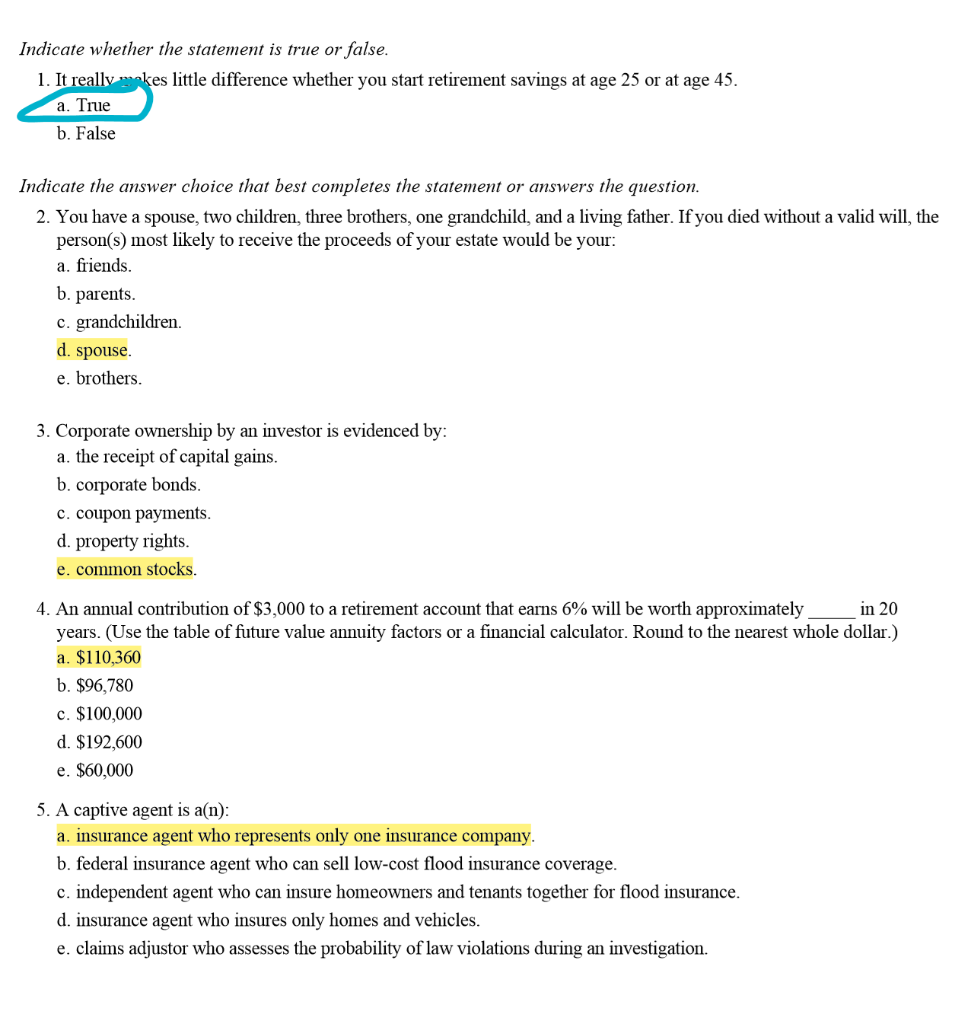

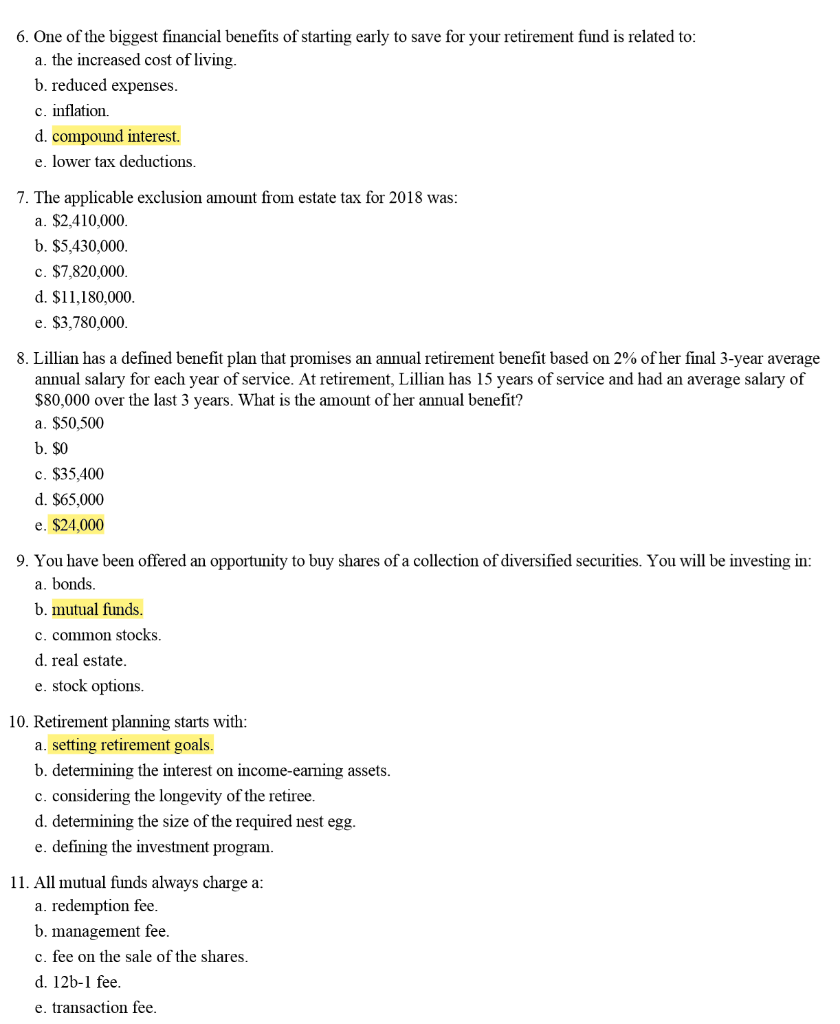

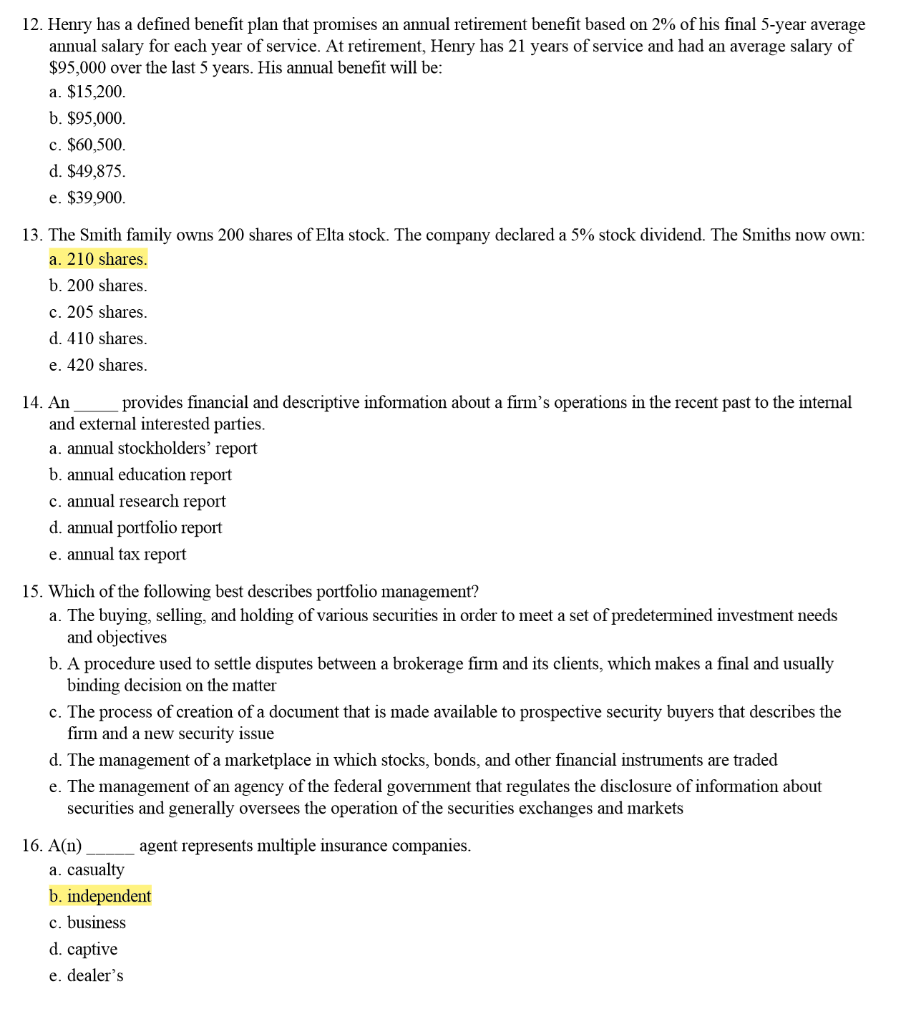

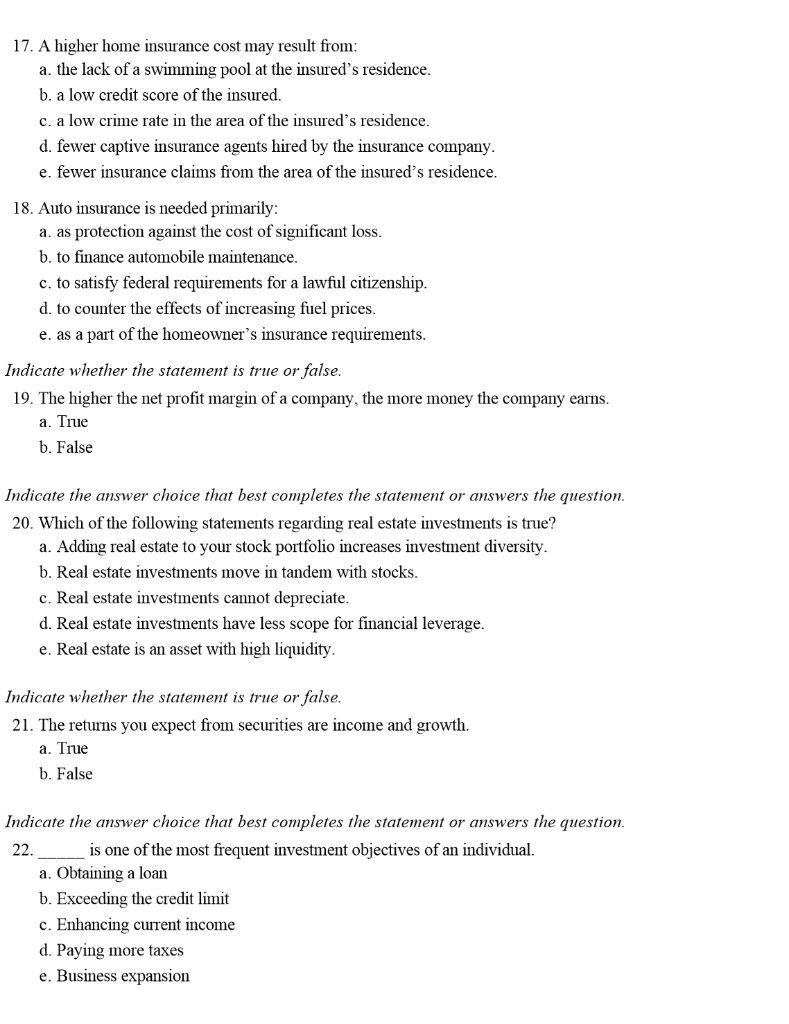

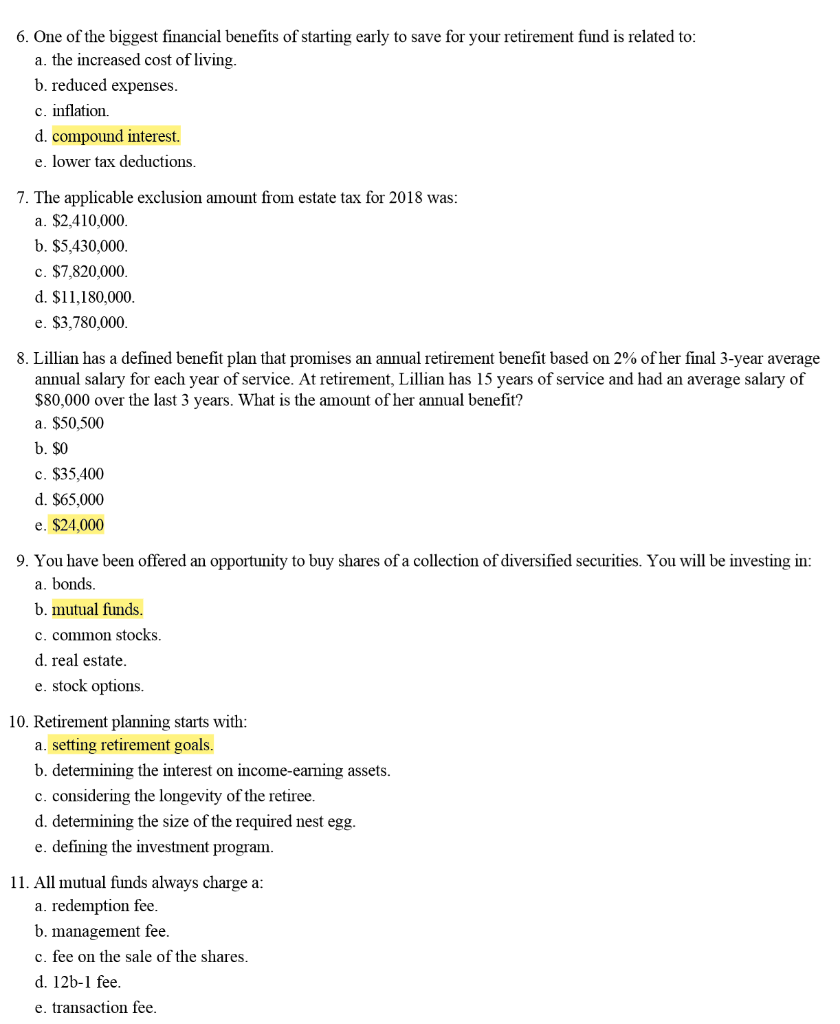

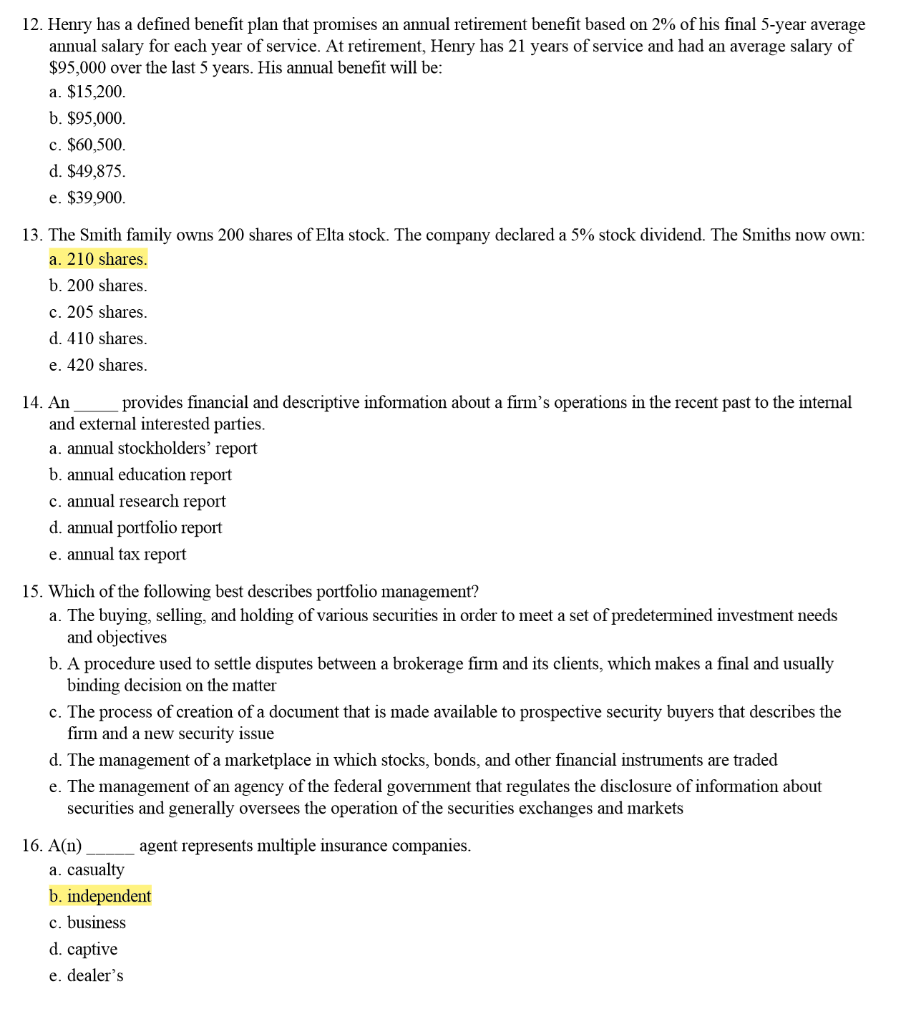

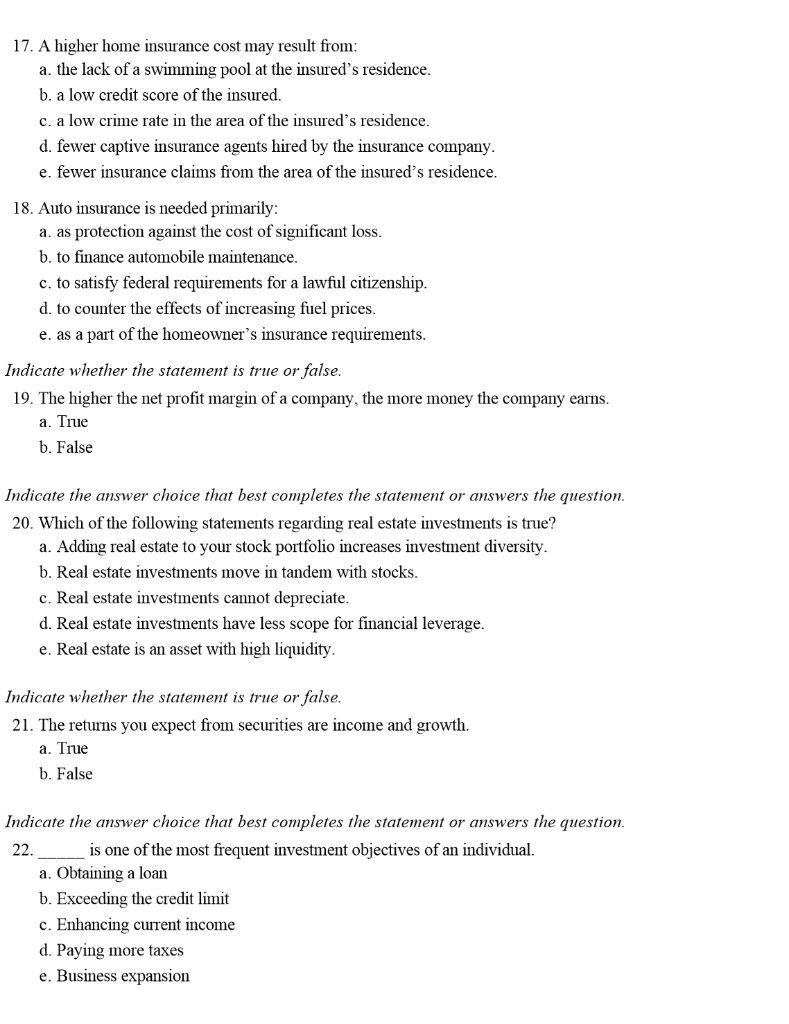

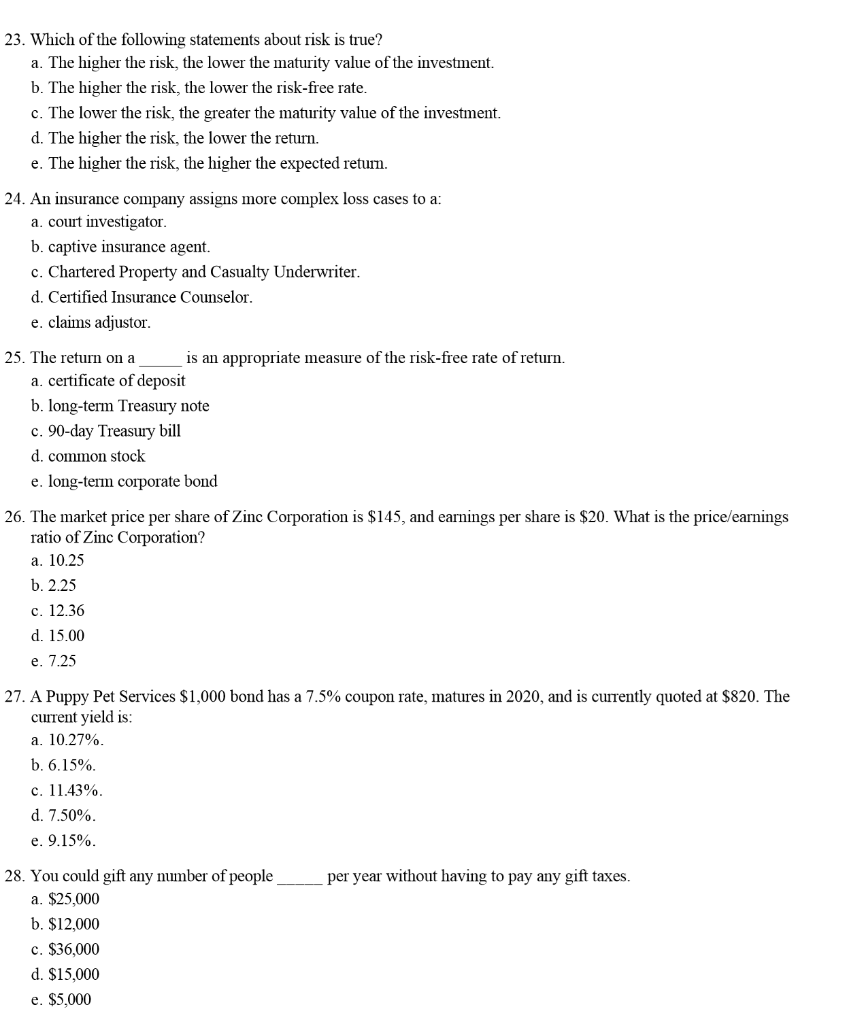

Indicate whether the statement is true or false. 1. It really makes little difference whether you start retirement savings at age 25 or at age 45. a. True b. False Indicate the answer choice that best completes the statement or answers the question. person(s) most likely to receive the proceeds of your estate would be your: a. friends. b. parents. c. grandchildren. d. spouse. e. brothers. 3. Corporate ownership by an investor is evidenced by: a. the receipt of capital gains. b. corporate bonds. C. coupon payments. d. property rights. e. common stocks. 4. An annual contribution of $3,000 to a retirement account that earns 6% will be worth approximately in 20 years. (Use the table of future value annuity factors or a financial calculator. Round to the nearest whole dollar.) a. $110,360 b. $96,780 