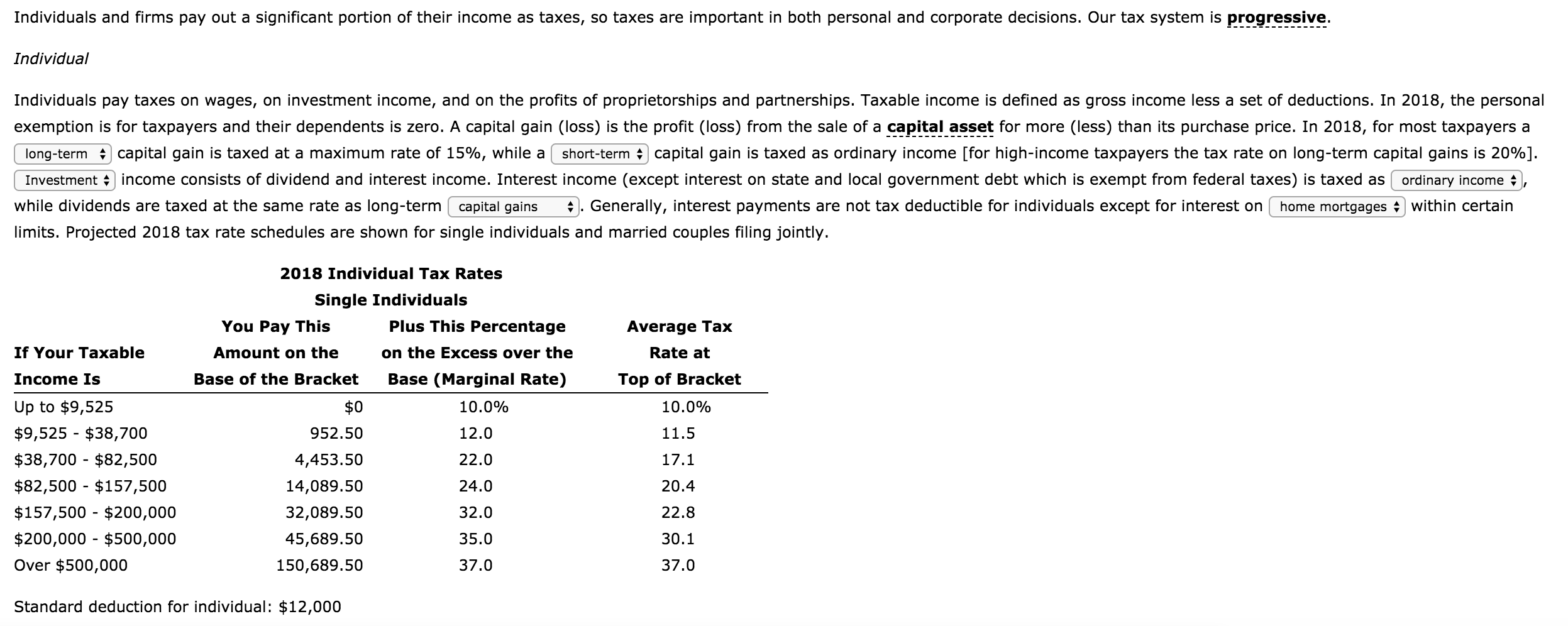

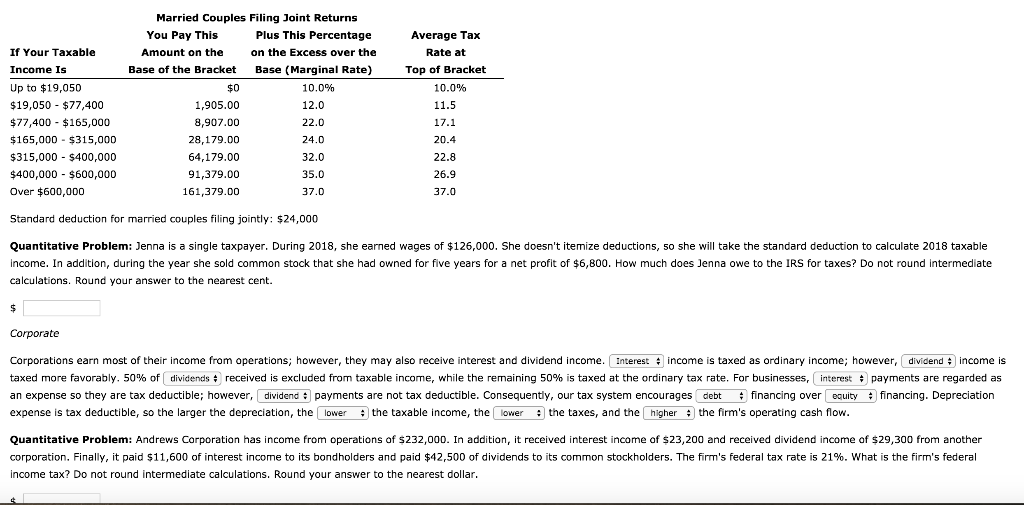

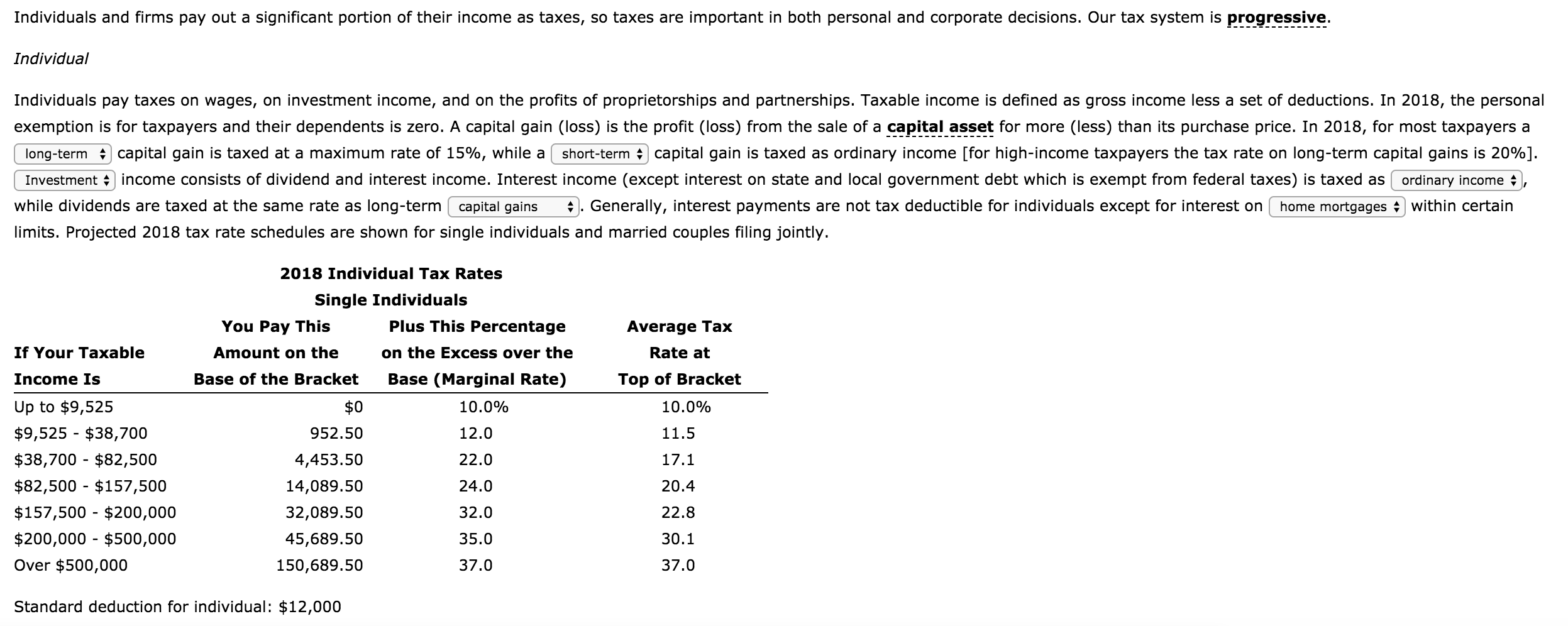

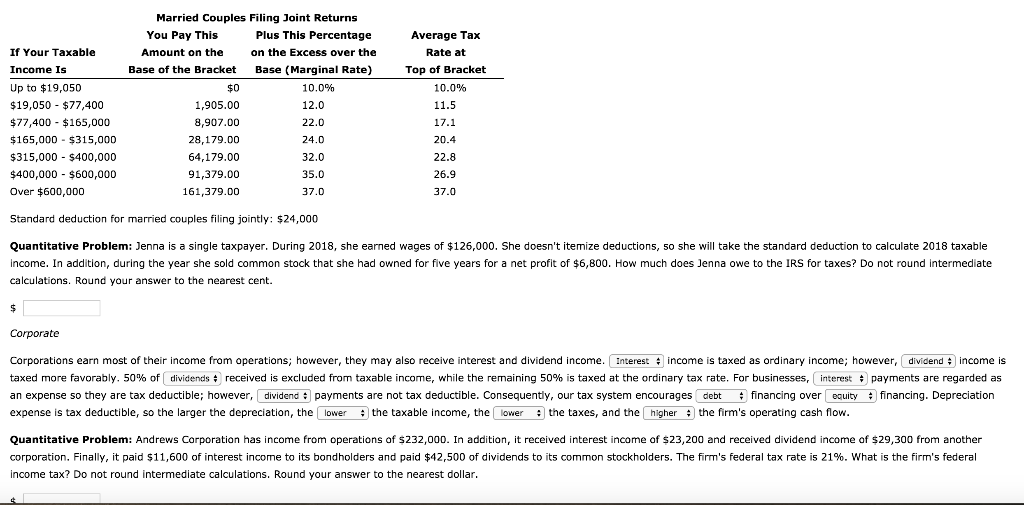

Individuals and firms pay out a significant portion of their income as taxes, so taxes are important in both personal and corporate decisions. Our tax system is progressive. Individual Individuals pay taxes on wages, on investment income, and on the profits of proprietorships and partnerships. Taxable income is defined as gross income less a set of deductions. In 2018, the personal exemption is for taxpayers and their dependents is zero. A capital gain (loss) is the profit (loss) from the sale of a capital asset for more (less) than its purchase price. In 2018, for most taxpayers a capital gain is taxed as ordinary income [for high-income taxpayers the tax rate on long-term capital gains is 20%. long-term capital gain is taxed at a maximum rate of 15%, while a short-term income consists of dividend and interest income. Interest income (except interest on state and local government debt which is exempt from federal taxes) is taxed as ordinary income Investment while dividends are taxed at the same rate as long-term capital gains ). Generally, interest payments are not tax deductible for individuals except for interest on home mortgages within certain limits. Projected 2018 tax rate schedules are shown for single individuals and married couples filing jointly. 