Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Initial Investment (Equipment Cost): $465,000 Salvage Value of Equipment: $100,000 Initial Inventory and Blueberries: $9,000 Sales in Year 1: 15,000 jars Sales Growth: 50% in

- Initial Investment (Equipment Cost): $465,000

- Salvage Value of Equipment: $100,000

- Initial Inventory and Blueberries: $9,000

- Sales in Year 1: 15,000 jars

- Sales Growth: 50% in Year 2, 15% increase every subsequent year

- Retail Price per Jar: $16

- Variable Costs: 25% of Price

- Inflation: 5% for the next 2 years, 3% thereafter

- Number of Employees: 2 in Year 1, 3 from Year 2 onwards

- Initial Employee Salary: $45,000

- Rent per Month: $2,000

- Marketing Cost in Year 1: $25,000

- Accounts Receivable: 45% of Revenue

- Accounts Payable: 20% of Costs of Goods Sold

- Initial Inventory Recovery in Year 8: 15% of Revenue

Calculations:

- Calculate annual revenues for each year based on the sales growth rate and price per jar.

- Calculate variable costs as a percentage of revenue.

- Calculate annual salaries, taking inflation into account.

- Calculate rent expenses for each year.

- Calculate marketing costs, considering inflation.

- Calculate accounts receivable and accounts payable.

- Calculate net cash flows by subtracting expenses from revenues.

- Calculate taxes as 13% of taxable income.

- Calculate NPV using a discount rate of 16%.

- Calculate the IRR.

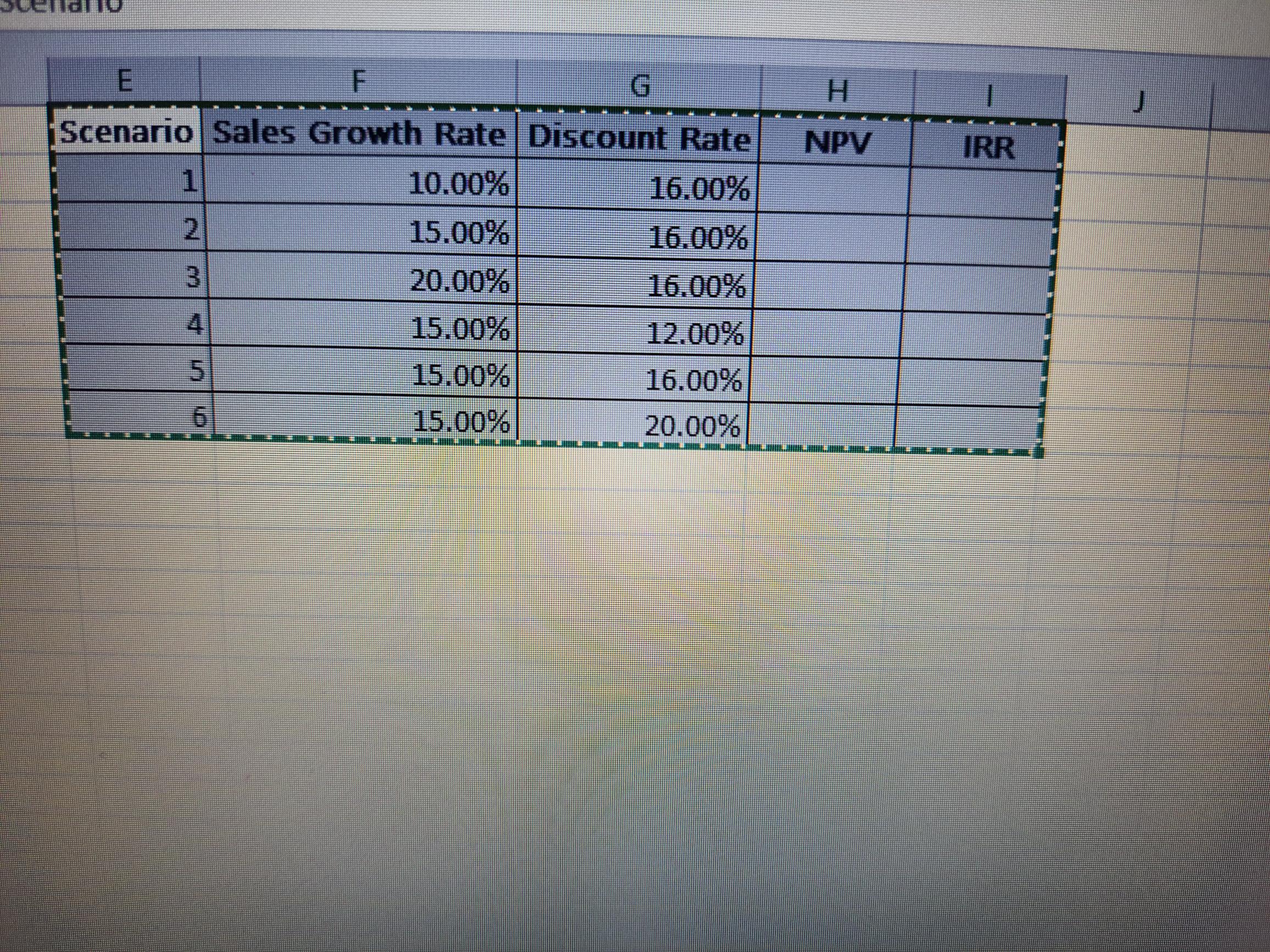

- Calculate the NPV and IRR for the above scenarios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started