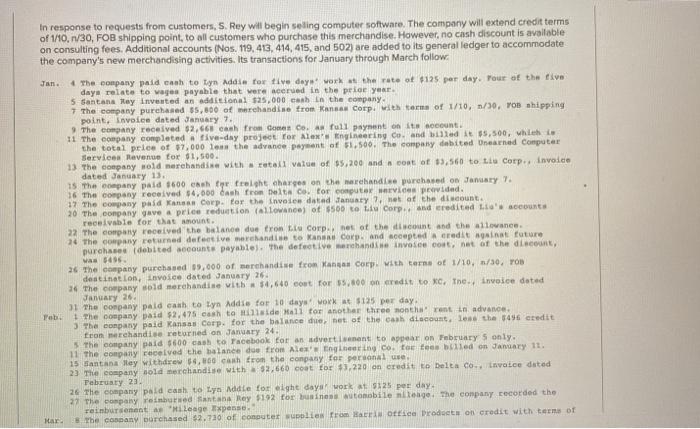

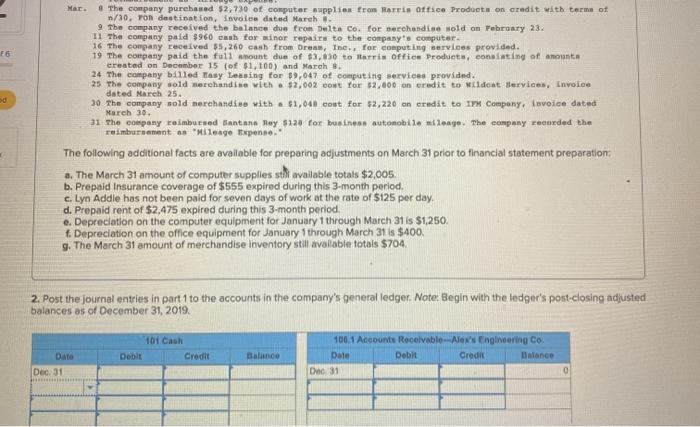

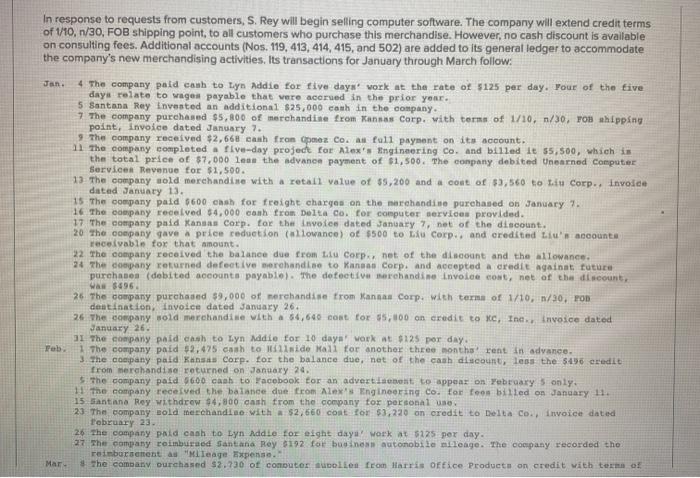

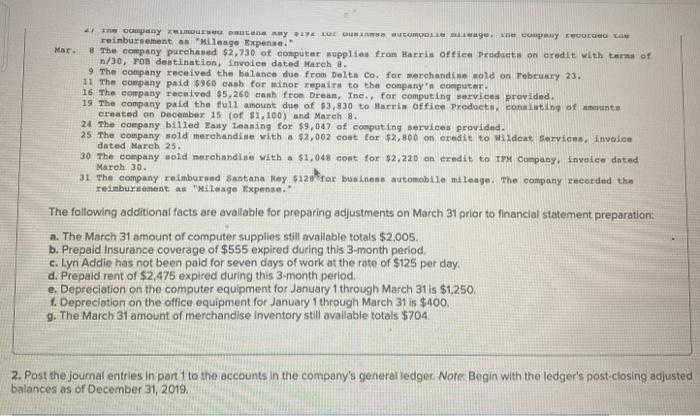

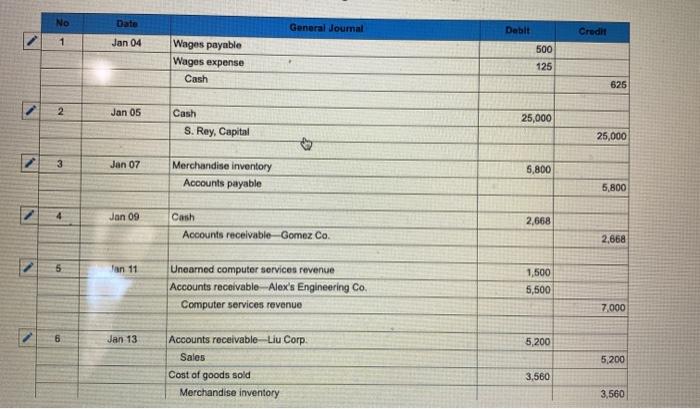

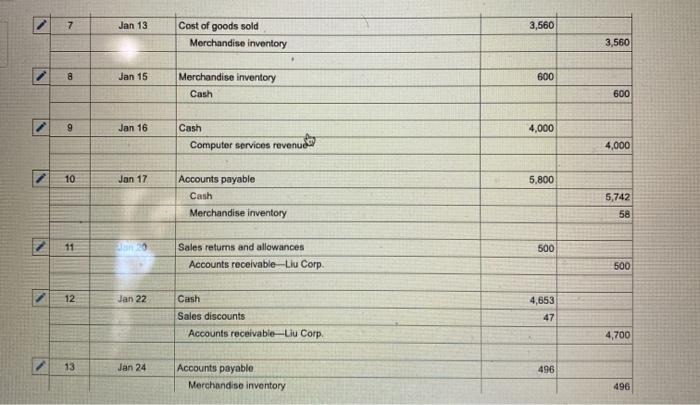

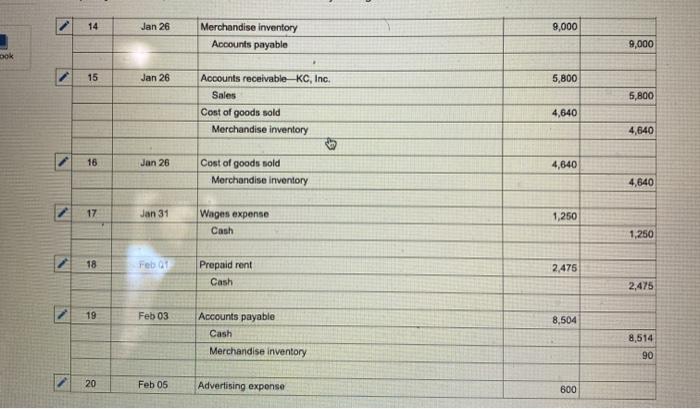

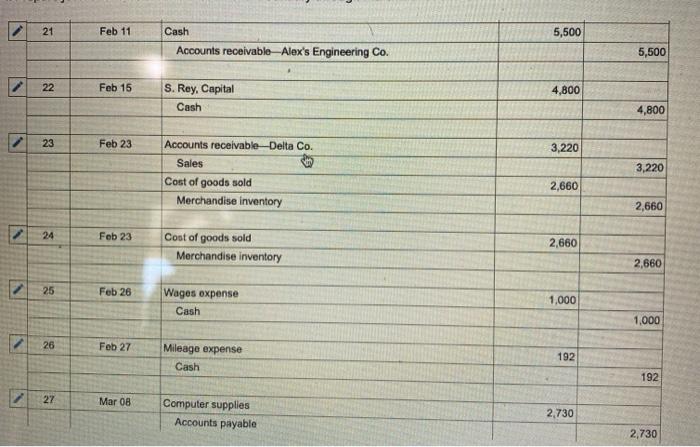

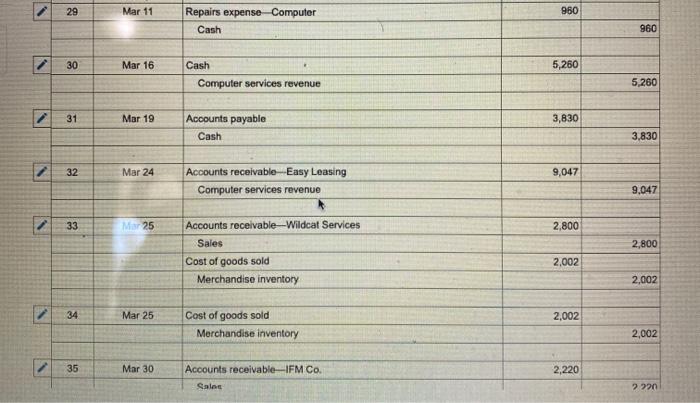

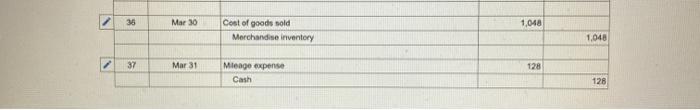

In response to requests from customers, S. Rey will begin seling computer software. The company will extend credit terms of 1/10, 1/30, FOB shipping point to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119,413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. Jan. The company paid cash to Tyn Addie tox tive days work at the rate of $125 per day. Your of the five days relate to wages payable that were accrued in the prior year 5 santana Kay Invented an additional $25,000 cash in the company 7 The company purchased 55,800 of marchandise from Kansas Corp! its terms of 1/10, 1/30, Yon shipping point, invoice dated January 7. The company received $2,668 cash from Comet Co. A full payment on to account 11 The company completed a five-day project for Alex ngineering co and bild it $5,500, which is the total price of $7,000 loan the advance payment of 5.500. The company debited Onearned Computer Services Revenue for $1,500. 13 The company old merchandise with real value of $5,200 and cost of $3,560 totiu Corp. invoice dated January 13. 15 The company paid $600 cash or fright charges on the marchandise purchased on January 16 The company received $4,000 cash frontet e for computer Vis provided. 17 The company paid Kansas Corp. for the invoice dated January 7. net of the discount 20. The company gave a price reduction allowance of $500 to til Corp. and credited L'accounts receivable for that amount. 22 The company received the balance due tron Le Corp.net of the discount and the allowance 24 The company returned defective merchandise to Kanne Corp. and accepted credit in future purchases (dobited accounts payable). The defective merchandise invoice cout, net of the discount, was 5. 26 The company purchased 19,000 of merchandise from a corp With terns of 1/10, 1/30, TOB destination, invoice dated January 26. The company old merchandise with $4,640 cout for 5.800 on credit to xe, the invoice dated January 26 31 The company paid cash to lyn Addie for 10 days work at $125 per day. Tab 1 The company paid $2.475 cash to side all for another three month rent in advance. 3 The company paid Kansas Corp. for the balance de net of the cash discount, so the 1496 credit fron merchandise returned on January 24. 3 The company paid $600 cash to Facebook for an advertisement to appear on February 5 only. 11 The company received the balance due from Alexeering co. toe te billed on January 11. 