Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year.

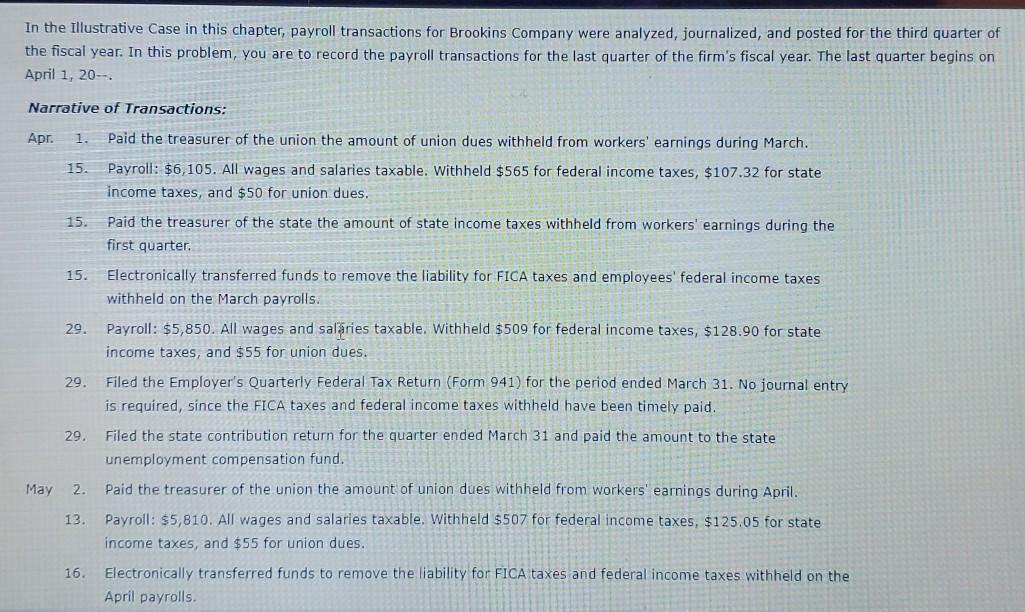

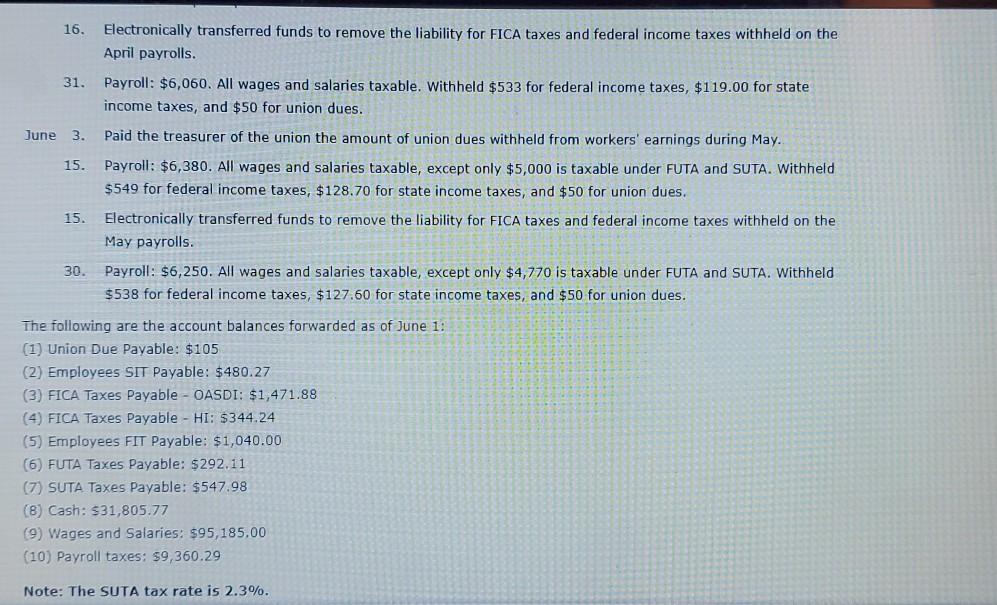

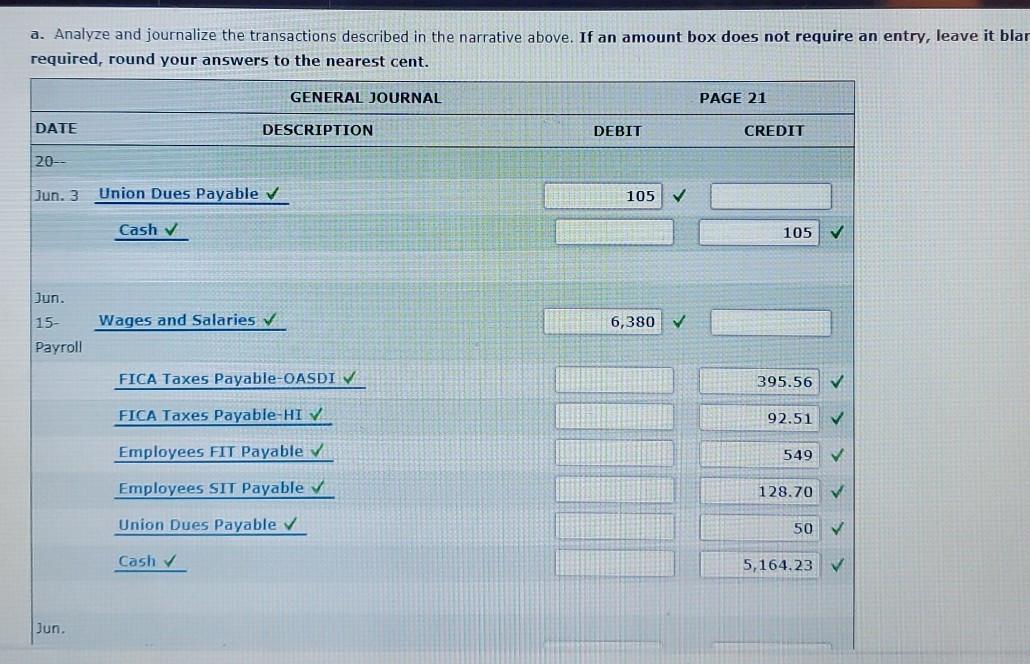

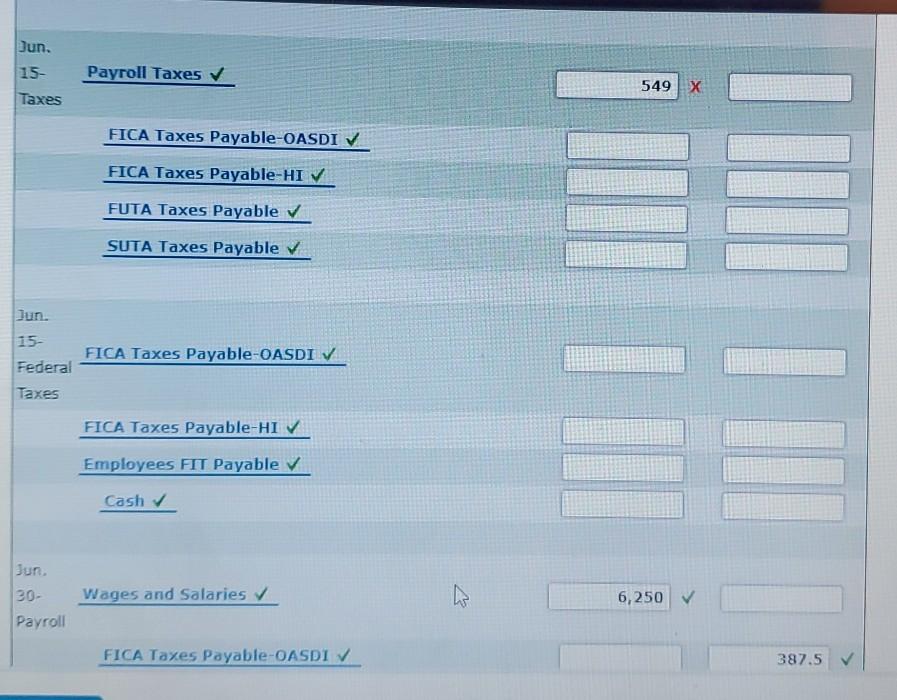

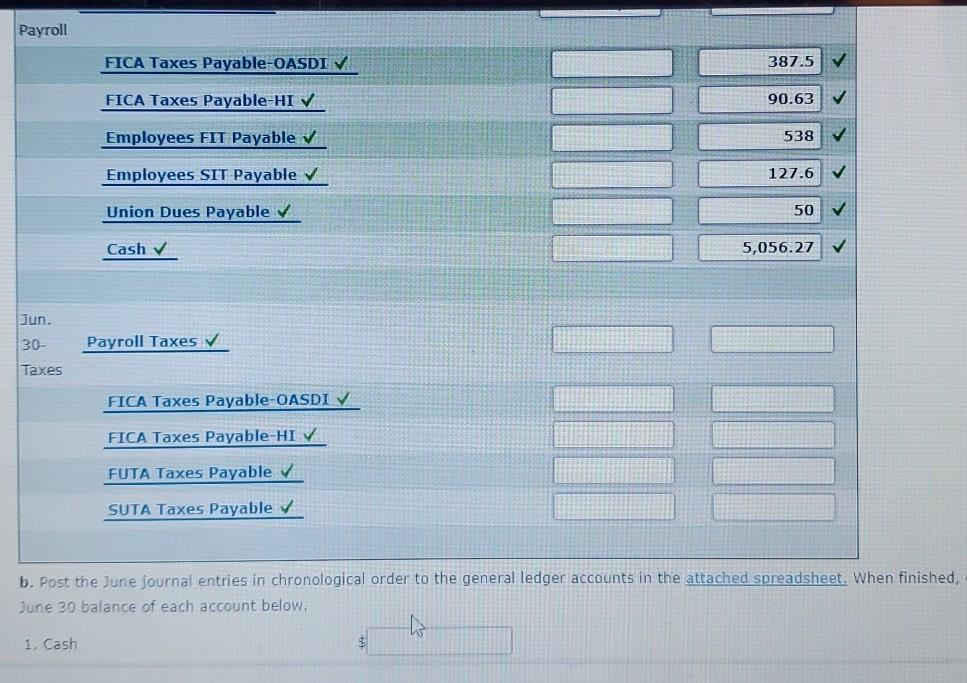

In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm's fiscal year. The last quarter begins on April 1, 20- Narrative of Transactions: Apr. 1. 15. 15. 15. 29. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during March. Payroll: $6,105. All wages and salaries taxable. Withheld $565 for federal income taxes, $107.32 for state income taxes, and $50 for union dues. Paid the treasurer of the state the amount of state income taxes withheld from workers' earnings during the first quarter. Electronically transferred funds to remove the liability for FICA taxes and employees' federal income taxes withheld on the March payrolls. Payroll: $5,850. All wages and salaries taxable. Withheld $509 for federal income taxes, $128.90 for state income taxes, and $55 for union dues. Filed the Employer's Quarterly Federal Tax Return (Form 941) for the period ended March 31. No journal entry is required, since the FICA taxes and federal income taxes withheld have been timely paid. Filed the state contribution return for the quarter ended March 31 and paid the amount to the state unemployment compensation fund. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during April. Payroll: $5,810. All wages and salaries taxable. Withheld $507 for federal income taxes, $125.05 for state income taxes, and $55 for union dues. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the April payrolls. 29 29. May 2 13. 16. 16. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the April payrolls. 31. Payroll: $6,060. All wages and salaries taxable. Withheld $533 for federal income taxes, $119.00 for state income taxes, and $50 for union dues. June 3. