Answered step by step

Verified Expert Solution

Question

1 Approved Answer

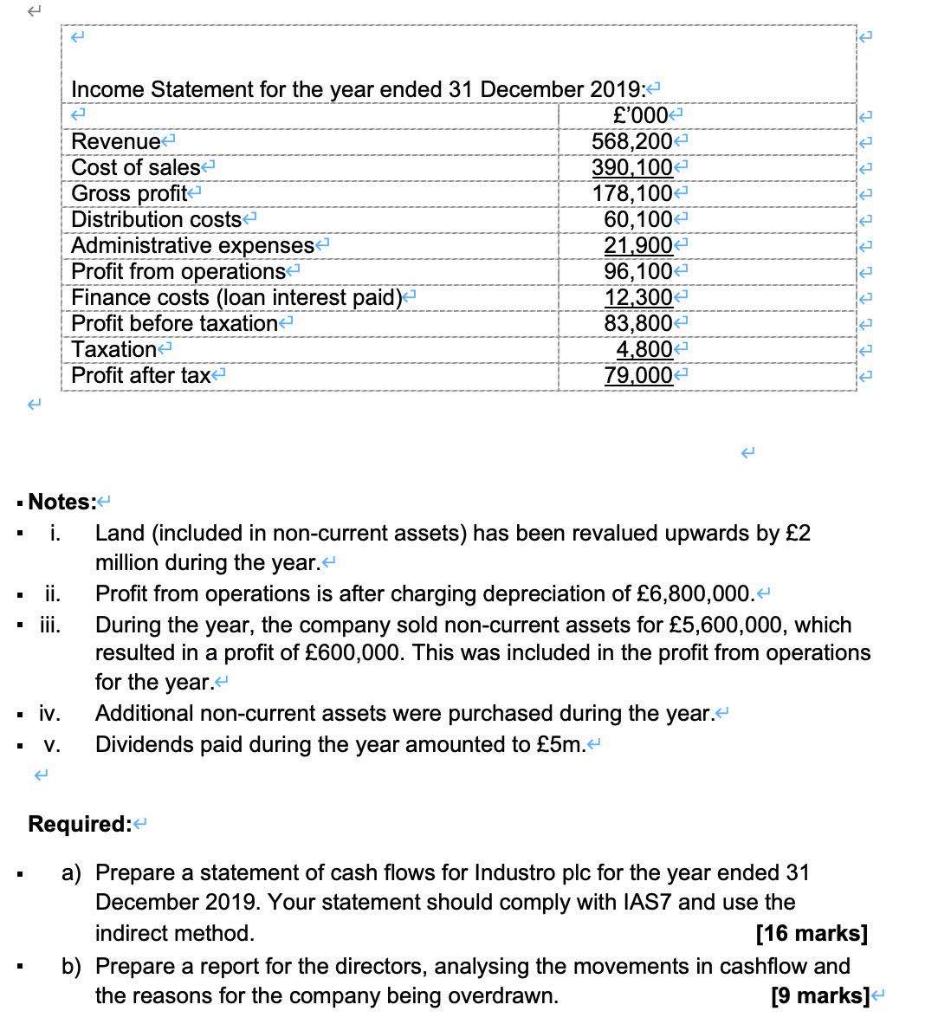

Income Statement for the year ended 31 December 2019:4 4 Revenue Cost of sales Gross profit '000 568,200 390,100 178,100 Distribution costs < 60,100

