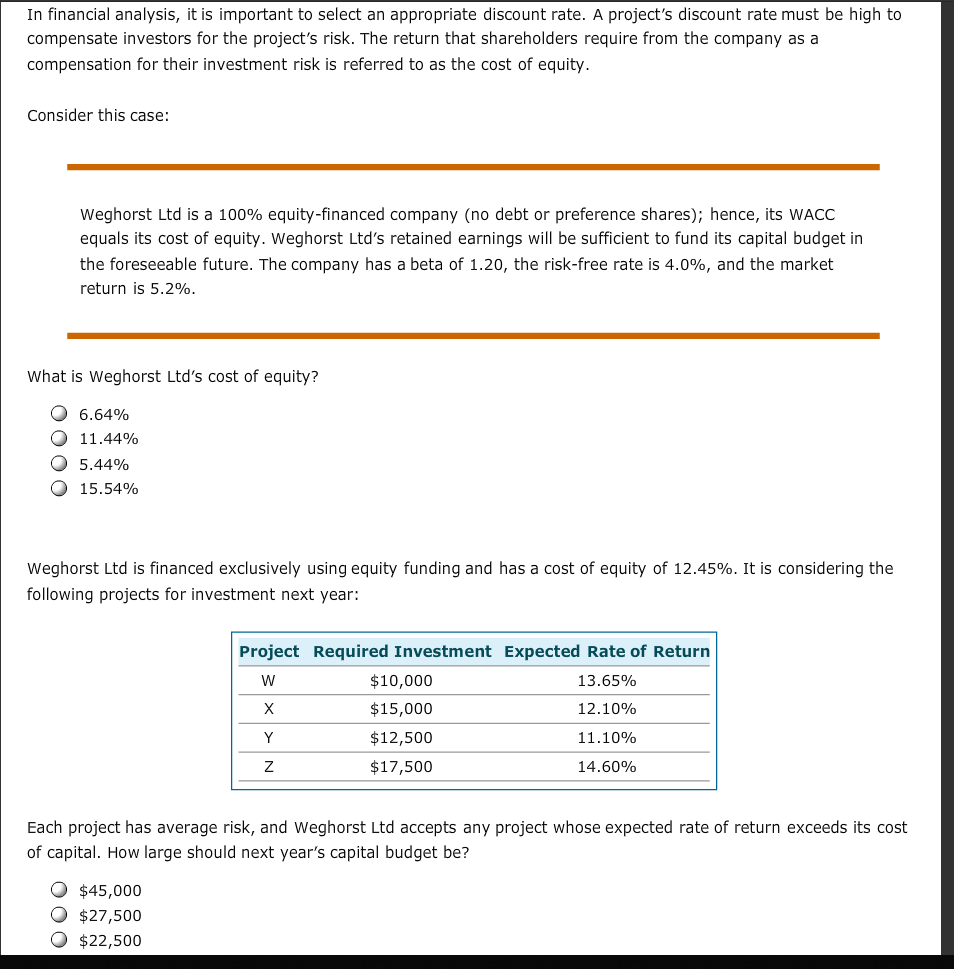

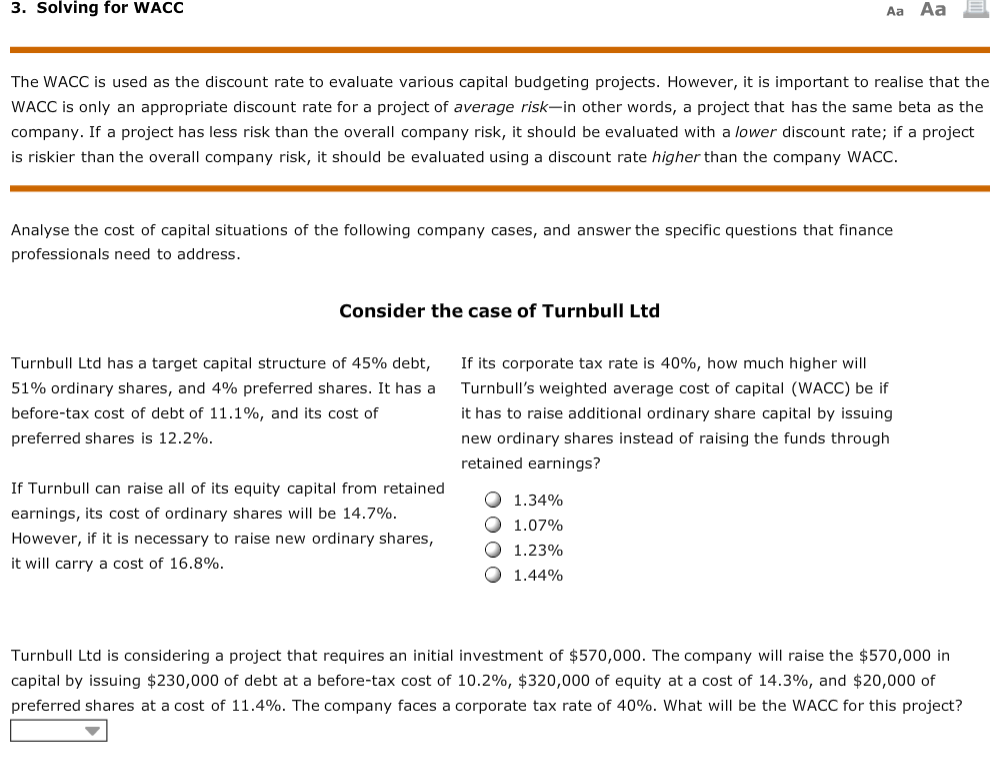

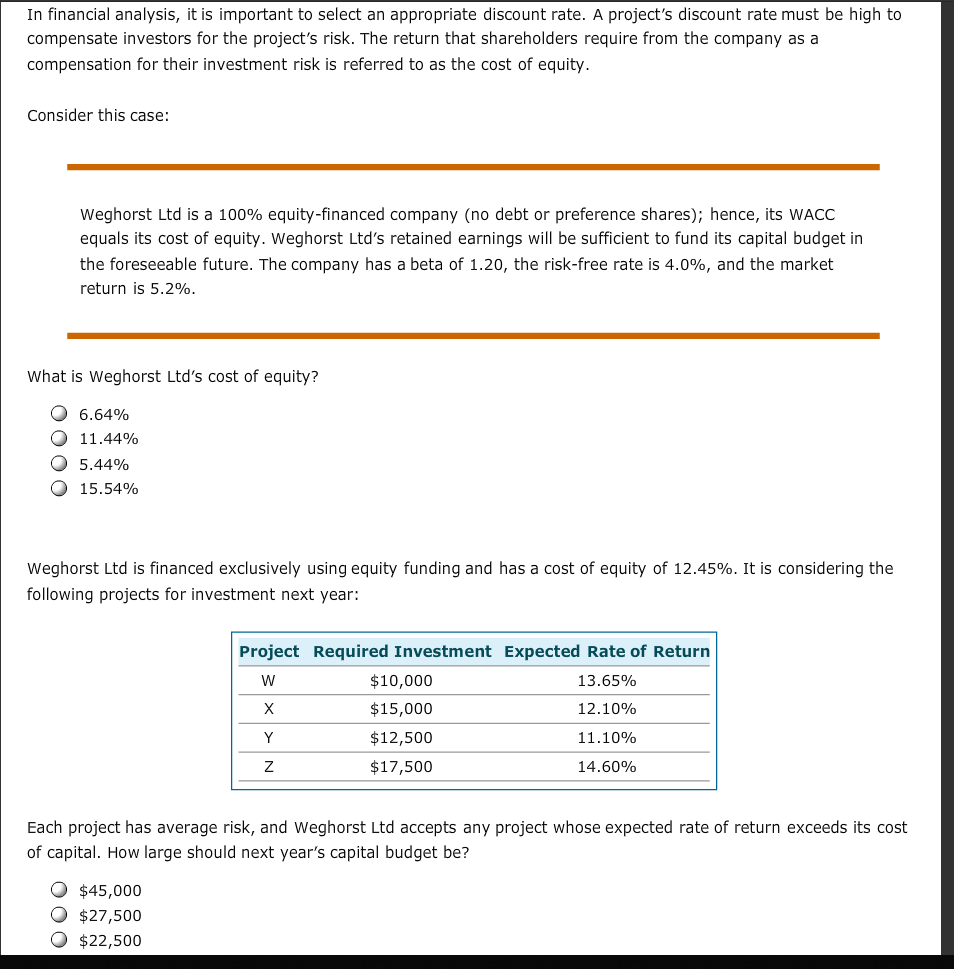

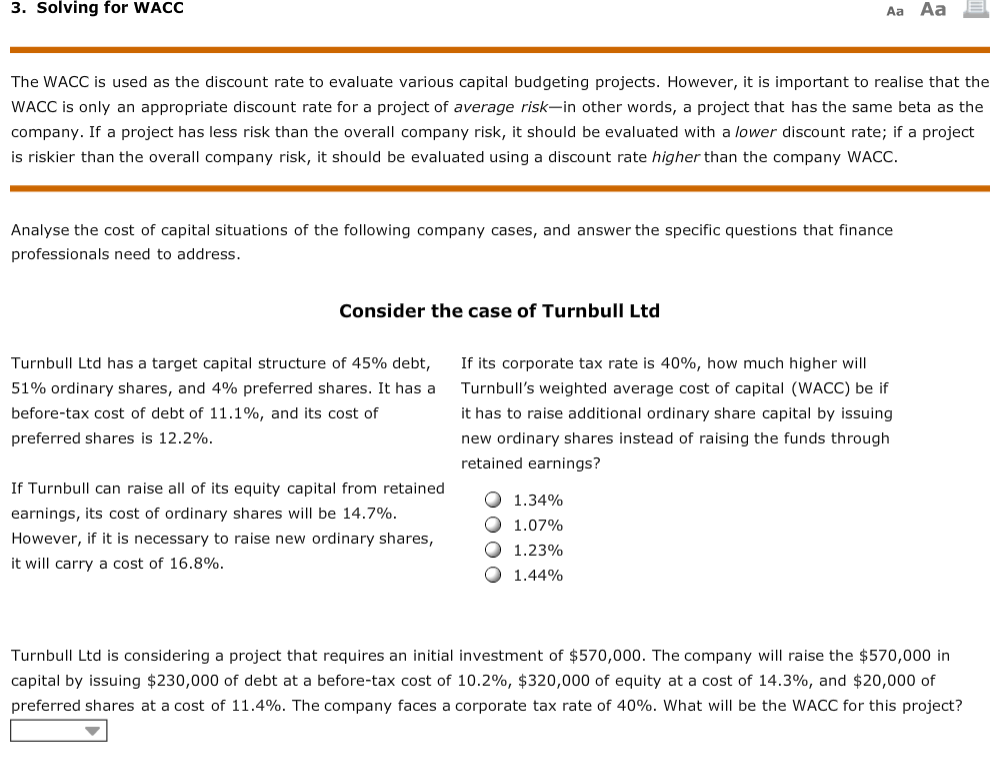

In financial analysis, it is important to select an appropriate discount rate. A project's discount rate must be high to compensate investors for the project's risk. The return that shareholders require from the company as a compensation for their investment risk is referred to as the cost of equity. Consider this case: Weghorst Ltd is a 100% equity-financed company (no debt or preference shares); hence, its wACC equals its cost of equity. Weghorst Ltd's retained earnings will be sufficient to fund its capital budget in the foreseeable future. The company has a beta of 1.20, the risk-free rate is 4.0%, and the market return is 5.2% What is Weghorst Ltd's cost of equity? O 6.64% O 11.44% 5.44% O 15.54% weghorst Ltd is financed exclusively using equity funding and has a cost of equity of 12.45%. It is considering