c. $100,000 d. $192,600 e. $60,000 5. A captive agent is an): a. insurance agent who represents only one insurance company. b. federal insurance agent who can sell low-cost flood insurance coverage. c. independent agent who can insure homeowners and tenants together for flood insurance. d. insurance agent who insures only homes and vehicles. e. claims adjustor who assesses the probability of law violations during an investigation. 6. One of the biggest financial benefits of starting early to save for your retirement fund is related to: a. the increased cost of living. b. reduced expenses. c. inflation. d. compound interest. e. lower tax deductions. 7. The applicable exclusion amount from estate tax for 2018 was: a. $2,410,000. b. $5,430,000 c. $7,820,000 d. $11,180,000 e. $3,780,000 8. Lillian has a defined benefit plan that promises an annual retirement benefit based on 2% of her final 3-year average annual salary for each year of service. At retirement, Lillian has 15 years of service and had an average salary of $80,000 over the last 3 years. What is the amount of her annual benefit? a. $50,500 b. $0 c. $35,400 d. $65,000 e. $24,000 9. You have been offered an opportunity to buy shares of a collection of diversified securities. You will be investing in: a. bonds. b. mutual funds. c. common stocks. d. real estate. e. stock options. 10. Retirement planning starts with: a. setting retirement goals. b. determining the interest on income-earning assets. c. considering the longevity of the retiree. d. determining the size of the required nest egg. e. defining the investment program. 11. All mutual funds always charge a: a. redemption fee. b. management fee. c. fee on the sale of the shares. d. 12b-1 fee. e. transaction fee. 12. Henry has a defined benefit plan that promises an annual retirement benefit based on 2% of his final 5-year average annual salary for each year of service. At retirement, Henry has 21 years of service and had an average salary of $95,000 over the last 5 years. His annual benefit will be: a. $15,200. b. $95,000. c. $60,500. d. $49,875. e. $39,900. 13. The Smith family owns 200 shares of Elta stock. The company declared a 5% stock dividend. The Smiths now own: a. 210 shares. b. 200 shares. c. 205 shares. d. 410 shares. e. 420 shares. 