Answered step by step

Verified Expert Solution

Question

1 Approved Answer

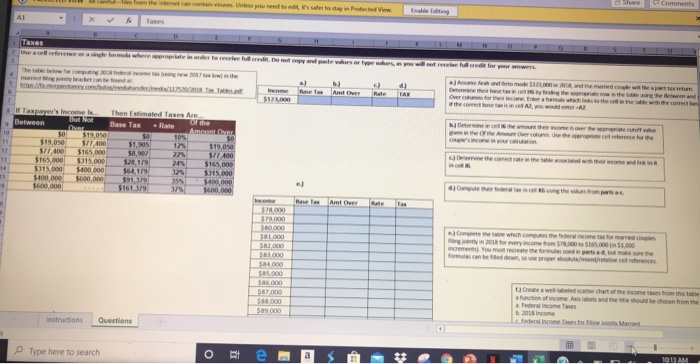

In this problem, you will caculate the federal income tax for married couples filling joinlty incomes? Please show cell refences and formulas Start Excel Download

In this problem, you will caculate the federal income tax for married couples filling joinlty incomes? Please show cell refences and formulas

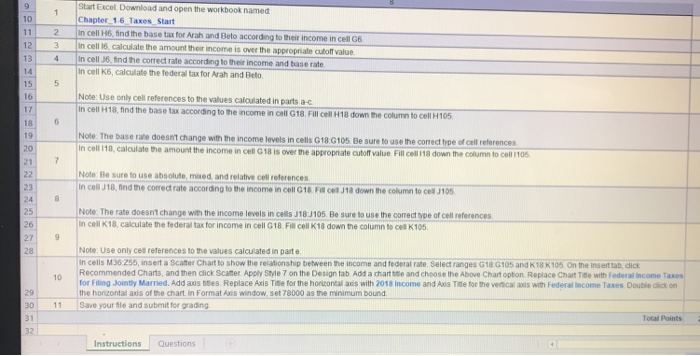

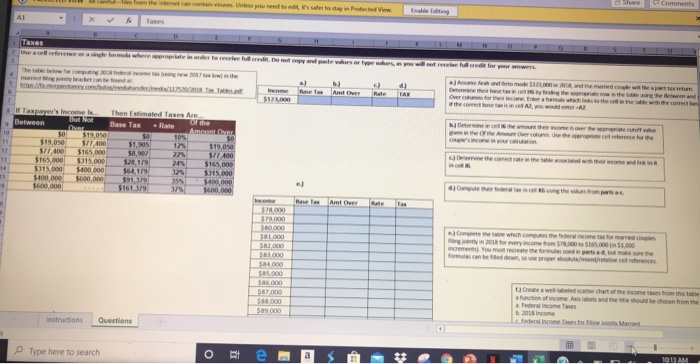

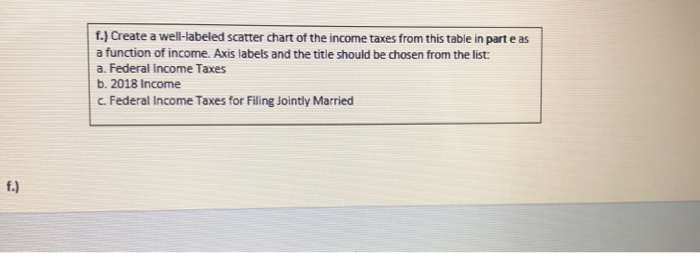

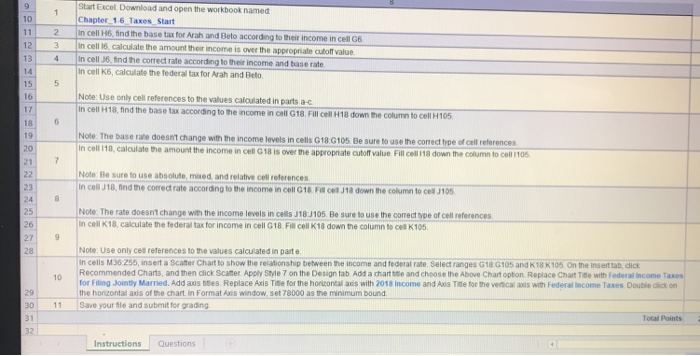

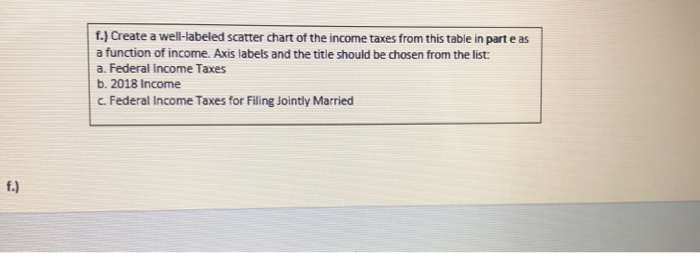

Start Excel Download and open the workbook named Chapter 16 Taxes Start In cell H6 find the base tax for Arah and Beto according to the income in cell G6 In cell 16. calculate the amount the income is over the appropriate cutoff value In cell find the correct rate according to the income and base rate In cell Ko, calculate the federal tax for Arah and Beto Note: Use only cell references to the values calculated in parts ac In cell H18 find the base tax according to the income in cell G18 Fill cell H18 down the column to cell H105 Note: The base rate doesn't change with the income levels in cells G18G105 Be sure to use the correct type of cell references In colt 110, calculate the amount the income in cell G18 is over the appropriate cutoff value Fill coll 18 down the column to cell 105 Note Be sure to use absolute mored and relative cell references In cel J18 find the correct rate according to the income in cell G18 Fill cell 18 down the column to cell 105 Note: The rate doesn't change with the income levels in Cells J18 J105. Be sure to use the correct pe of cell references in cell K18 calculate the federal tax for income in cell G18 Fill cell K18 down the column to cel K105. 10 Note: Use only cel references to the values calculated in parte, In cells M36:255, insert a Scatter Chart to show the relationship between the income and federal rate. Select ranges GIB G105 and 18 K105 On the insert tab, click Recommended Charts, and then dick scatter Apply Style 7 on the Designlab Add a charts and choose the Above Chart option Replace Chart Title with Federal income Taxes for Filing Jointly Married. Add as bes. Replace Axis Title for the horizontal with 2018 income and Axis Tide for the vertical axis with Federal income Taxes Double click on the horizontal axis of the chart in Format Axis window. set 78000 as the minimum bound. Save your file and submit for grading Total Points 30 11 Instructions Questions om the reference and where it is de M o d e Taxpayer's income is. Then Estimated Taxes Are Between Bee Tax Rate 0 19.00 10 $19,050 $71.400 $1,905 $1.000 $169000 07 3165000 15000 1 315.000 100.000 $64,179 H00,000 $600,000 $91,179 $161.379 $19,050 $17.400 $115.000 & meheg a every $1,000 te the water the remo M Instructions