the following projects for investment next year: Project Required Investment Expected Rate of Return $10,000 13.65% $15,000 12.10% $12,500 11.10% $17,500 14.60% Each project has average risk, and Weghorst Ltd accepts any project whose expected rate of return exceeds its cost of capital. How large should next year's capital budget be? O $45,000 O $27,500 $22,500 3. Solving for WACOC Aa Aa The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realise that the WACC is only an appropriate discount rate for a project of average risk-in other words, a project that has the same beta as the company. If a project has less risk than the overall company risk, it should be evaluated with a lower discount rate; if a project is riskier than the overall company risk, it should be evaluated using a discount rate higher than the company WACC. Analyse the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address Consider the case of Turnbull Ltd Turnbull Ltd has a target capital structure of 45% debt, If its corporate tax rate is 40%, how much higher will 51% ordinary shares, and 4% preferred shares. It has a Turnbull's weighted average cost of capital (WACC) be if before-tax cost of debt of 11.1%, and its cost of it has to raise additional ordinary share capital by issuing preferred shares is 12.2% new ordinary shares instead of raising the funds through retained earnings? If Turnbull can raise all of its equity capital from retained 1.34% 1.07% earnings, its cost of ordinary shares will be 14.7% However, if it is necessary to raise new ordinary shares, 1.23% it will carry a cost of 16.8% 1.44% Turnbull Ltd is considering a project that requires an initial investment of $570,000. The company will raise the $570,000 in capital by issuing $230,000 of debt at a before-tax cost of 10.2%, $320,000 of equity at a cost of 14.3%, and $20,000 of preferred shares at a cost of 11.4%. The company faces a corporate tax rate of 40%. what will be the WACC for this project