2018 Individual Tax Rates Single Individuals Plus This Percentage You Pay This Average Tax Amount on the If Your Taxable on the Excess over the Rate at Base (Marginal Rate) Base of the Bracket Income Is Top of Bracket Up to $9,525 $0 10.0% 10.0% $9,525 - $38,700 12.0 952.50 11.5 $38,700 $82,500 4,453.50 22.0 17.1 $82,500 $157,500 14,089.50 24.0 20.4 $157,500 $200,000 32,089.50 32.0 22.8 $200,000 $500,000 45,689.50 35.0 30.1 Over $500,000 150,689.50 37.0 37.0 Standard deduction for individual: $12,000 Married Couples Filing Joint Returns Plus This Percentage You Pay This Average Tax If Your Taxable Amount on the on the Excess over the Rate at Base (Marginal Rate) Income Is Base of the Bracket Top of Bracket Up to $19,050 10.0% $0 10.0% $19,050 $77,400 $77,400 $165,000 1,905.00 12.0 11.5 8,907.00 22.0 17.1 $165,000 $315,000 28,179.00 24.0 20.4 64,179.00 32.0 $315,000 $400,000 22.8 $400,000 $600,000 91,379.00 35.0 26.9 Over $600,000 37.0 161,379.00 37.0 Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $126,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $6,800. How much does Jenna owe to the IRS for taxes? Do not round intermediate calculations. Round your answer to the nearest cent. Corporate Corporations earn most of their income from operations; however, they may also receive interest and dividend income. Interest income is taxed as ordinary income; however, dividendincome is taxed more favorably. 50% of dividends received is excluded from taxable income, while the remaining 50% is taxed at the ordinary tax rate. For businesses, interest payments are regarded as dividendpayments are not tax deductible. Consequently, our tax system encourages debt an expense so they are tax deductible; however, financing over equityfinancing. Depreciation the taxes, and the higher the firm's operating cash flow expense is tax deductible, so the larger the depreciation, the the taxable income, the lower lower Quantitative Problem: Andrews Corporation has income from operations of $232,000. In addition, it received interest income of $23,200 and received dividend income of $29,300 from another corporation. Finally, it paid $11,600 of interest income to its bondholders and paid $42,500 of dividends to its common stockholders. The firm's federal tax rate is 21%. What is the firm's federal income tax? Do not round intermediate calculations. Round your answer to the nearest dollar