Questions Toe here to search 1.) Create a well-labeled scatter chart of the income taxes from this table in parte as a function of income. Axis labels and the title should be chosen from the list: a. Federal Income Taxes b. 2018 Income c. Federal Income Taxes for Filing Jointly Married Start Excel Download and open the workbook named Chapter 16 Taxes Start In cell H6 find the base tax for Arah and Beto according to the income in cell G6 In cell 16. calculate the amount the income is over the appropriate cutoff value In cell find the correct rate according to the income and base rate In cell Ko, calculate the federal tax for Arah and Beto Note: Use only cell references to the values calculated in parts ac In cell H18 find the base tax according to the income in cell G18 Fill cell H18 down the column to cell H105 Note: The base rate doesn't change with the income levels in cells G18G105 Be sure to use the correct type of cell references In colt 110, calculate the amount the income in cell G18 is over the appropriate cutoff value Fill coll 18 down the column to cell 105 Note Be sure to use absolute mored and relative cell references In cel J18 find the correct rate according to the income in cell G18 Fill cell 18 down the column to cell 105 Note: The rate doesn't change with the income levels in Cells J18 J105. Be sure to use the correct pe of cell references in cell K18 calculate the federal tax for income in cell G18 Fill cell K18 down the column to cel K105. 10 Note: Use only cel references to the values calculated in parte, In cells M36:255, insert a Scatter Chart to show the relationship between the income and federal rate. Select ranges GIB G105 and 18 K105 On the insert tab, click Recommended Charts, and then dick scatter Apply Style 7 on the Designlab Add a charts and choose the Above Chart option Replace Chart Title with Federal income Taxes for Filing Jointly Married. Add as bes. Replace Axis Title for the horizontal with 2018 income and Axis Tide for the vertical axis with Federal income Taxes Double click on the horizontal axis of the chart in Format Axis window. set 78000 as the minimum bound. Save your file and submit for grading Total Points 30 11 Instructions Questions om the reference and where it is de M o d e Taxpayer's income is. Then Estimated Taxes Are Between Bee Tax Rate 0 19.00 10 $19,050 $71.400 $1,905 $1.000 $169000 07 3165000 15000 1 315.000 100.000 $64,179 H00,000 $600,000 $91,179 $161.379 $19,050 $17.400 $115.000 & meheg a every $1,000 te the water the remo M Instructions Questions Toe here to search 1.) Create a well-labeled scatter chart of the income taxes from this table in parte as a function of income. Axis labels and the title should be chosen from the list: a. Federal Income Taxes b. 2018 Income c. Federal Income Taxes for Filing Jointly Married

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started