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during May. 15. Payroll: $6,380. All wages and salaries taxable, except only $5,000 is taxable under FUTA and SUTA. Withheld $549 for federal income taxes, $128.70 for state income taxes, and $50 for union dues. 15. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the May payrolls. 30. Payroll: $6,250. All wages and salaries taxable, except only $4,770 is taxable under FUTA and SUTA. Withheld $538 for federal income taxes, $127.60 for state income taxes, and $50 for union dues. The following are the account balances forwarded as of June 1: (1) Union Due Payable: $105 (2) Employees SIT Payable: $480.27 (3) FICA Taxes Payable - OASDI: $1,471.88 (4) FICA Taxes Payable - HI: $344.24 (5) Employees FIT Payable: $1,040.00 (6) FUTA Taxes Payable: $292.11 (7) SUTA Taxes Payable: $547.98 (8) Cash: $31,805.77 (9) Wages and Salaries: $95,185.00 (10) Payroll taxes: 59,360.29 Note: The SUTA tax rate is 2.3%. a. Analyze and journalize the transactions described in the narrative above. If an amount box does not require an entry, leave it blar required, round your answers to the nearest cent. GENERAL JOURNAL PAGE 21 DATE DESCRIPTION DEBIT CREDIT 20- Jun. 3 Union Dues Payable 105 Cash 105 Jun. Wages and Salaries 6,380 15- Payroll FICA Taxes Payable-OASDI V 395.56 FICA Taxes Payable-HI V 92.51 Employees FIT Payable v 549 Employees SIT Payable 128.70 Union Dues Payable 50 Cash 5,164.23 Jun. Dun. 15- Taxes Payroll Taxes 549 X FICA Taxes Payable-OASDI FICA Taxes Payable-HI FUTA Taxes Payable SUTA Taxes Payable Jun. 15- Federal III FICA Taxes Payable-OASDI Taxes FICA Taxes Payable-HI III Employees FIT Payable Cash Jun 20- Payroll Wages and Salaries 6,250 FICA Taxes Payable-OASDI 387.5 Payroll FICA Taxes Payable-OASDI V 387.5 FICA Taxes Payable-HIV 90.63 Employees FIT Payable 5387 Employees SIT Payable 127.6 Union Dues Payable 50 Cash 5,056.27 Jun. 30- Payroll Taxes Taxes FICA Taxes Payable-OASDI V FICA Taxes Payable-HIV FUTA Taxes Payable SUTA Taxes Payable b. Post the June journal entries in chronological order to the general ledger accounts in the attached spreadsheet. When finished, June 30 balance of each account below, 1. Cash In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm's fiscal year. The last quarter begins on April 1, 20- Narrative of Transactions: Apr. 1. 