Question

In three units of study, there will be application-focused cases due at the beginning of the class that will be provided by the instructor. These

In three units of study, there will be application-focused cases due at the beginning of the class that will be provided by the instructor. These cases will be complex in nature and will require the application of course concepts to real-word business situations. Each case will have an associated rubric to highlight expectations. All submissions must be of professional quality and done in Microsoft Word, Microsoft Excel, or submitted as a PDF.

Objectives

- To evaluate different costing systems and their impact on business decisions.

- To illustrate the importance of hidden (undirected) issues that arise from a detailed analysis.

- To prepare a coherent report and integrated analysis that meets specific user needs.

Instructions

In order to complete your case analysis successfully, you must

- identify the role you are playing,

- assess user needs

- analyze user needs or issues (qualitatively and quantitatively), and

- provide a recommendation and conclusion.

An average grade will result from answering all questions with basic coverage and accuracy, showing all your work. Additional points come from including greater detail, astute, informed commentary where appropriate and connections to readings and other content.

Case: Cost System Considerations for CANADA SNOWCONES LTD.

Canada Snowcones Ltd. (CSL) owned and operated 20 retail frozen yogurt stores spread throughout Southern Ontario, from Toronto to Windsor. CSL's stores sold only high quality, premium frozen yogurt. They offered an assortment of 35 different frozen yogurt flavours. A significant amount of the CSL flavours were special, such as "Peanut Butter Bacon", "Charcoal-Sushi", and "Tropical Cheese Sensations". However, CSL also sold a few of the classic frozen yogurt flavours, such as vanilla, milk chocolate, mint, and other singular fruit flavours. While some of the flavours were very popular, there were also some of the more peculiar flavours that had low total sales in terms of units.

CSL produced its own frozen yogurt. The founder of the company, Samantha Reynolds, had originally made the yogurt in her basement. But eventual growing demand led to Samantha renting part of factory for CSL's production. As CSL grew, Samantha was able to afford automated but more costly production equipment that blended the flavours and packaged the liquid frozen yogurt for freezing. CSL's most significant production costs were for raw materials, particularly yogurt, brown sugar, and the special flavour ingredients, and for the purchase, operation, and maintenance of production equipment.

All of CSL's products had the same retail price, as customers could choose or combine any flavours by scoops. Samantha set the prices to generate, on average, a markup of 100% on average full production costs. CSL's 2019 budget included manufacturing overhead (MOH) of $450,000. To estimate product costs, Samantha spread this MOH cost to products based on a proportion of the direct labour (DL) costs used in the production process. CSL's total DL costs for 2019 was $200,000, so Samantha charged the overhead to products at a rate of MOH to total DL costs.

Last week, Laura Horton, Samantha's babysitter for her daughter and the CEO of a large production firm, advised that Samantha's pricing strategy was not optimal. Laura's insight was that the expenses for producing CSL's numerous flavours were not uniform. She thought those inconsistencies should be reflected in the prices charged, or CSL's earnings would fluctuate as the combination of flavours sold varied.

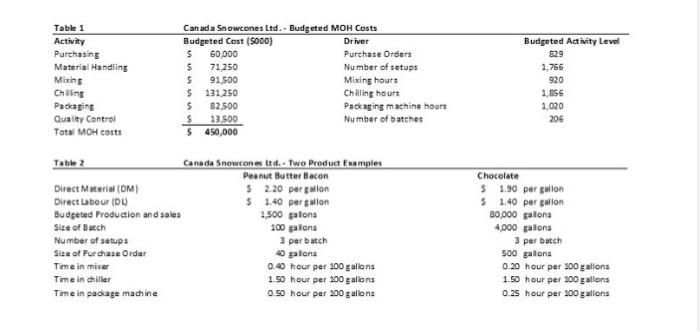

Laura proposed that Samantha reestimate product costs using activity-based costing. She recommended that Samantha identify the major activities whose costs were included in the company's MOH costs. Then, she should apply these costs to products based on the products consumption of each of those activities. In response to Laura's suggestions, Samantha prepared the information presented below in Table 1.

Samantha decided to hire your consulting firm to help calculate the costs of two demonstrative flavours as an experiment to see if Laura's activity based costing system suggested produced any significant contrasts. She asked Laura to take her best estimate as to where she might find the most material differences, if any existed. After Samantha described the products to her, Laura suggested that she use Peanut Butter Bacon and Chocolate as the test product examples. Table 2 provides data relevant to the two selected products.

Case Questions

1. Utilizing the information above, calculate the full product cost (on a per gallon basis) of the Peanut Butter Bacon and Chocolate flavours utilizing:

a. Samantha's more traditional costing system.

b. Laura's suggestion to use activity-based costing.

2. What are the impacts, if there is any at all, of switching CSL's costing method? In particular, are the any significant contrasts between traditional costing and activity-based costing in terms of:

a. Their impact on costs for independent products.

b. Their effect on CSL's total firm income? (assuming everything else remains the same, such as production and sales prices)

c. If there are significant contrasts, why are they present? If there are no significant contrasts, why are they not present?

3. What would you recommend to be Samantha's next step, based on this analysis? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started