15 santana ley withdrew $4,60 cash from the company for personal use. 23 The company sold merchandise with $2,665 coat for $3,220 on eredit to Delta convatce dated February 23 26 The company paid can to Lyn Mdie fotight days work at 9:25 per day. 27 The company reimbursed Santana Rey $192 for business automobile nitenge the company recorded the reimbursement a Mileage pense. Har The company burchased $2.720 of computer supplies from Barn ottice Products on credit with terms of Mac F6 The company purchased $2,730 of computer upplies from farris Office Products on credit with term of n/30, Ton destination. Invoice dated March 9 The company received the balance due from Delta Co. for merchandise wold on February 23. 11 The company paid $960 cash for minor repairs to the company's computer. 16 The company received 5,260 cash from Dream, Inc., for computing services provided. 19 The company paid the fall anount due of $3,00 to larris Office Products, consisting of amount created on December 15 (of $1,100) and More 24 The company billed Tasy Leasing for $9,047 of computing services provided. 25 The company sold merchandise with a $2,002 cost for $2,000 on credit to Miidont services, Invoice dated March 25. 30 The company sold merchandise with a $1,043 cost for $2,220 on credit to ITM Company, invoice dated March 30. 31 The company reimburseddantana Tay $120 for businen automobile mileage. The company recorded the reimbursement as Mileage Expenso The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation a. The March 31 amount of computer supplies that available totals $2,005. b. Prepaid Insurance coverage of $555 expired during this 3-month period. c. Lyn Addle has not been paid for seven days of work at the rate of $125 per day. d. Prepaid rent of $2,475 expired during this 3-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,250 f. Depreciation on the office equipment for January 1 through March 31 is $400, 9. The March 31 amount of merchandise inventory still available totals $704 2. Post the journal entries in part 1 to the accounts in the company's general ledger. Note: Begin with the ledger's post-closing adjusted balances as of December 31, 2019. 101 Cash Dobit Credit Date Balance 106 1 Accounts Rocelvable-Alex's Engineering Co Dale Debit Credit Balance Dec 31 Dec. 31 0 Jan In response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30, FOB shipping point to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119, 413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow: 4 The company paid cash to Lyn Addie for five days work at the rate of $125 per day. Four of the five days relate to wages payable that were accrued in the prior year. 5 Santana Rey invented an additional $25,000 cash in the company. 7 The company purchased $5,800 of merchandise from Kansas Corp. with tons of 1/10, n/30, POB shipping point, invoice dated January 7. 9 The company received $2,668 cash fron apmes Co. as foll payment on its account. 11 The company completed a five-day project for Alex's Ingineering Co. and billed it 55,500, which is the total price of $7,000 lean the advance payment of $1,500. The company debited Unearned Computer Services Revenue for $1.500. 