15. 15. 15. 29. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during March. Payroll: $6,105. All wages and salaries taxable. Withheld $565 for federal income taxes, $107.32 for state income taxes, and $50 for union dues. Paid the treasurer of the state the amount of state income taxes withheld from workers' earnings during the first quarter. Electronically transferred funds to remove the liability for FICA taxes and employees' federal income taxes withheld on the March payrolls. Payroll: $5,850. All wages and salaries taxable. Withheld $509 for federal income taxes, $128.90 for state income taxes, and $55 for union dues. Filed the Employer's Quarterly Federal Tax Return (Form 941) for the period ended March 31. No journal entry is required, since the FICA taxes and federal income taxes withheld have been timely paid. Filed the state contribution return for the quarter ended March 31 and paid the amount to the state unemployment compensation fund. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during April. Payroll: $5,810. All wages and salaries taxable. Withheld $507 for federal income taxes, $125.05 for state income taxes, and $55 for union dues. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the April payrolls. 29 29. May 2 13. 16. 16. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the April payrolls. 31. Payroll: $6,060. All wages and salaries taxable. Withheld $533 for federal income taxes, $119.00 for state income taxes, and $50 for union dues. June 3. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during May. 15. Payroll: $6,380. All wages and salaries taxable, except only $5,000 is taxable under FUTA and SUTA. Withheld $549 for federal income taxes, $128.70 for state income taxes, and $50 for union dues. 15. Electronically transferred funds to remove the liability for FICA taxes and federal income taxes withheld on the May payrolls. 