Answered step by step

Verified Expert Solution

Question

1 Approved Answer

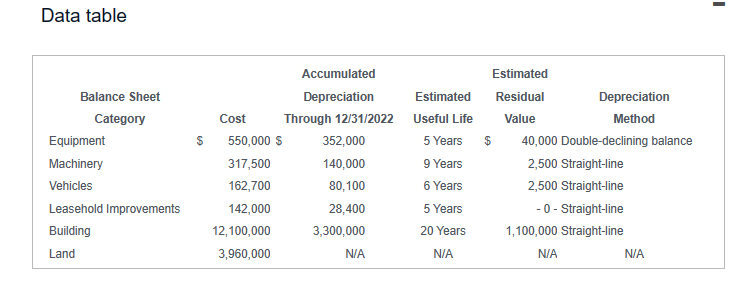

Information related to the long-term operating assets of Irwin Retail Distributors, Inc. at December 31, 2022, is as follows: The fiscal year end of the

Information related to the long-term operating assets of Irwin Retail Distributors, Inc. at December 31, 2022, is as follows:

Information related to the long-term operating assets of Irwin Retail Distributors, Inc. at December 31, 2022, is as follows:

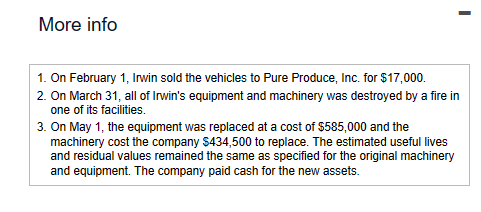

The fiscal year end of the company is December 31. The following events occurred during 2023:

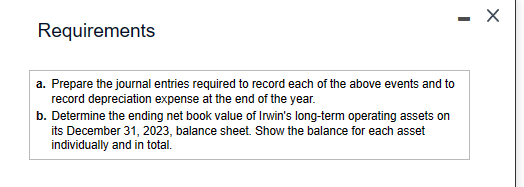

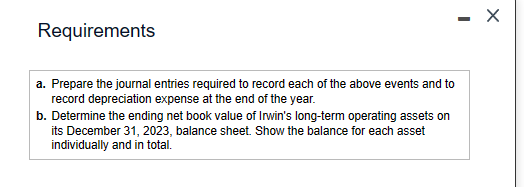

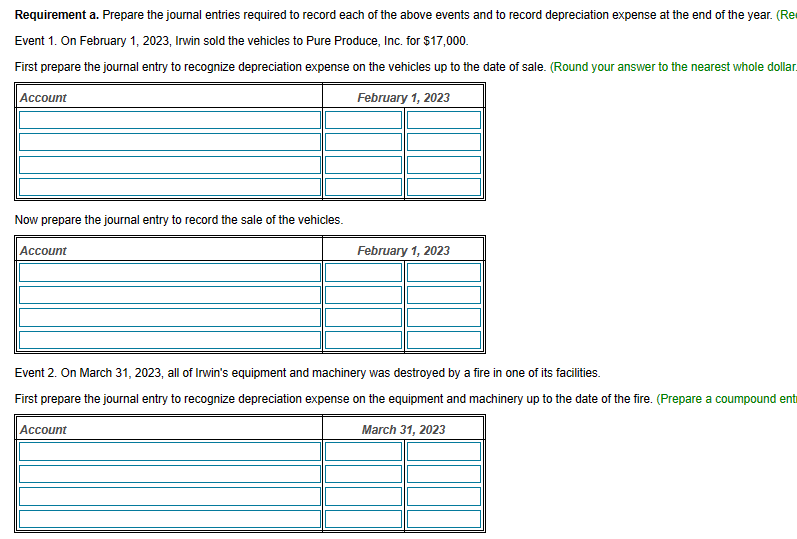

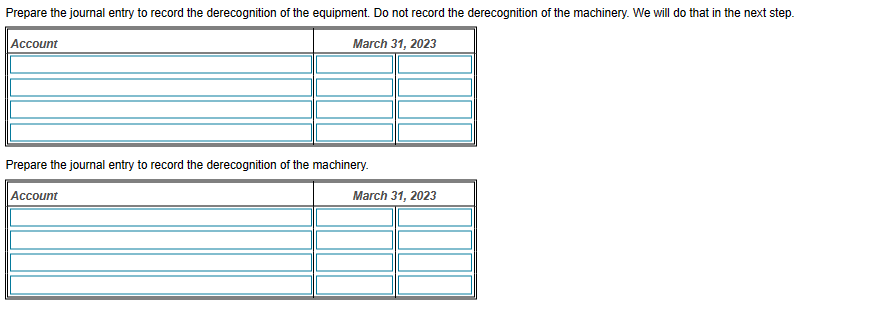

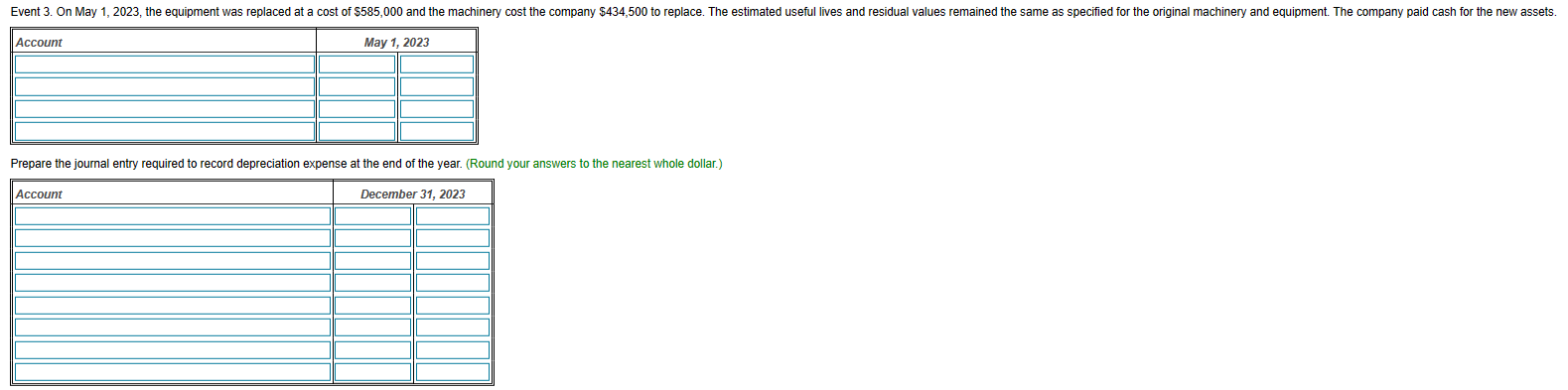

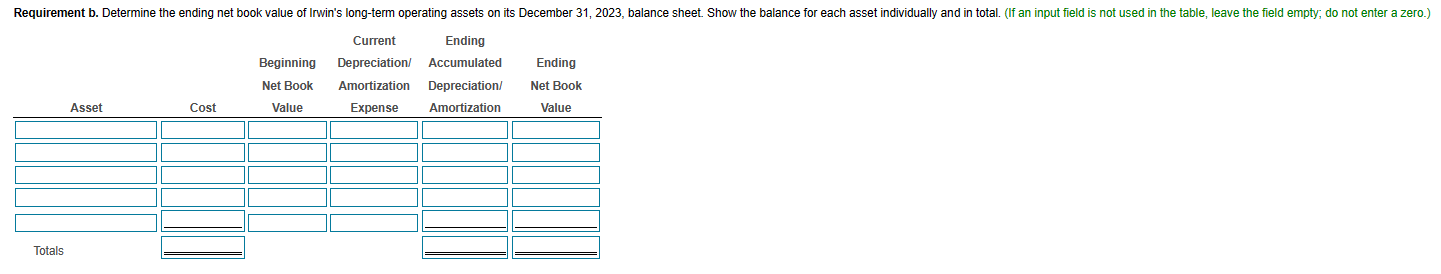

Requirements a. Prepare the journal entries required to record each of the above events and to record depreciation expense at the end of the year. b. Determine the ending net book value of Irwin's long-term operating assets on its December 31, 2023, balance sheet. Show the balance for each asset individually and in total. Data table More info 1. On February 1, Irwin sold the vehicles to Pure Produce, Inc. for $17,000. 2. On March 31, all of Irwin's equipment and machinery was destroyed by a fire in one of its facilities. 3. On May 1, the equipment was replaced at a cost of $585,000 and the machinery cost the company $434,500 to replace. The estimated useful lives and residual values remained the same as specified for the original machinery and equipment. The company paid cash for the new assets. Requirements a. Prepare the journal entries required to record each of the above events and to record depreciation expense at the end of the year. b. Determine the ending net book value of Irwin's long-term operating assets on its December 31, 2023, balance sheet. Show the balance for each asset individually and in total. Requirement a. Prepare the journal entries required to record each of the above events and to record depreciation expense at the end of the year. (Re Event 1. On February 1, 2023, Irwin sold the vehicles to Pure Produce, Inc. for $17,000. First prepare the journal entry to recognize depreciation expense on the vehicles up to the date of sale. (Round your answer to the nearest whole dolla Now prepare the journal entry to record the sale of the vehicles. Event 2. On March 31, 2023, all of Irwin's equipment and machinery was destroyed by a fire in one of its facilities. First prepare the journal entry to recognize depreciation expense on the equipment and machinery up to the date of the fire. (Prepare a coumpound en Prepare the journal entry to record the derecognition of the machinery. \begin{tabular}{||l|l|l||} \hline \hline Account & \multicolumn{2}{|c||}{ May 1, 2023} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Prepare the journal entry required to record depreciation expense at the end of the year. (Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started