13. The company sold merchandise with a retall value of $5,200 and a coat of $3,560 to tu corp.. invoice dated January 1). 15. The company paid $600 chish for freight charges on the marchandise purchased on January 7. 16 The company received $4,000 con from Delta Co. for computer services provided 17 The company paid Kansas Corp. for the invoice dated January 7, net of the discount. 20 The company gave price reduction allowance) of $500 to Liu Corp., and credited Liu's accounts receivable for that amount. 22. The company received the balance due from Lu Corp. net of the discount and the allowance. 24 The company returned defective merchandise to Kansas Corp. and accepted a credit against tuture purchases (dobited accounts payable). The defective merchandise invoice cont, net of the discount, Was $496 26. The company purchased $9,000 of merchandise from Kansas Corp. with terms of 1/10, n/30, TOD dautination, Invoice dated January 26. 26 The company wold merchandise with a 54,640 COR for 55,100 on credit to Me, Inc. invoice dated January 26 31 The company paid cash to Lyn Addie for 10 days work at $125 por day. Feb The company paid 42,475 cash to Maside Mall for another three months rent in advance. 3. The company paid Kansas Corp. for the balance due, net of the cash discount, less the $496 credit from merchandise returned on January 24. 5. The company paid $600 cab to Facebook for an advertisement to appear on February 5 only. The company received the balance due from Alex's Engineering Co. for foon billed on January 11 15 Santana Roy withdrew $4,800 cash from the company tor personal use. 23. The company Bold merchandise with a $2,660 cost tom $3,220 on credit to Delta Co., invoice dated t'obruary 23. 26 the company paid cash to Lyn Addte for eight daya' work at $125 per day. 27 The company reimbursed Santana Rey 6192 for business automobile mileage. The company recorded the reimbursement a "Mileage Expense. the company purchased $2.730 of computer bolies from Harris Office Products on credit with terms of MA 47 cany DENGUE ANY LE LE OU COMODLL. we engany HUGO CON reimbursement on "Mileage Expense." Mar. 8 The company purchased $2,730 of computer supplies Erom Harris Office Products on credit with tears of n/30, ron destination, Invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. 11 The company paid $960 cash for minor repairs to the company's computer 16 The company received $5,260 can from Dream, Inc., for computing services provided. 19 The company paid the full amount due of $3,830 to Harris Office Products consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company bilied Rasy Leasing for $9,047 of computing services provided. 25 The company wold merchandise with a $2,002 coat for $2,800 on credit to Wildeat services, Invoice dated March 25. 30 The company old marchandise with a $1,048 cont for $2,220 on credit to 1PM Company, invoice dated March 30. 