Answered step by step

Verified Expert Solution

Question

1 Approved Answer

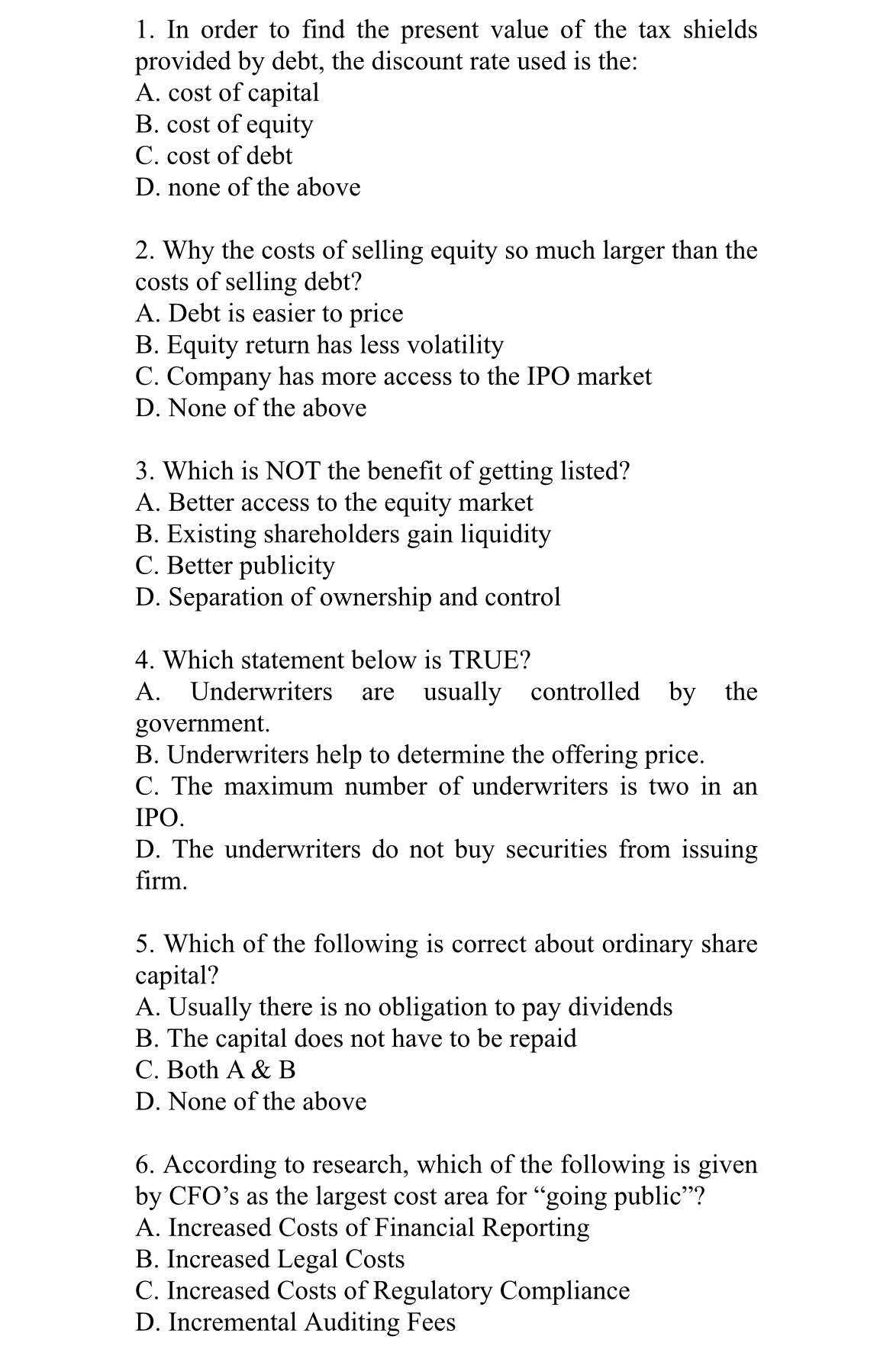

In order to find the present value of the tax shields provided by debt, the discount rate used is the: A . cost of capital

In order to find the present value of the tax shields provided by debt, the discount rate used is the:

A cost of capital

B cost of equity

C cost of debt

D none of the above

Why the costs of selling equity so much larger than the costs of selling debt?

A Debt is easier to price

B Equity return has less volatility

C Company has more access to the IPO market

D None of the above

Which is NOT the benefit of getting listed?

A Better access to the equity market

B Existing shareholders gain liquidity

C Better publicity

D Separation of ownership and control

Which statement below is TRUE?

A Underwriters are usually controlled by the government.

B Underwriters help to determine the offering price.

C The maximum number of underwriters is two in an IPO.

D The underwriters do not buy securities from issuing firm.

Which of the following is correct about ordinary share capital?

A Usually there is no obligation to pay dividends

B The capital does not have to be repaid

C Both A & B

D None of the above

According to research, which of the following is given by CFO's as the largest cost area for "going public"?

A Increased Costs of Financial Reporting

B Increased Legal Costs

C Increased Costs of Regulatory Compliance

D Incremental Auditing Fees

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started