30. Payroll: $6,250. All wages and salaries taxable, except only $4,770 is taxable under FUTA and SUTA. Withheld $538 for federal income taxes, $127.60 for state income taxes, and $50 for union dues. The following are the account balances forwarded as of June 1: (1) Union Due Payable: $105 (2) Employees SIT Payable: $480.27 (3) FICA Taxes Payable - OASDI: $1,471.88 (4) FICA Taxes Payable - HI: $344.24 (5) Employees FIT Payable: $1,040.00 (6) FUTA Taxes Payable: $292.11 (7) SUTA Taxes Payable: $547.98 (8) Cash: $31,805.77 (9) Wages and Salaries: $95,185.00 (10) Payroll taxes: 59,360.29 Note: The SUTA tax rate is 2.3%. a. Analyze and journalize the transactions described in the narrative above. If an amount box does not require an entry, leave it blar required, round your answers to the nearest cent. GENERAL JOURNAL PAGE 21 DATE DESCRIPTION DEBIT CREDIT 20- Jun. 3 Union Dues Payable 105 Cash 105 Jun. Wages and Salaries 6,380 15- Payroll FICA Taxes Payable-OASDI V 395.56 FICA Taxes Payable-HI V 92.51 Employees FIT Payable v 549 Employees SIT Payable 128.70 Union Dues Payable 50 Cash 5,164.23 Jun. Dun. 15- Taxes Payroll Taxes 549 X FICA Taxes Payable-OASDI FICA Taxes Payable-HI FUTA Taxes Payable SUTA Taxes Payable Jun. 15- Federal III FICA Taxes Payable-OASDI Taxes FICA Taxes Payable-HI III Employees FIT Payable Cash Jun 20- Payroll Wages and Salaries 6,250 FICA Taxes Payable-OASDI 387.5 Payroll FICA Taxes Payable-OASDI V 387.5 FICA Taxes Payable-HIV 90.63 Employees FIT Payable 5387 Employees SIT Payable 127.6 Union Dues Payable 50 Cash 5,056.27 Jun. 30- Payroll Taxes Taxes FICA Taxes Payable-OASDI V FICA Taxes Payable-HIV FUTA Taxes Payable SUTA Taxes Payable b. Post the June journal entries in chronological order to the general ledger accounts in the attached spreadsheet. When finished, June 30 balance of each account below, 1. Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started