31 The company reimbursed Santana Roy $120tor business automobile mileage. The company recorded the reimbursement as Mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation: a. The March 31 amount of computer supplies still available totals $2,005. b. Prepaid Insurance coverage of $555 expired during this 3-month period. c. Lyn Addie has not been paid for seven days of work at the rate of $125 per day d. Prepaid rent of $2,475 expired during this 3-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,250, Depreciation on the office equipment for January 1 through March 31 is $400. g. The March 31 amount of merchandise inventory still available totals $704 2. Post the journal entries in part 1 to the accounts in the company's general ledger. Nore Begin with the ledger's post-closing adjusted balances as of December 31, 2019 No Date General Journal Debit Credit 1 Jan 04 Wages payable Wages expense Cash 500 125 625 2 Jan 05 25,000 Cash S. Rey, Capital 25,000 3 Jan 07 Merchandise inventory Accounts payable 5,800 5,800 Jan 09 Cash Accounts receivable Gomez Co. 2,668 2,668 5 tan 11 Unearned computer services revenue Accounts receivable-Alex's Engineering Co. Computer services revenue 1,500 5,500 7.000 Jan 13 5,200 Accounts receivable Liu Corp. Sales Cost of goods sold Merchandise inventory 5,200 3,560 3,560 7 Jan 13 3,560 Cost of goods sold Merchandise inventory 3,560 8 Jan 15 600 Merchandise inventory Cash 600 9 Jan 16 Cash 4,000 Computer services revenue 4,000 10 Jan 17 5,800 Accounts payable Cash Merchandise inventory 5,742 58 11 500 Sales returns and allowances Accounts receivable Liu Corp. 500 12 Jan 22 Cash Sales discounts Accounts receivable-Liu Corp 4,653 47 4,700 13 Jan 24 496 Accounts payable Merchandise inventory 496 14 Jan 26 9,000 Merchandise inventory Accounts payable 9,000 2 15 Jan 26 5,800 5,800 Accounts receivable KC, Inc. Sales Cost of goods sold Merchandise inventory 4,640 4,640 16 Jan 26 4,640 Cost of goods sold Merchandise inventory 4,640 4 17 Jan 31 Wages expense Cash 1,250 1,250 18 Feb 01 2.475 Prepaid rent Cash 2,475 19 Feb 03 8,504 Accounts payable Cash Merchandise inventory 8,514 90 20 Feb 05 Advertising expense 600 21 Feb 11 5,500 Cash Accounts receivableAlex's Engineering Co. 5,500 22 Feb 15 4,800 S. Rey, Capital Cash 4,800 23 Feb 23 3,220 Accounts receivable Delta Co. Sales Cost of goods sold Merchandise inventory 3,220 2,660 2,660 Feb 23 Cost of goods sold Merchandise inventory 2,660 2,660 25 Feb 26 Wages expense Cash 1,000 1,000 26 Feb 27 Mileage expense Cash 192 192 27 Mar 08 Computer supplies Accounts payable 2,730 2,730 29 Mar 11 960 Repairs expense Computer Cash 960 30 Mar 16 5,260 Cash Computer services revenue 5,260 2 31 Mar 19 3,830 Accounts payable Cash 3,830 2 32 Mar 24 9,047 Accounts receivable-Easy Leasing Computer services revenue 9.047 33 Mar 25 2,800 2,800 Accounts receivable--Wildcat Services Sales Cost of goods sold Merchandise inventory 2,002 2,002 34 Mar 