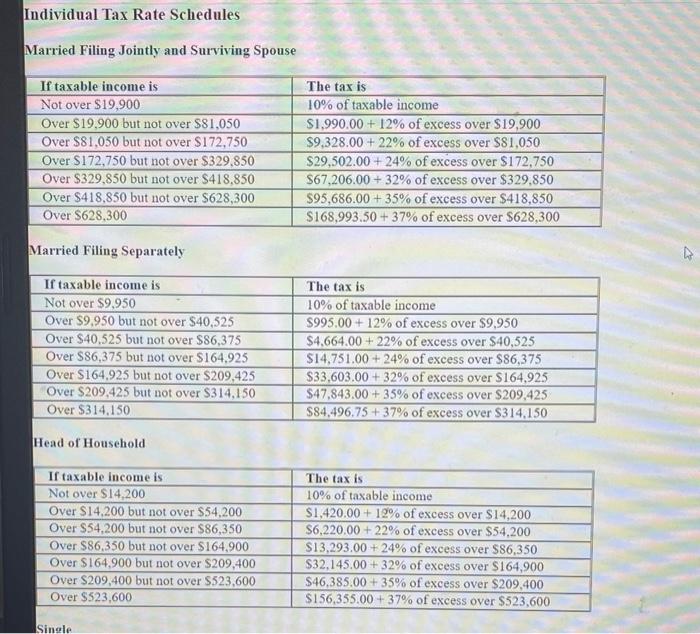

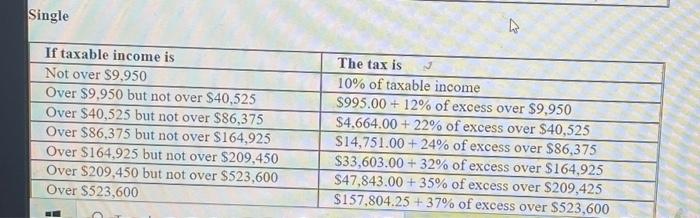

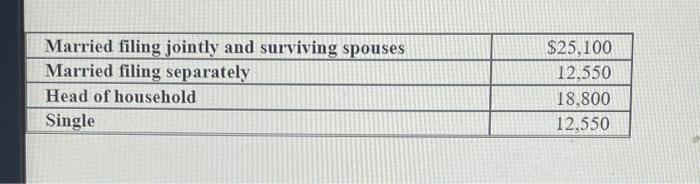

Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse If taxable income is Not over $19,900 Over $19.900 but not over $81,050 Over $81,050 but not over $172.750 Over $172,750 but not over $329,850 Over $329,850 but not over $418,850 Over $418,850 but not over $628,300 Over $628,300 The tax is 10% of taxable income $1.990.00 + 12% of excess over $19,900 $9,328.00 + 22% of excess over $81,050 $29,502.00 +24% of excess over $172,750 $67,206.00+ 32% of excess over $329,850 $95,686.00+ 35% of excess over $418,850 $168,993,50 + 37% of excess over $628,300 Married Filing Separately If taxable income is Not over $9.950 Over $9.950 but not over $40,525 Over $40,525 but not over $86,375 Over $86,375 but not over $164.925 Over $164.925 but not over $209,425 Over $209,425 but not over S314,150 Over $314.150 The tax is 10% of taxable income $995.00+ 12% of excess over $9.950 $4.664.00+ 22% of excess over $40,525 $14.751.00 +24% of excess over $86,375 $33.603.00 +32% of excess over $164.925 $47,843.00 + 35% of excess over $209,425 $84.496.75 + 37% of excess over $314.150 Head of Household If taxable income is Not over $14,200 Over $14,200 but not over $54,200 Over $54,200 but not over $86,350 Over $86,350 but not over $164.900 Over $164.900 but not over $209,400 Over $209,400 but not over S523,600 Over $523,600 The tax is 10% of taxable income $1,420.00 + 12% of excess over $14,200 S6,220.00 + 22% of excess over $54,200 $13,293.00 + 24% of excess over $86,350 $32.145.00+ 32% of excess over $164,900 $46,385.00+ 35% of excess over $209,400 $156,355.00+ 37% of excess over $523,600 Single Single m. If taxable income is Not over $9.950 Over $9.950 but not over $40,525 Over $40,525 but not over $86,375 Over $86.375 but not over $164,925 Over $164.925 but not over $209,450 Over $209,450 but not over S523,600 Over $523,600 The tax is 10% of taxable income $995.00 + 12% of excess over $9.950 $4,664.00 + 22% of excess over $40,525 S14,751.00 +24% of excess over $86,375 $33,603.00 + 32% of excess over $164,925 S47,843.00 + 35% of excess over $209,425 $157,804.25 +37% of excess over S523,600 Married filing jointly and surviving spouses Married filing separately Head of household Single $25.100 12,550 18,800 12.550 Mr. Toomey (a 45 year-old single taxpayer) exercised an ISO and purchased $380,000 worth of his employer's stock for only $113.000. His only other income was his $158,500 salary, and he doesn't itemize deductions. Required: Compute Mr. Toomey's income tax including any AMT. Use adividual Tax Rate Schedules and Standard Deduction Table (Round intermediate and final answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Mr Toomey's regular income tax Mr Toomoy's AMT Me Toomey's totallax IS S Amount 34,873 425,500 115,550 S