14. An provides financial and descriptive information about a firm's operations in the recent past to the internal and external interested parties. a. annual stockholders' report b. annual education report c. annual research report d. annual portfolio report e. annual tax report 15. Which of the following best describes portfolio management? a. The buying, selling, and holding of various securities in order to meet a set of predetermined investment needs and objectives b. A procedure used to settle disputes between a brokerage firm and its clients, which makes a final and usually binding decision on the matter c. The process of creation of a document that is made available to prospective security buyers that describes the firm and a new security issue d. The management of a marketplace in which stocks, bonds, and other financial instruments are traded e. The management of an agency of the federal government that regulates the disclosure of information about securities and generally oversees the operation of the securities exchanges and markets 16. A(n) agent represents multiple insurance companies. a. casualty b. independent c. business d. captive e. dealer's 17. A higher home insurance cost may result from: a. the lack of a swimming pool at the insured's residence. b. a low credit score of the insured. c. a low crime rate in the area of the insured's residence. d. fewer captive insurance agents hired by the insurance company. e. fewer insurance claims from the area of the insured's residence 18. Auto insurance is needed primarily: a. as protection against the cost of significant loss. b. to finance automobile maintenance. c. to satisfy federal requirements for a lawful citizenship. d. to counter the effects of increasing fuel prices. e. as a part of the homeowner's insurance requirements. Indicate whether the statement is true or false. 19. The higher the net profit margin of a company, the more money the company earns. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 20. Which of the following statements regarding real estate investments is true? a. Adding real estate to your stock portfolio increases investment diversity. b. Real estate investments move in tandem with stocks. c. Real estate investments