25 2,002 Cost of goods sold Merchandise inventory 2,002 35 Mar 30 2,220 Accounts receivable IFM Co. Sales 2 22 36 Mar 30 1,048 Cost of goods sold Merchandise inventory 1,048 37 Mar 31 128 Mleage expense Cash 128 In response to requests from customers, S. Rey will begin seling computer software. The company will extend credit terms of 1/10, 1/30, FOB shipping point to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119,413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. Jan. The company paid cash to Tyn Addie tox tive days work at the rate of $125 per day. Your of the five days relate to wages payable that were accrued in the prior year 5 santana Kay Invented an additional $25,000 cash in the company 7 The company purchased 55,800 of marchandise from Kansas Corp! its terms of 1/10, 1/30, Yon shipping point, invoice dated January 7. The company received $2,668 cash from Comet Co. A full payment on to account 11 The company completed a five-day project for Alex ngineering co and bild it $5,500, which is the total price of $7,000 loan the advance payment of 5.500. The company debited Onearned Computer Services Revenue for $1,500. 13 The company old merchandise with real value of $5,200 and cost of $3,560 totiu Corp. invoice dated January 13. 15 The company paid $600 cash or fright charges on the marchandise purchased on January 16 The company received $4,000 cash frontet e for computer Vis provided. 17 The company paid Kansas Corp. for the invoice dated January 7. net of the discount 20. The company gave a price reduction allowance of $500 to til Corp. and credited L'accounts receivable for that amount. 22 The company received the balance due tron Le Corp.net of the discount and the allowance 24 The company returned defective merchandise to Kanne Corp. and accepted credit in future purchases (dobited accounts payable). The defective merchandise invoice cout, net of the discount, was 5. 26 The company purchased 19,000 of merchandise from a corp With terns of 1/10, 1/30, TOB destination, invoice dated January 26. The company old merchandise with $4,640 cout for 5.800 on credit to xe, the invoice dated January 26 31 The company paid cash to lyn Addie for 10 days work at $125 per day. Tab 1 The company paid $2.475 cash to side all for another three month rent in advance. 3 The company paid Kansas Corp. for the balance de net of the cash discount, so the 1496 credit fron merchandise returned on January 24. 3 The company paid $600 cash to Facebook for an advertisement to appear on February 5 only. 11 The company received the balance due from Alexeering co. toe te billed on January 11. 