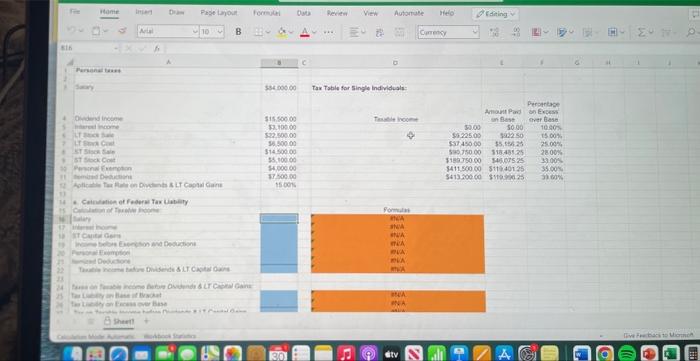

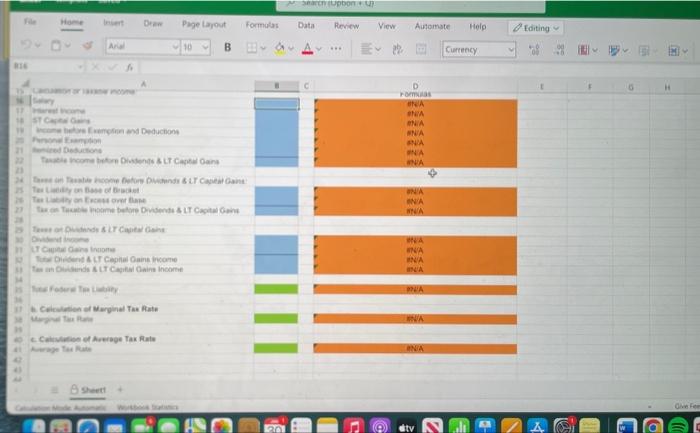

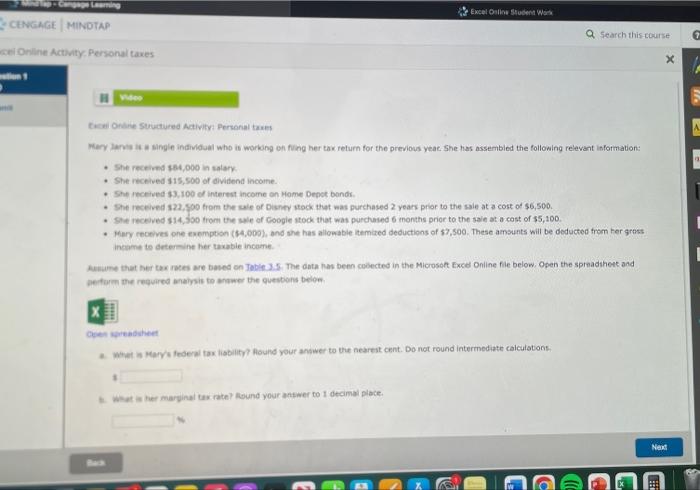

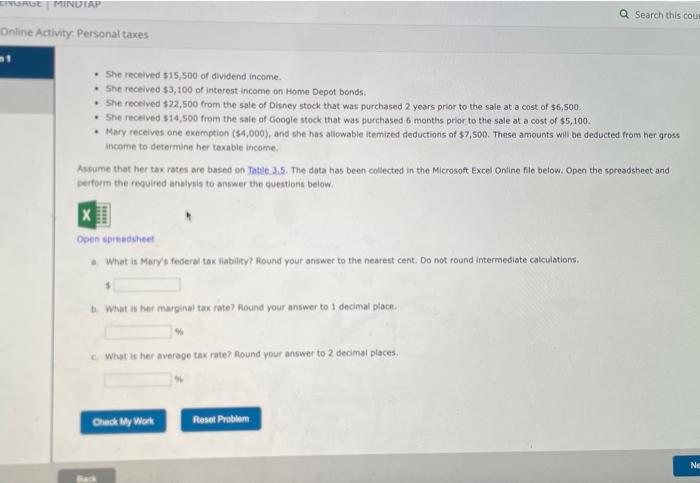

ins. tion Divine Stoutured Astivityit Fersonal tanes Wary larvis is in singif individual who is working of fing her tav return for the previous yeac. She has assembled the following relevant information: - Ste receivnd 384,000 in salary - She received 115,500 of dividena incoine. - She feceived 33,100 of interest income on kome Depet bandi. - She received 122, 400 from the wale of Disher stock. that was purchased 2 years prior to the sale at a cost of 56,500. - Ste recelved 114,300 from the sale of Coogie stock that was purchated 6 months prior to the saie at a cost of $5,100. - Mary receives one exemption (54,000} and the has allowable itemired deductions of 47,500. These amsunts will be deducted from rer gross income to Grtermine her taxable income. Aunume that her tax rates are based on Toble.3.5. The data has been coolected in the Microseft Fxce Oniline file below. Open the sprnadihete and She received $15,500 of dividend income. - She received $3,100 of interest income on Home Depot bonds. - She recelved $22,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,500. * She received 514,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $5,100. - Mary recelives ane exemption (54,000), and she has allowable itemited deductions of 47,500 . Theise amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table.3.5. The data has been collected in the Microsoft Excel Online file below: Open the spreadsheet and perforin the required analysis to answer the questions below. Ooen spreadsheet 3. What is Mafy's federal tax liabilify? Rhound your answer to the nearest cent. Do not round intermediate calculations. 1 ti. What is her marginel tax ratel Round your answer to 1 decimal place. c. What is her average tax rate? found your answer to 2 decimal places. ins. tion Divine Stoutured Astivityit Fersonal tanes Wary larvis is in singif individual who is working of fing her tav return for the previous yeac. She has assembled the following relevant information: - Ste receivnd 384,000 in salary - She received 115,500 of dividena incoine. - She feceived 33,100 of interest income on kome Depet bandi. - She received 122, 400 from the wale of Disher stock. that was purchased 2 years prior to the sale at a cost of 56,500. - Ste recelved 114,300 from the sale of Coogie stock that was purchated 6 months prior to the saie at a cost of $5,100. - Mary receives one exemption (54,000} and the has allowable itemired deductions of 47,500. These amsunts will be deducted from rer gross income to Grtermine her taxable income. Aunume that her tax rates are based on Toble.3.5. The data has been coolected in the Microseft Fxce Oniline file below. Open the sprnadihete and She received $15,500 of dividend income. - She received $3,100 of interest income on Home Depot bonds. - She recelved $22,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,500. * She received 514,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $5,100. - Mary recelives ane exemption (54,000), and she has allowable itemited deductions of 47,500 . Theise amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table.3.5. The data has been collected in the Microsoft Excel Online file below: Open the spreadsheet and perforin the required analysis to answer the questions below. Ooen spreadsheet 3. What is Mafy's federal tax liabilify? Rhound your answer to the nearest cent. Do not round intermediate calculations. 1 ti. What is her marginel tax ratel Round your answer to 1 decimal place. c. What is her average tax rate? found your answer to 2 decimal places