in qutions 1 and 2 i just want (c) answesr only

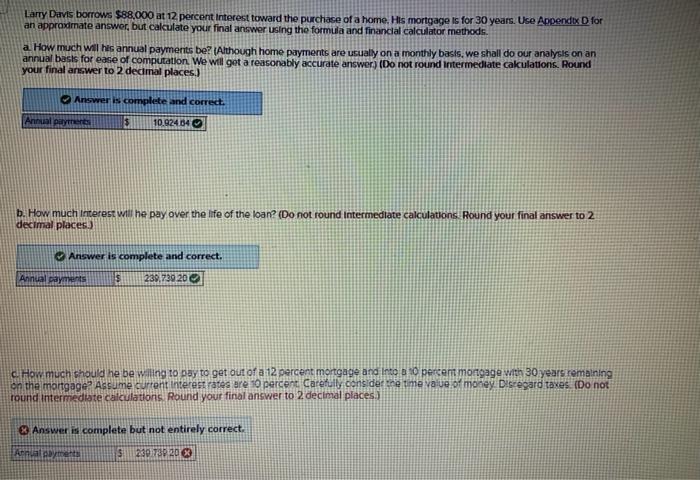

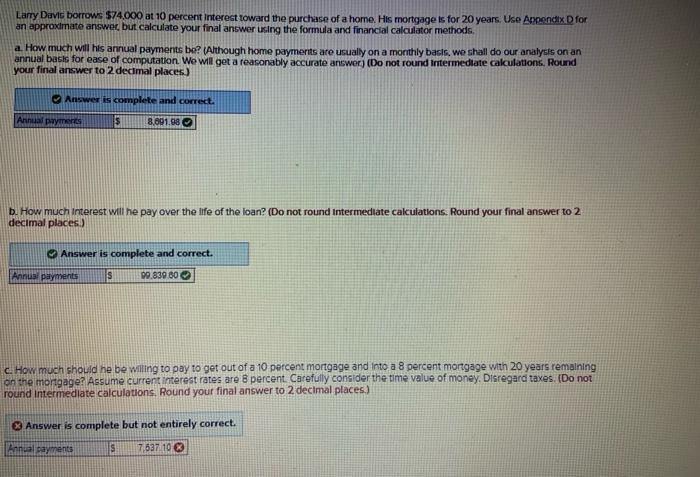

Larry Davis borrows $88,000 at 12 percent interest toward the purchase of a home. His mortgage is for 30 years. Use Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a How much wil his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer) (Do not round Intermediate cakulations. Round your final answer to 2 decimal places) Answer is complete and correct. Annual payment $ 10.92434 b. How much Interest will he pay over the life of the loan? (Do not found Intermediate calculations Round your final answer to 2 decimal places Answer is complete and correct. Annual payments 15 239,739 20 c. How much should he be willing to pay to get out of a 12 percent mortgage and into o percent mongage with 30 years remaining on the mortgage Assume current interest rates are 10 percent. Carefully consider the time value of money Disregard taxes. (Do not round Intermediate calculations. Round your final answer to 2 decimal places) & Answer is complete but not entirely correct. Ana pytreet S230730208 Larry Davis borrows $74.000 at 10 percent interest toward the purchase of a home. His mortgagets for 20 years. Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods a. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer) (Do not round Intermediate cakulations. Round your final answer to 2 decimal places.) Answer is complete and correct. Annual payments $ 8.091.98 D. How much Interest will he pay over the life of the loan? (Do not round Intermediate calculations. Round your final answer to 2 decimal places) Answer is complete and correct. Annual payments IS 99.839 80 c. How much should he be willing to pay to get out of a 10 percent mortgage and into a 8 percent mortgage with 20 years remaining on the mortgage? Assume current interest rates are 8 percent. Carefully consider the time value of money. Disregard taxes. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Answer is complete but not entirely correct. Annual payments IS 7,627.10