15 santana ley withdrew $4,60 cash from the company for personal use. 23 The company sold merchandise with $2,665 coat for $3,220 on eredit to Delta convatce dated February 23 26 The company paid can to Lyn Mdie fotight days work at 9:25 per day. 27 The company reimbursed Santana Rey $192 for business automobile nitenge the company recorded the reimbursement a Mileage pense. Har The company burchased $2.720 of computer supplies from Barn ottice Products on credit with terms of Mac F6 The company purchased $2,730 of computer upplies from farris Office Products on credit with term of n/30, Ton destination. Invoice dated March 9 The company received the balance due from Delta Co. for merchandise wold on February 23. 11 The company paid $960 cash for minor repairs to the company's computer. 16 The company received 5,260 cash from Dream, Inc., for computing services provided. 19 The company paid the fall anount due of $3,00 to larris Office Products, consisting of amount created on December 15 (of $1,100) and More 24 The company billed Tasy Leasing for $9,047 of computing services provided. 25 The company sold merchandise with a $2,002 cost for $2,000 on credit to Miidont services, Invoice dated March 25. 30 The company sold merchandise with a $1,043 cost for $2,220 on credit to ITM Company, invoice dated March 30. 31 The company reimburseddantana Tay $120 for businen automobile mileage. The company recorded the reimbursement as Mileage Expenso The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation a. The March 31 amount of computer supplies that available totals $2,005. b. Prepaid Insurance coverage of $555 expired during this 3-month period. c. Lyn Addle has not been paid for seven days of work at the rate of $125 per day. d. Prepaid rent of $2,475 expired during this 3-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,250 f. Depreciation on the office equipment for January 1 through March 31 is $400, 9. The March 31 amount of merchandise inventory still available totals $704 2. Post the journal entries in part 1 to the accounts in the company's general ledger. Note: Begin with the ledger's post-closing adjusted balances as of December 31, 2019. 101 Cash Dobit Credit Date Balance 106 1 Accounts Rocelvable-Alex's Engineering Co Dale Debit Credit Balance Dec 31 Dec. 31 0 Jan In response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30, FOB shipping point to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119, 413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow: 4 The company paid cash to Lyn Addie for five days work at the rate of $125 per day. Four of the five days relate to wages payable that were accrued in the prior year. 5 Santana Rey invented an additional $25,000 cash in the company. 7 The company purchased $5,800 of merchandise from Kansas Corp. with tons of 1/10, n/30, POB shipping point, invoice dated January 7. 9 The company received $2,668 cash fron apmes Co. as foll payment on its account. 11 The company completed a five-day project for Alex's Ingineering Co. and billed it 55,500, which is the total price of $7,000 lean the advance payment of $1,500. The company debited Unearned Computer Services Revenue for $1.500. 13. The company sold merchandise with a retall value of $5,200 and a coat of $3,560 to tu corp.. invoice dated January 1). 