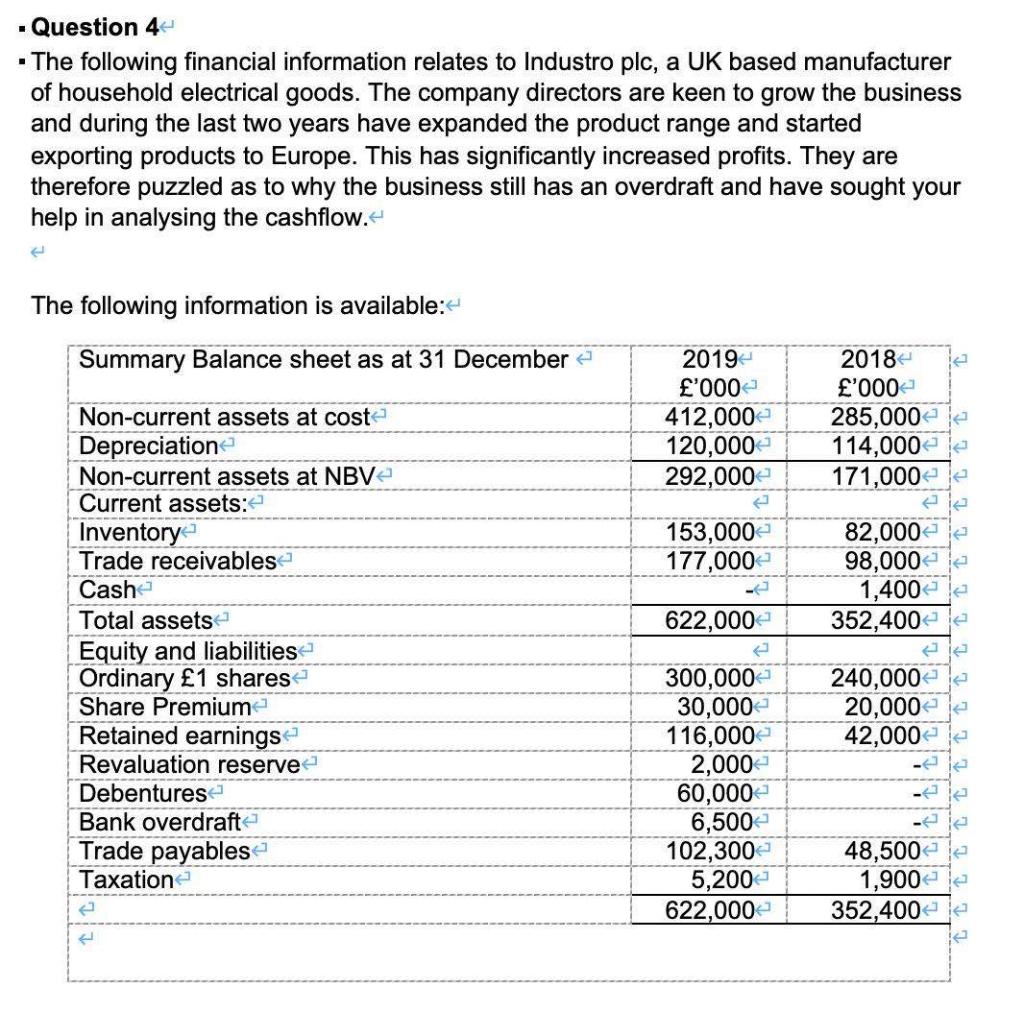

Income Statement for the year ended 31 December 2019:4 4 Revenue Cost of sales Gross profit '000 568,200 390,100 178,100 Distribution costs < 60,100 Administrative expenses 21,900 Profit from operations 96,100 Finance costs (loan interest paid) 12,300 Profit before taxation 83,800 Taxation 4,800 Profit after tax 79,000 Notes: < " i. " " ii. iii. iv. Land (included in non-current assets) has been revalued upwards by 2 million during the year. < Profit from operations is after charging depreciation of 6,800,000. < During the year, the company sold non-current assets for 5,600,000, which resulted in a profit of 600,000. This was included in the profit from operations for the year. Additional non-current assets were purchased during the year. < V. Dividends paid during the year amounted to 5m. < Required: < a) Prepare a statement of cash flows for Industro plc for the year ended 31 December 2019. Your statement should comply with IAS7 and use the indirect method. [16 marks] b) Prepare a report for the directors, analysing the movements in cashflow and the reasons for the company being overdrawn. [9 marks] Question 4 < The following financial information relates to Industro plc, a UK based manufacturer of household electrical goods. The company directors are keen to grow the business and during the last two years have expanded the product range and started exporting products to Europe. This has significantly increased profits. They are therefore puzzled as to why the business still has an overdraft and have sought your help in analysing the cashflow. < W The following information is available: < Summary Balance sheet as at 31 December 2019 2018 '000 '000 Non-current assets at cost 412,000 285,000 Depreciation 120,000 114,000 Non-current assets at NBV 292,000 171,000 Current assets: < Inventory Trade receivables < Cash 153,000 82,000 177,000 98,000 1,400 Total assets < 622,000 352,400 Equity and liabilities Ordinary 1 shares 300,000 240,000 Share Premium 30,000 20,000 Retained earnings < 116,000 42,000 Revaluation reserve 2,000 Debentures 60,000 Bank overdraft 6,500 Trade payables 102,300 48,500 Taxation 5,200 1,900 622,000 352,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Statement of Cash Flows for Industro plc For the Year Ended 31 December 2019 Cash flows from Operating Activities Profit before taxation 83800 Adjus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started