cannot depreciate. d. Real estate investments have less scope for financial leverage. e. Real estate is an asset with high liquidity. Indicate whether the statement is true or false. 21. The returns you expect from securities are income and growth. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 22._ is one of the most frequent investment objectives of an individual. a. Obtaining a loan b. Exceeding the credit limit c. Enhancing current income d. Paying more taxes e. Business expansion 23. Which of the following statements about risk is true? a. The higher the risk, the lower the maturity value of the investment. b. The higher the risk, the lower the risk-free rate. c. The lower the risk, the greater the maturity value of the investment. d. The higher the risk, the lower the return. e. The higher the risk, the higher the expected return. 24. An insurance company assigns more complex loss cases to a: a. court investigator. b. captive insurance agent. c. Chartered Property and Casualty Underwriter. d. Certified Insurance Counselor. e. claims adjustor. 25. The return on a is an appropriate measure of the risk-free rate of return. a certificate of deposit b. long-term Treasury note c. 90-day Treasury bill d. common stock e. long-term corporate bond 26. The market price per share of Zinc Corporation is $145, and earnings per share is $20. What is the price/earnings ratio of Zinc Corporation? a. 10.25 b. 2.25 c. 12.36 d. 15.00 e. 7.25 27. A Puppy Pet Services $1,000 bond has a 7.5% coupon rate, matures in 2020, and is currently quoted at $820. The current yield is: a. 10.27% b. 6.15%. c. 11.43%. d. 7.50%. e. 9.15%. per year without having to pay any gift taxes. 28. You could gift any number of people_ a. $25,000 b. $12,000 c. $36,000 d. $15,000 e. $5,000 34. An investor receives a return from an investment due to: a. capital gains on the sale of an investment. b. recurring deposits. c. rebalancing by buying more equities. d. asset allocation among different asset classes. e. diversification among or within asset classes. 35. The first thing you need to determine in order to reach an investment goal after accumulating the capital is the: a. rate of return. b. rate of inflation. c. rate of consumption. d. rate of interest. e. rate of savings