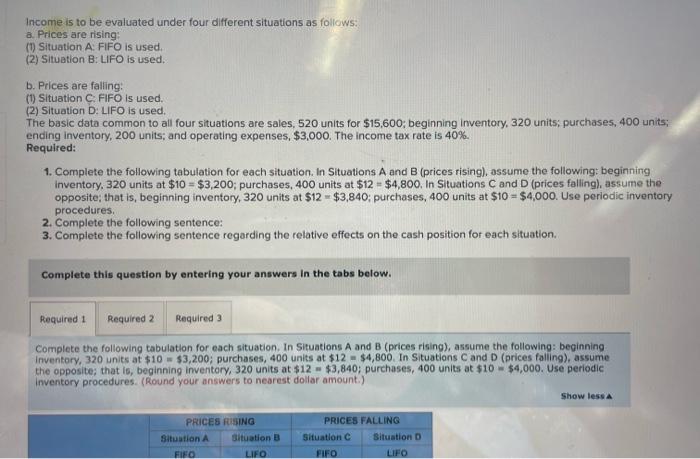

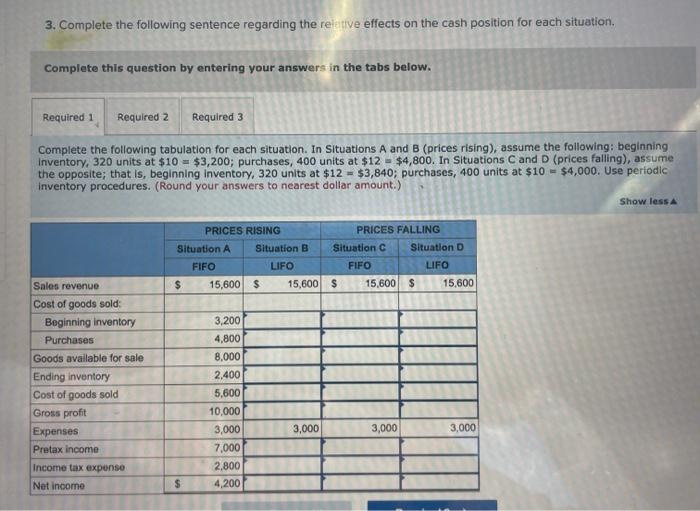

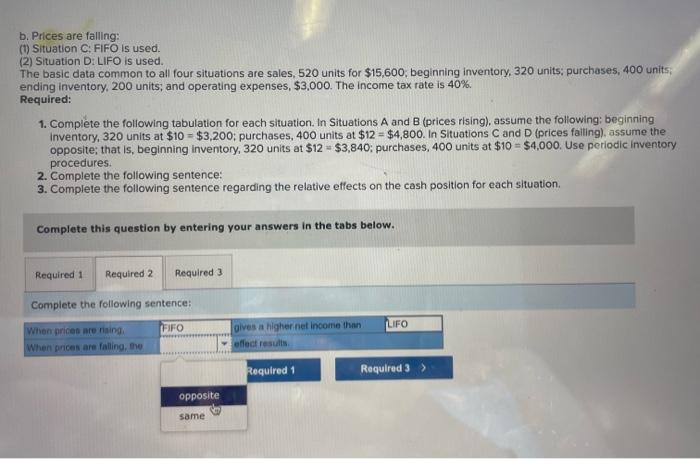

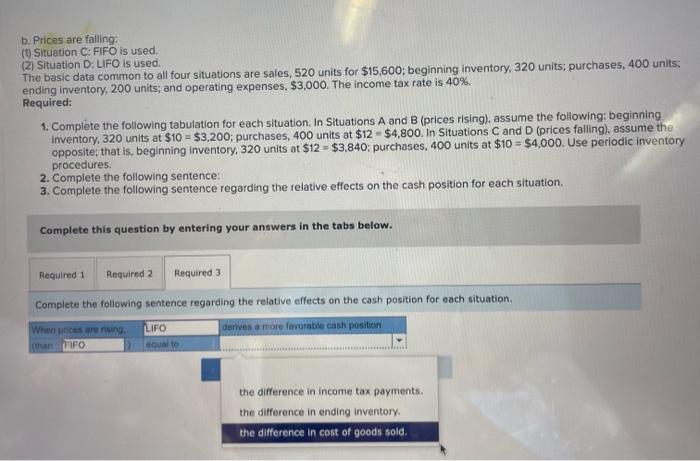

Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A:FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data common to all four situations are sales, 520 units for $15,600; beginning inventory, 320 units; purchases, 400 units; ending inventory, 200 units; and operating expenses, $3,000. The income tax rate is 40%. Required: 1. Complete the following tabulation for each situation. In Situations A and B (prices rising), assume the following: beginning inventory, 320 units at $10=$3,200; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 320 units at $12=$3,840; purchases, 400 units at $10=$4,000. Use periodic inventory procedures. 2. Complete the following sentence: 3. Complete the following sentence regarding the relative effects on the cash position for each situation. Complete this question by entering your answers in the tabs below. Complete the following tabulation for each situation. In Situations A and B (prices rising), assume the following: beginning inventory, 320 units at $10=$3,200; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 320 units at $12=$3,840; purchases, 400 units at $10=$4,000. Use periodic inventory procedures. (Round your answers to nearest dollar amount.) 3. Complete the following sentence regarding the relitive effects on the cash position for each situation. Complete this question by entering your answers in the tabs below. Complete the following tabulation for each situation. In Situations A and B (prices rising), assume the following: beginning Inventory, 320 units at $10=$3,200; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 320 units at $12=$3,840; purchases, 400 units at $10=$4,000. Use periodic inventory procedures. (Round your answers to nearest dollar amount.) b. Prices are falling: (1) Situation C: FiFO is used. (2) Situation D: LIFO is used. The basic data common to all four situations are sales, 520 units for $15,600, beginning inventory, 320 units; purchases, 400 units: ending inventory, 200 units; and operating expenses, $3,000. The income tax rate is 40%. Required: 1. Complete the following tabulation for each situation. In Situations A and B (prices rising), assume the following: beginning inventory, 320 units at $10=$3,200; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 320 units at $12=$3,840; purchases, 400 units at $10=$4,000. Use periodic inventory procedures. 2. Complete the following sentence: 3. Complete the following sentence regarding the relative effects on the cash position for each situation. Complete this question by entering your answers in the tabs below. Complete the following sentence: b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data common to all four situations are sales, 520 units for $15,600; beginning inventory, 320 units; purchases, 400 units; ending inventory, 200 units; and operating expenses, $3,000. The income tax rate is 40%. Required: 1. Compiete the following tabulation for each situation. In Situations A and B (prices rising), assume the following: beginning inventory, 320 units at $10=$3,200; purchases, 400 units at $12=$4,800. In Situations C and D (prices falling). assume the opposite; that is, beginning inventory, 320 units at $12=$3,840; purchases, 400 units at $10=$4,000. Use periodic inventory procedures. 2. Complete the following sentence: 3. Complete the following sentence regarding the relative effects on the cash position for each situation. Complete this question by entering your answers in the tabs below. Complete the following sentence regarding the relative effects on the cash position for each situation. the difference in income tax payments. the difference in ending inventory