Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: For Supreme Limited, (a) prepare the income statement for the year ended 31 December 2019. (b) prepare the statement of changes in equity for

Required:

For Supreme Limited,

(a) prepare the income statement for the year ended 31 December 2019.

(b) prepare the statement of changes in equity for the year ended 31 December 2019.

(c) prepare the classified statement of financial position as at 31 December 2019.

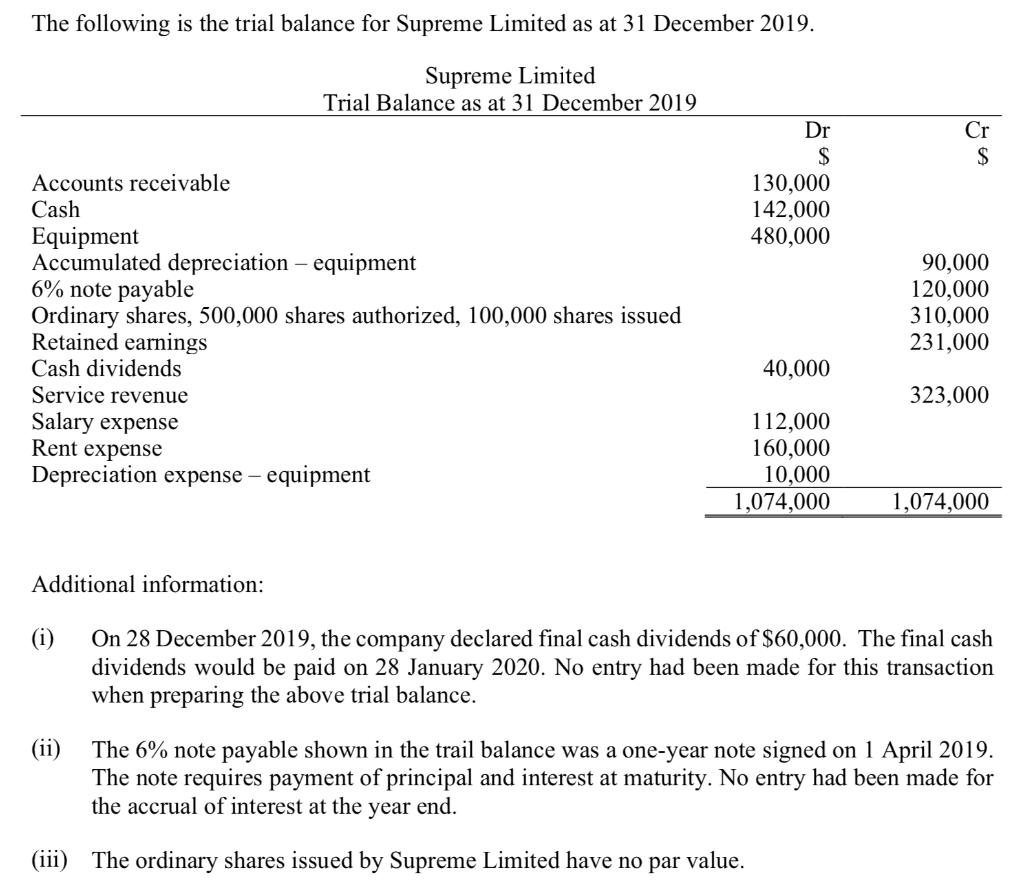

The following is the trial balance for Supreme Limited as at 31 December 2019. Supreme Limited Trial Balance as at 31 December 2019 Dr Cr $ $ Accounts receivable 130,000 Cash 142,000 Equipment 480,000 Accumulated depreciation - equipment 90,000 6% note payable 120,000 Ordinary shares, 500,000 shares authorized, 100,000 shares issued 310,000 Retained earnings 231,000 Cash dividends 40,000 Service revenue 323,000 Salary expense 112,000 Rent expense 160,000 Depreciation expense - equipment 10,000 1,074,000 1,074,000 Additional information: (i) (ii) On 28 December 2019, the company declared final cash dividends of $60,000. The final cash dividends would be paid on 28 January 2020. No entry had been made for this transaction when preparing the above trial balance. The 6% note payable shown in the trail balance was a one-year note signed on 1 April 2019. The note requires payment of principal and interest at maturity. No entry had been made for the accrual of interest at the year end. (iii) The ordinary shares issued by Supreme Limited have no par value.

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Income Statement for Supreme Limited For the Year Ended 31 December 2019 Service Revenue 323000 Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started