Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information: Date Sales (Cost of Goods Sold) Inventory Account 1-Nov 8-Nov 11/1:2,000 @ $5.30 10,600.00 11/1:2,000 @ $5.30 10,600.00 11/8: 8,000 @ $5.50 44,000.00

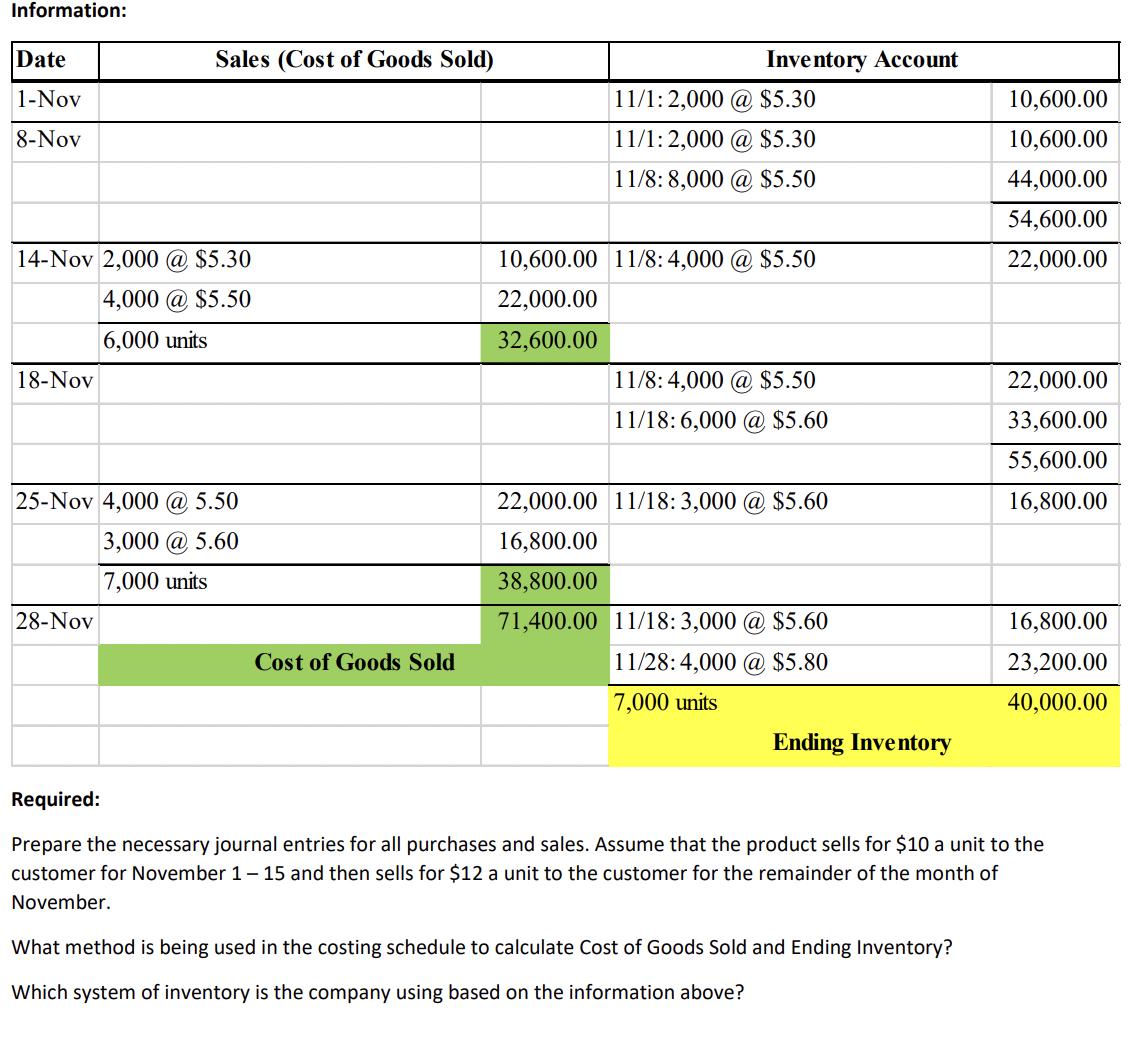

Information: Date Sales (Cost of Goods Sold) Inventory Account 1-Nov 8-Nov 11/1:2,000 @ $5.30 10,600.00 11/1:2,000 @ $5.30 10,600.00 11/8: 8,000 @ $5.50 44,000.00 54,600.00 14-Nov 2,000 @ $5.30 10,600.00 11/8: 4,000 @ $5.50 22,000.00 18-Nov 4,000 @ $5.50 6,000 units 22,000.00 32,600.00 11/8: 4,000 @ $5.50 22,000.00 11/18: 6,000 @ $5.60 33,600.00 55,600.00 25-Nov 4,000 @ 5.50 3,000 @ 5.60 22,000.00 11/18: 3,000 @ $5.60 16,800.00 16,800.00 7,000 units 28-Nov 38,800.00 71,400.00 11/18: 3,000 @ $5.60 16,800.00 Cost of Goods Sold 11/28:4,000 @ $5.80 23,200.00 7,000 units 40,000.00 Ending Inventory Required: Prepare the necessary journal entries for all purchases and sales. Assume that the product sells for $10 a unit to the customer for November 1-15 and then sells for $12 a unit to the customer for the remainder of the month of November. What method is being used in the costing schedule to calculate Cost of Goods Sold and Ending Inventory? Which system of inventory is the company using based on the information above?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the purchases and sales for November Nov 1 Inventory10600 Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427db27aa18_979836.pdf

180 KBs PDF File

66427db27aa18_979836.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started