Answered step by step

Verified Expert Solution

Question

1 Approved Answer

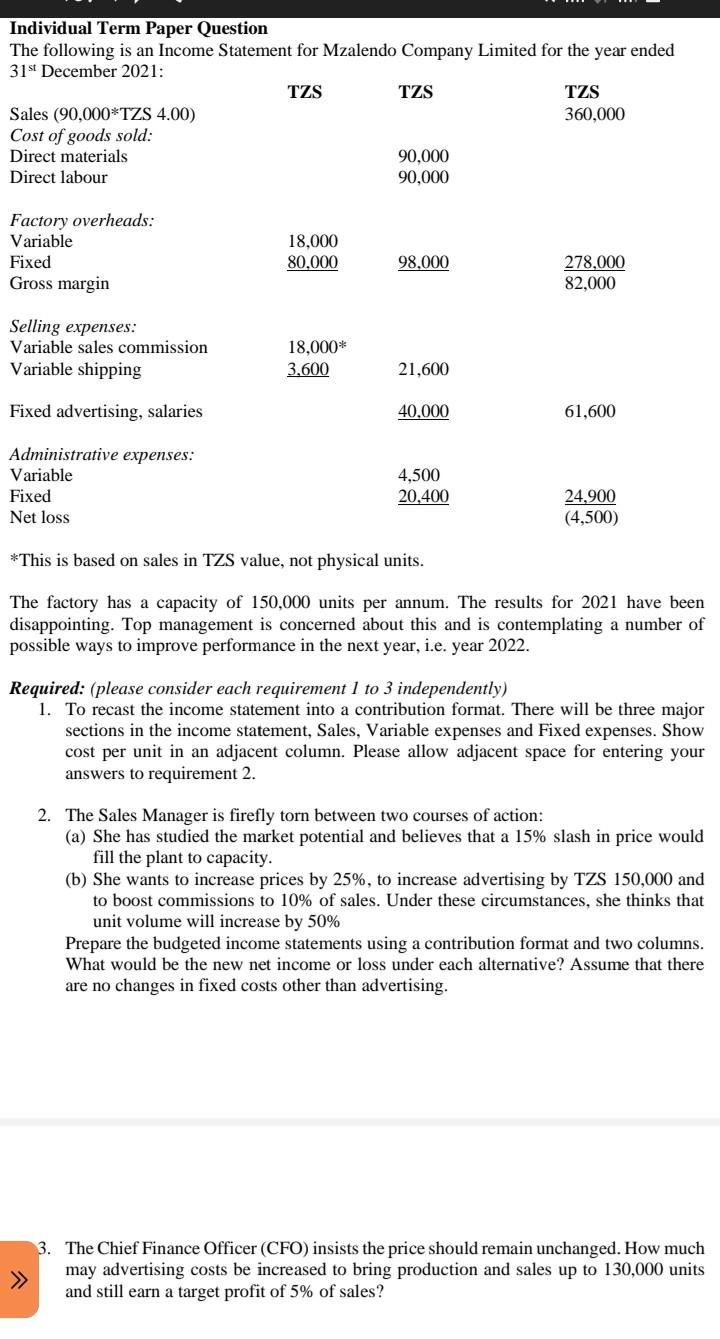

Individual Term Paper Question The following is an Income Statement for Mzalendo Company Limited for the year ended 31st December 2021: TZS TZS TZS Sales

Individual Term Paper Question The following is an Income Statement for Mzalendo Company Limited for the year ended 31st December 2021: TZS TZS TZS Sales (90,000 TZS 4.00) 360,000 Cost of goods sold: Direct materials 90,000 Direct labour 90,000 Factory overheads: Variable Fixed Gross margin 18,000 80.000 98,000 278,000 82,000 Selling expenses: Variable sales commission Variable shipping 18,000* 3,600 21,600 Fixed advertising, salaries 40,000 61,600 Administrative expenses: Variable Fixed Net loss 4,500 20,400 24,900 (4,500) *This is based on sales in TZS value, not physical units. The factory has a capacity of 150,000 units per annum. The results for 2021 have been disappointing. Top management is concerned about this and is contemplating a number of possible ways to improve performance in the next year, i.e. year 2022. Required: (please consider each requirement 1 to 3 independently) 1. To recast the income statement into a contribution format. There will be three major sections in the income statement, Sales, Variable expenses and Fixed expenses. Show cost per unit in an adjacent column. Please allow adjacent space for entering your answers to requirement 2. 2. The Sales Manager is firefly torn between two courses of action: (a) She has studied the market potential and believes that a 15% slash in price would fill the plant to capacity. (b) She wants to increase prices by 25%, to increase advertising by TZS 150,000 and to boost commissions to 10% of sales. Under these circumstances, she thinks that unit volume will increase by 50% Prepare the budgeted income statements using a contribution format and two columns. What would be the new net income or loss under each alternative? Assume that there are no changes in fixed costs other than advertising. 3. The Chief Finance Officer (CFO) insists the price should remain unchanged. How much may advertising costs be increased to bring production and sales up to 130,000 units and still earn a target profit of 5% of sales? Individual Term Paper Question The following is an Income Statement for Mzalendo Company Limited for the year ended 31st December 2021: TZS TZS TZS Sales (90,000 TZS 4.00) 360,000 Cost of goods sold: Direct materials 90,000 Direct labour 90,000 Factory overheads: Variable Fixed Gross margin 18,000 80.000 98,000 278,000 82,000 Selling expenses: Variable sales commission Variable shipping 18,000* 3,600 21,600 Fixed advertising, salaries 40,000 61,600 Administrative expenses: Variable Fixed Net loss 4,500 20,400 24,900 (4,500) *This is based on sales in TZS value, not physical units. The factory has a capacity of 150,000 units per annum. The results for 2021 have been disappointing. Top management is concerned about this and is contemplating a number of possible ways to improve performance in the next year, i.e. year 2022. Required: (please consider each requirement 1 to 3 independently) 1. To recast the income statement into a contribution format. There will be three major sections in the income statement, Sales, Variable expenses and Fixed expenses. Show cost per unit in an adjacent column. Please allow adjacent space for entering your answers to requirement 2. 2. The Sales Manager is firefly torn between two courses of action: (a) She has studied the market potential and believes that a 15% slash in price would fill the plant to capacity. (b) She wants to increase prices by 25%, to increase advertising by TZS 150,000 and to boost commissions to 10% of sales. Under these circumstances, she thinks that unit volume will increase by 50% Prepare the budgeted income statements using a contribution format and two columns. What would be the new net income or loss under each alternative? Assume that there are no changes in fixed costs other than advertising. 3. The Chief Finance Officer (CFO) insists the price should remain unchanged. How much may advertising costs be increased to bring production and sales up to 130,000 units and still earn a target profit of 5% of sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started