15. The company paid $600 chish for freight charges on the marchandise purchased on January 7. 16 The company received $4,000 con from Delta Co. for computer services provided 17 The company paid Kansas Corp. for the invoice dated January 7, net of the discount. 20 The company gave price reduction allowance) of $500 to Liu Corp., and credited Liu's accounts receivable for that amount. 22. The company received the balance due from Lu Corp. net of the discount and the allowance. 24 The company returned defective merchandise to Kansas Corp. and accepted a credit against tuture purchases (dobited accounts payable). The defective merchandise invoice cont, net of the discount, Was $496 26. The company purchased $9,000 of merchandise from Kansas Corp. with terms of 1/10, n/30, TOD dautination, Invoice dated January 26. 26 The company wold merchandise with a 54,640 COR for 55,100 on credit to Me, Inc. invoice dated January 26 31 The company paid cash to Lyn Addie for 10 days work at $125 por day. Feb The company paid 42,475 cash to Maside Mall for another three months rent in advance. 3. The company paid Kansas Corp. for the balance due, net of the cash discount, less the $496 credit from merchandise returned on January 24. 5. The company paid $600 cab to Facebook for an advertisement to appear on February 5 only. The company received the balance due from Alex's Engineering Co. for foon billed on January 11 15 Santana Roy withdrew $4,800 cash from the company tor personal use. 23. The company Bold merchandise with a $2,660 cost tom $3,220 on credit to Delta Co., invoice dated t'obruary 23. 26 the company paid cash to Lyn Addte for eight daya' work at $125 per day. 27 The company reimbursed Santana Rey 6192 for business automobile mileage. The company recorded the reimbursement a "Mileage Expense. the company purchased $2.730 of computer bolies from Harris Office Products on credit with terms of MA 47 cany DENGUE ANY LE LE OU COMODLL. we engany HUGO CON reimbursement on "Mileage Expense." Mar. 8 The company purchased $2,730 of computer supplies Erom Harris Office Products on credit with tears of n/30, ron destination, Invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. 11 The company paid $960 cash for minor repairs to the company's computer 16 The company received $5,260 can from Dream, Inc., for computing services provided. 19 The company paid the full amount due of $3,830 to Harris Office Products consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company bilied Rasy Leasing for $9,047 of computing services provided. 25 The company wold merchandise with a $2,002 coat for $2,800 on credit to Wildeat services, Invoice dated March 25. 30 The company old marchandise with a $1,048 cont for $2,220 on credit to 1PM Company, invoice dated March 30. 