Question

Individual MODEL The Majestic Mulch and Compost Company (MMCC) MMCC is investigating the feasibility of a new line of power mulching tools aimed at the

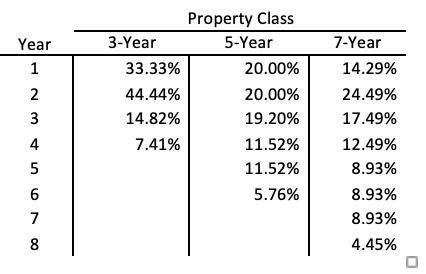

Individual MODEL The Majestic Mulch and Compost Company (MMCC) MMCC is investigating the feasibility of a new line of power mulching tools aimed at the growing number of home composters. MMCC expects to run the project for 8 years. MMCC expects unit sales of 3,000 in year 1. Annual average sales growth is anticipated to be 10% with a 7% standard deviation. The new power mulcher will be priced to sell between $120 and $125 per unit to start. When the competition catches up after three years, however, MMCC anticipates that the price will drop to $110. The power mulcher project will require $20,000 in net working capital (NWC) at the start. Subsequently, total NWC at the end of each year will be between 12 and 15 percent of sales for that year. The variable cost per unit is between $58 and $62, and total fixed costs are $20,000 per year. It will cost about $600,000 to buy the equipment necessary to begin production. This investment is primarily in industrial equipment and thus qualifies as seven-year MACRS property. The equipment will be worth about 20 to 25 percent of its cost in eight years. The tax rate is 25 percent, and the required return is 15 percent. Based on this information, should MMCC proceed?

To do list: 1. Estimate unit sales for years 2-8 assuming growth of 10% and standard deviation of 7% (be sure to use the RAND() function) 2. Estimate pro forma income statements years 1-8 3. Estimate pro forma balance sheets years 1-8 (NWC and FA) 4. Estimate FCFs 5. Estimate NPV, IRR, PI, and payback period 6. Draw the NPV profile of the project 7. Run 1,000 Monte Carlo Simulations on NPV 8. Estimate descriptive statistics 9. Estimate the 5%, 25%, 50%, 75%, and 90% percentile ranks 10. Draw the histogram of the simulations 11. What is your recommendation? Use all your estimations in your recommendation

To do list: 1. Estimate unit sales for years 2-8 assuming growth of 10% and standard deviation of 7% (be sure to use the RAND() function) 2. Estimate pro forma income statements years 1-8 3. Estimate pro forma balance sheets years 1-8 (NWC and FA) 4. Estimate FCFs 5. Estimate NPV, IRR, PI, and payback period 6. Draw the NPV profile of the project 7. Run 1,000 Monte Carlo Simulations on NPV 8. Estimate descriptive statistics 9. Estimate the 5%, 25%, 50%, 75%, and 90% percentile ranks 10. Draw the histogram of the simulations 11. What is your recommendation? Use all your estimations in your recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started