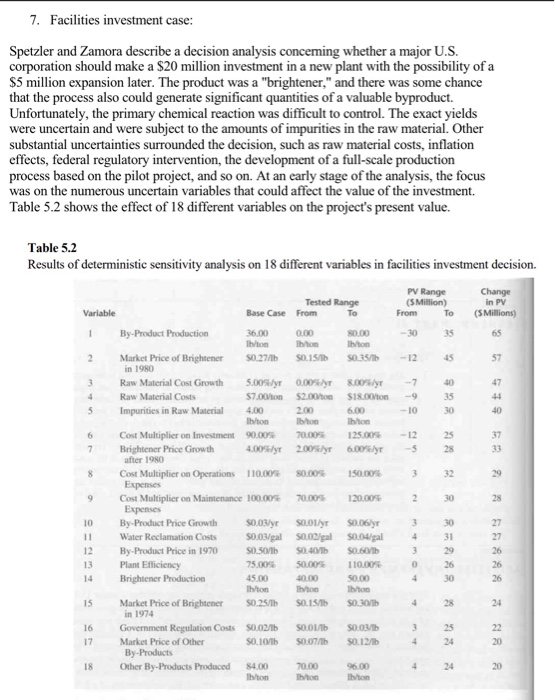

7. Facilities investment case: Spetzler and Zamora describe a decision analysis conceming whether a major U.S. corporation should make a $20 million investment in a new plant with the possibility of a $5 million expansion later. The product was a "brightener," and there was some chance that the process also could generate significant quantities of a valuable byproduct. Unfortunately, the primary chemical reaction was difficult to control. The exact yields were uncertain and were subject to the amounts of impurities in the raw material. Other substantial uncertainties surrounded the decision, such as raw material costs, inflation effects, federal regulatory intervention, the development of a full-scale production process based on the pilot project, and so on. At an early stage of the analysis, the focus was on the numerous uncertain variables that could affect the value of the investment. Table 5.2 shows the effect of 18 different variables on the project's present value. Table 5.2 Results of deterministic sensitivity analysis on 18 different variables in facilities investment decision. PV Range (5 Million) From Change in PV (5 Millions) 35 65 -12 45 57 35 30 -10 40 -12 25 28 37 33 8 3 32 29 Tested Range Variable Base Case From To By-Product Production 36,00 0.00 80.00 Ib/ton Ibon Ibon 2 Market Price of Brightener SO 27/16 SO. 15/16 SO 35/10 in 1980 3 Raw Material Cost Growth 5.009/yr 0.00%/ 8.00 4 Raw Material Costs $7.00/ton $2.00 S18.00 ton 3 Impurities in Raw Material 4.00 2.00 6.00 ib/ton Ibon 6 Cost Multiplier on Investment 90.00 70.00 125.00 7 Brightener Price Growth 4.005/2006 6.00 after 1980 Cost Multiplier on Operations 110.00% SO. 150.00 Expenses 9 Cost Multiplier on Maintenance 100.00 70.005 120.00 Expenses 10 By-Product Price Growth S0.03/yr 0.01 SO.06/y 11 Water Reclamation Costs 50.03/gal S.gal $0.04.gal 12 By-Product Price in 1970 SO 50/1b S0.40 SO_601 13 Plant Efficiency 75.005 50.005 110.00% Brightener Production 45.00 10.00 50.00 Ibon ht hoo 15 Market Price of Brightener S0.25/1b SO 151 $0.30/1 in 1974 16 Government Regulation Costs $0.02/1b S00 S0.03 17 Market Price of Other SO. 101 SO 07/ SO12/ By-Products 18 Other By-Products Produced 84.00 70.00 96.00 hton hon 2 30 28 30 27 27 26 26 26 0 26 30 25 24 22 20 4 4 20 7. Facilities investment case: Spetzler and Zamora describe a decision analysis conceming whether a major U.S. corporation should make a $20 million investment in a new plant with the possibility of a $5 million expansion later. The product was a "brightener," and there was some chance that the process also could generate significant quantities of a valuable byproduct. Unfortunately, the primary chemical reaction was difficult to control. The exact yields were uncertain and were subject to the amounts of impurities in the raw material. Other substantial uncertainties surrounded the decision, such as raw material costs, inflation effects, federal regulatory intervention, the development of a full-scale production process based on the pilot project, and so on. At an early stage of the analysis, the focus was on the numerous uncertain variables that could affect the value of the investment. Table 5.2 shows the effect of 18 different variables on the project's present value. Table 5.2 Results of deterministic sensitivity analysis on 18 different variables in facilities investment decision. PV Range (5 Million) From Change in PV (5 Millions) 35 65 -12 45 57 35 30 -10 40 -12 25 28 37 33 8 3 32 29 Tested Range Variable Base Case From To By-Product Production 36,00 0.00 80.00 Ib/ton Ibon Ibon 2 Market Price of Brightener SO 27/16 SO. 15/16 SO 35/10 in 1980 3 Raw Material Cost Growth 5.009/yr 0.00%/ 8.00 4 Raw Material Costs $7.00/ton $2.00 S18.00 ton 3 Impurities in Raw Material 4.00 2.00 6.00 ib/ton Ibon 6 Cost Multiplier on Investment 90.00 70.00 125.00 7 Brightener Price Growth 4.005/2006 6.00 after 1980 Cost Multiplier on Operations 110.00% SO. 150.00 Expenses 9 Cost Multiplier on Maintenance 100.00 70.005 120.00 Expenses 10 By-Product Price Growth S0.03/yr 0.01 SO.06/y 11 Water Reclamation Costs 50.03/gal S.gal $0.04.gal 12 By-Product Price in 1970 SO 50/1b S0.40 SO_601 13 Plant Efficiency 75.005 50.005 110.00% Brightener Production 45.00 10.00 50.00 Ibon ht hoo 15 Market Price of Brightener S0.25/1b SO 151 $0.30/1 in 1974 16 Government Regulation Costs $0.02/1b S00 S0.03 17 Market Price of Other SO. 101 SO 07/ SO12/ By-Products 18 Other By-Products Produced 84.00 70.00 96.00 hton hon 2 30 28 30 27 27 26 26 26 0 26 30 25 24 22 20 4 4 20 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started