31 The company reimbursed Santana Roy $120tor business automobile mileage. The company recorded the reimbursement as Mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation: a. The March 31 amount of computer supplies still available totals $2,005. b. Prepaid Insurance coverage of $555 expired during this 3-month period. c. Lyn Addie has not been paid for seven days of work at the rate of $125 per day d. Prepaid rent of $2,475 expired during this 3-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,250, Depreciation on the office equipment for January 1 through March 31 is $400. g. The March 31 amount of merchandise inventory still available totals $704 2. Post the journal entries in part 1 to the accounts in the company's general ledger. Nore Begin with the ledger's post-closing adjusted balances as of December 31, 2019 No Date General Journal Debit Credit 1 Jan 04 Wages payable Wages expense Cash 500 125 625 2 Jan 05 25,000 Cash S. Rey, Capital 25,000 3 Jan 07 Merchandise inventory Accounts payable 5,800 5,800 Jan 09 Cash Accounts receivable Gomez Co. 2,668 2,668 5 tan 11 Unearned computer services revenue Accounts receivable-Alex's Engineering Co. Computer services revenue 1,500 5,500 7.000 Jan 13 5,200 Accounts receivable Liu Corp. Sales Cost of goods sold Merchandise inventory 5,200 3,560 3,560 7 Jan 13 3,560 Cost of goods sold Merchandise inventory 3,560 8 Jan 15 600 Merchandise inventory Cash 600 9 Jan 16 Cash 4,000 Computer services revenue 4,000 10 Jan 17 5,800 Accounts payable Cash Merchandise inventory 5,742 58 11 500 Sales returns and allowances Accounts receivable Liu Corp. 500 12 Jan 22 Cash Sales discounts Accounts receivable-Liu Corp 4,653 47 4,700 13 Jan 24 496 Accounts payable Merchandise inventory 496 14 Jan 26 9,000 Merchandise inventory Accounts payable 9,000 2 15 Jan 26 5,800 5,800 Accounts receivable KC, Inc. Sales Cost of goods sold Merchandise inventory 4,640 4,640 16 Jan 26 4,640 Cost of goods sold Merchandise inventory 4,640 4 17 Jan 31 Wages expense Cash 1,250 1,250 18 Feb 01 2.475 Prepaid rent Cash 2,475 19 Feb 03 8,504 Accounts payable Cash Merchandise inventory 8,514 90 20 Feb 05 Advertising expense 600 21 Feb 11 5,500 Cash Accounts receivableAlex's Engineering Co. 5,500 22 Feb 15 4,800 S. Rey, Capital Cash 4,800 23 Feb 23 3,220 Accounts receivable Delta Co. Sales Cost of goods sold Merchandise inventory 3,220 2,660 2,660 Feb 23 Cost of goods sold Merchandise inventory 2,660 2,660 25 Feb 26 Wages expense Cash 1,000 1,000 26 Feb 27 Mileage expense Cash 192 192 27 Mar 08 Computer supplies Accounts payable 2,730 2,730 29 Mar 11 960 Repairs expense Computer Cash 960 30 Mar 16 5,260 Cash Computer services revenue 5,260 2 31 Mar 19 3,830 Accounts payable Cash 3,830 2 32 Mar 24 9,047 Accounts receivable-Easy Leasing Computer services revenue 9.047 33 Mar 25 2,800 2,800 Accounts receivable--Wildcat Services Sales Cost of goods sold Merchandise inventory 2,002 2,002 34 Mar 25 2,002 Cost of goods sold Merchandise inventory 2,002 35 Mar 30 2,220 Accounts receivable IFM Co. Sales 2 22 36 Mar 30 1,048 Cost of goods sold Merchandise inventory 1,048 37 Mar 31 128 Mleage expense Cash 128