In the article "How much is your company worth to its customers?," by Ying Chen, Hugo Hickson, Tobias Silberzahn and Thomas Sutherland, the article suggests six traits that B2B customers evaluate and pay a premium price for. Please reflect on the importance of these six traits. Also, do you believe there are other traits that should also be considered by a B2B buyer?

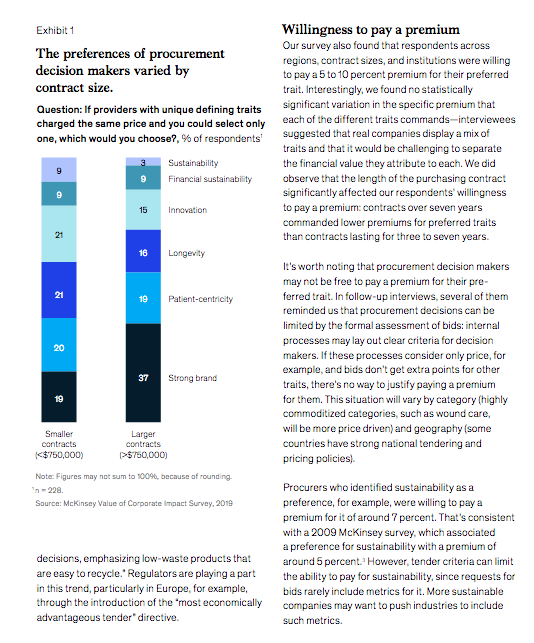

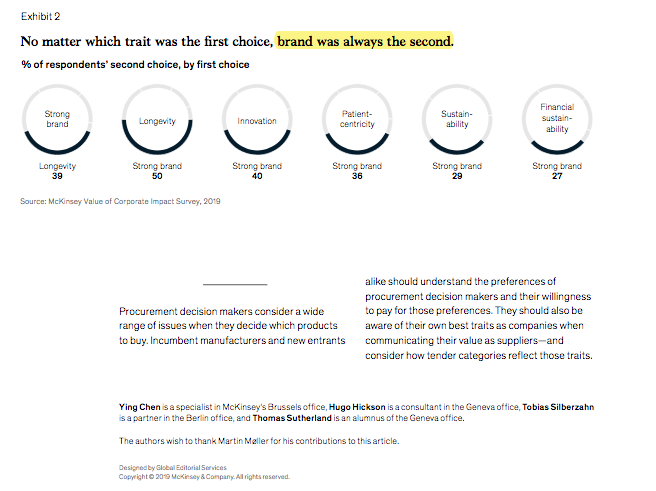

Let's say you're the sales rep for a well-established were willing to pay an average price premium of 5 to manufacturer. After years-even decades-of 10 percent for the traits they preferred. These selling to a range of retailers, you suddenly find findings can help incumbents to better position yourself competing against a new company that themselves to their customers (see sidebar, offers similar products at lower prices. On the one "Calculating your value to customers "). But they also hand, you have long-standing relationships with suggest how start-ups might break through. your current buyers, who are familiar with your brand, your pipeline of new offerings, and the quality of your products and services. On the other, you Brand image and other preferences know they'll be tempted by the lower-cost product In our survey, we asked procurement decision as long as the new competitor can meet their makers to make purchasing choices among fictional expectations for service and quality, availability manufacturers of medical products that we defined of supply, and on-demand delivery. You might as best in class in different ways. In real life, decision find yourself asking how much it is worth to your makers will have their own subjective perceptions customers to purchase products from you. of a manufacturer's traits. But for our survey, we defined each of the six traits strictly by objective It's a question that marketing experts have examined measures: we identified one manufacturer as having for decades. But for many companies it's worth the best brand, for example, based on its regular revisiting, especially in industries where technology appearance toward the top of brand-strength is enabling ever-faster disruption. Take medical rankings. We defined another as having the best devices, for example. Are procurers' decisions financial health based on its performance against influenced by a manufacturer's brand image, its measures of financial health, such as liquidity or customer-centricity, or its level of experience-and the ratio of long-term debt to total capital. A third are they willing to pay a pre-mium for these traits? we identified as the best in class for sustainability Are they also influenced by a manufacturer's for its high ranking on the Dow Jones Sustainability financial stability, its level of innovation, or even Indices. We then examined how strongly each its reputation for contributing to society and the of those traits was associated with the size and environment? Among a range of measures reflecting duration of procurement contracts. the performance of a company, strength in these six traits is, in our experience, often the strongest Interestingly, the duration of the contract under indicator of its value to customers. consideration did not change trait preferences. They were, however, affected by the size of the contract. To understand how much these traits might Of the six traits we examined, preferences varied be worth, we surveyed 228 people who make by customer segment. Brand image, for example, product-purchasing decisions for medical products, dominated the top of the rankings for contracts testing their preferences and price sensitivity. Our above $750,000 (Exhibit 1). For contracts below respondents were procurement decision makers, $750,000, buyers leaned toward companies with including CEOs, CFOs, procurement managers, and the longest history and experience creating the department heads' in public and private hospitals, market (longevity), as well as those with larger R&D clinics, laboratories, and insurance companies.' We investments or a history of launching new products found that their preferences varied but that they ahead of competitors (innovation). Our data alsosuggested that innovation may be more important Finally, although four traits-brand strength, for European respondents, for private institutions, innovation, longevity and patient-centricity-always and for more senior management-though additional wound up at the top, managers shouldn't disregard research is needed to confirm this impression. the bottom two. A significant number of managers identified even those traits as their top priority. Take Brand strength stood out when we tested our sustainability-the reputation and recognition a respondents' second-choice preferences; in company has won for contributing to society and fact, no matter what trait was a respondent's first the environment. Only 7 percent of procurement preference, brand strength was always the second decision makers (and only 3 percent of those with (Exhibit 2). This finding will provide some comfort large contracts) said that this was their top trait. for large incumbents, whose executives told us However in follow-up interviews, respondents in interviews that they took brand strength very alerted us that this is a recent trend and that its seriously, often associating it with high quality, good importance seems to be increasing, even if it is still service, and a mature, comprehensive portfolio. rarely a formal consideration in tender assessments. But our findings also highlight the opportunity As one manager told us, 'Over the past five for newcomers to disrupt the sector with highly years, we have been introducing sustainability innovative or patient-centric products. as a factor for consideration in procurementExhibit 1 Willingness to pay a premium The preferences of procurement Our survey also found that respondents across decision makers varied by regions, contract sizes, and institutions were willing to pay a 5 to 10 percent premium for their preferred contract size. trait. Interestingly, we found no statistically Question: If providers with unique defining traits significant variation in the specific premium that charged the same price and you could select only each of the different traits commands-interviewees one, which would you choose?, % of respondents' suggested that real companies display a mix of traits and that it would be challenging to separate 3 Sustainability the financial value they attribute to each. We did 9 Financial sustainability observe that the length of the purchasing contract significantly affected our respondents' willingness 15 Innovation to pay a premium: contracts over seven years commanded lower premiums for preferred traits than contracts lasting for three to seven years. 16 Longevity It's worth noting that procurement decision makers may not be free to pay a premium for their pre- 19 Patient-centricity ferred trait. In follow-up interviews, several of them reminded us that procurement decisions can be limited by the formal assessment of bids: internal processes may lay out clear criteria for decision makers. If these processes consider only price, for 37 Strong brand example, and bids don't get extra points for other traits, there's no way to justify paying a premium for them. This situation will vary by category (highly commoditized categories, such as wound care, Smaller Larger will be more price driven) and geography (some contracts contracts countries have strong national tendering and (