Answered step by step

Verified Expert Solution

Question

1 Approved Answer

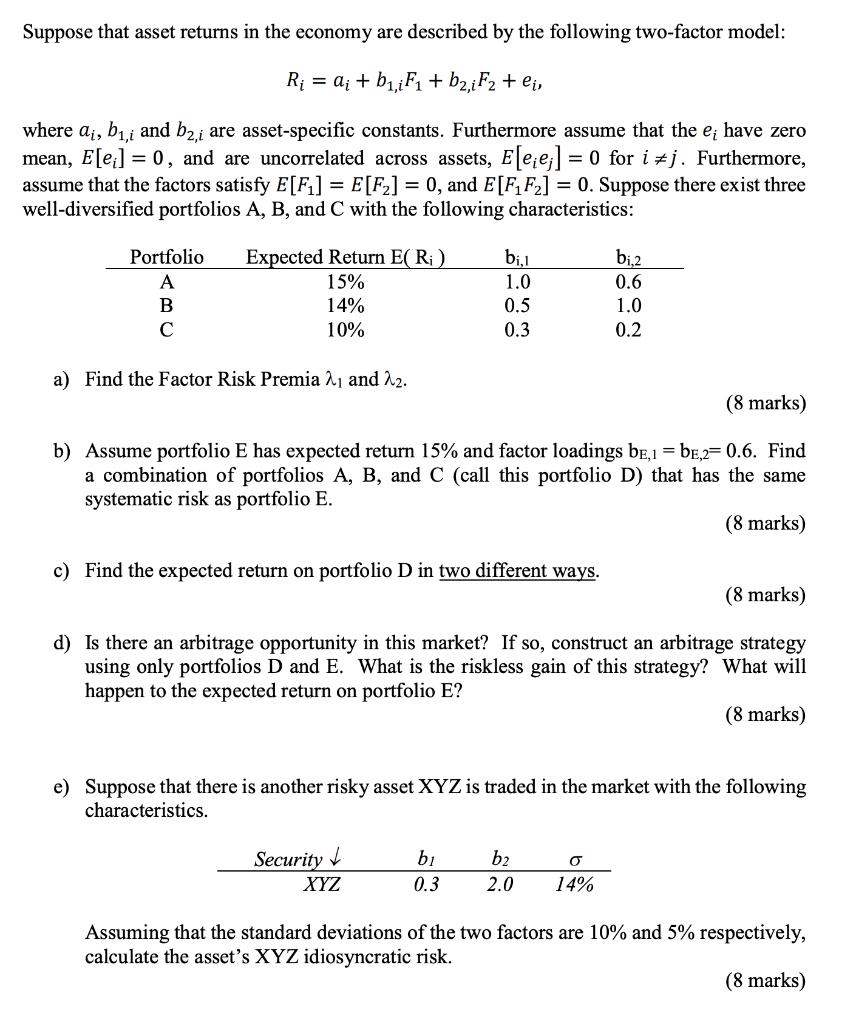

Suppose that asset returns in the economy are described by the following two-factor model: R = a + biF + b2, F2 + ei,

Suppose that asset returns in the economy are described by the following two-factor model: R = a + biF + b2, F2 + ei, where ai, b,i and b2,i are asset-specific constants. Furthermore assume that the e; have zero mean, E[e] = 0, and are uncorrelated across assets, E[eej] = 0 for i #j. Furthermore, assume that the factors satisfy E[F] = E[F] = 0, and E[FF] = 0. Suppose there exist three well-diversified portfolios A, B, and C with the following characteristics: Portfolio A B Expected Return E(R) 15% 14% 10% a) Find the Factor Risk Premia 2 and 22. (8 marks) b) Assume portfolio E has expected return 15% and factor loadings bE,1=bE,2= 0.6. Find a combination of portfolios A, B, and C (call this portfolio D) that has the same systematic risk as portfolio E. (8 marks) c) Find the expected return on portfolio D in two different ways. bi,1 1.0 0.5 0.3 (8 marks) d) Is there an arbitrage opportunity in this market? If so, construct an arbitrage strategy using only portfolios D and E. What is the riskless gain of this strategy? What will happen to the expected return on portfolio E? (8 marks) Security e) Suppose that there is another risky asset XYZ is traded in the market with the following characteristics. XYZ bi 0.3 b,2 0.6 1.0 0.2 b2 2.0 O 14% Assuming that the standard deviations of the two factors are 10% and 5% respectively, calculate the asset's XYZ idiosyncratic risk. (8 marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The factor risk premia 21 and 22 are the expected returns of the first and second factors respectively The expected return of the first factor is ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started