Question

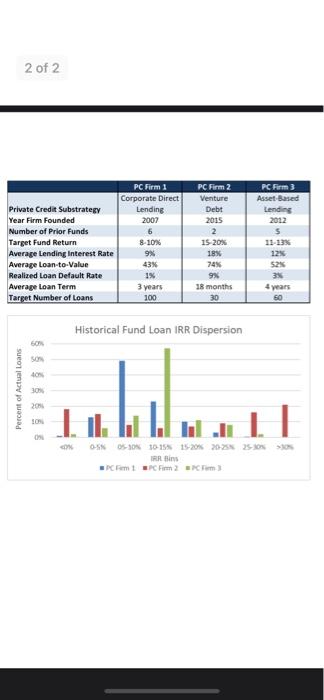

In the photos below, contains data about three fictional Private Credit firms (PC Firm 1, PC Firm 2, and PC Firm 3) that are raising

In the photos below, contains data about three fictional Private Credit firms (PC Firm 1, PC Firm 2, and PC Firm 3) that are raising new funds. We have also provided a histogram comparing the distribution of IRRs (internal rates of return) of loans in the previously raised funds of each of the three firms. Based on the table and graph, as well as any research you conduct or knowledge you have regarding these sub-strategies (corporate direct lending, venture debt, asset-based lending), describe which of these funds you believe are a potential fit for your portfolio. Your answer can be any number of funds between zero and all three (i.e., invest in none, invest with one fund, invest with two funds, invest with all three funds).

Please limit your answer to no bout three fictional Private Credit firms (PC Firm 1, PC Firm 2, and PC Firm 3) that are raising new funds. We have also provided a histogram comparing the distribution of IRRs (internal rates of return) of loans in the previously raised funds of each of the three firms. Based on the table and graph, as well as any research you conduct or knowledge you have regarding these sub-strategies (corporate direct lending, venture debt, asset-based lending), describe which of these funds you believe are a potential fit for Rhode Islands Private Credit portfolio. Your answer can be any number of funds between zero and all three (i.e., invest in none, invest with one fund, invest with two funds, invest with all three funds).

Please limit your answer to no more than 750 words.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started