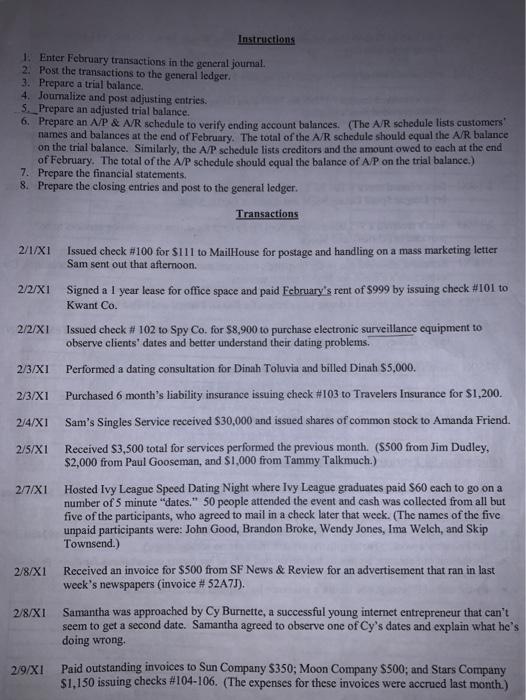

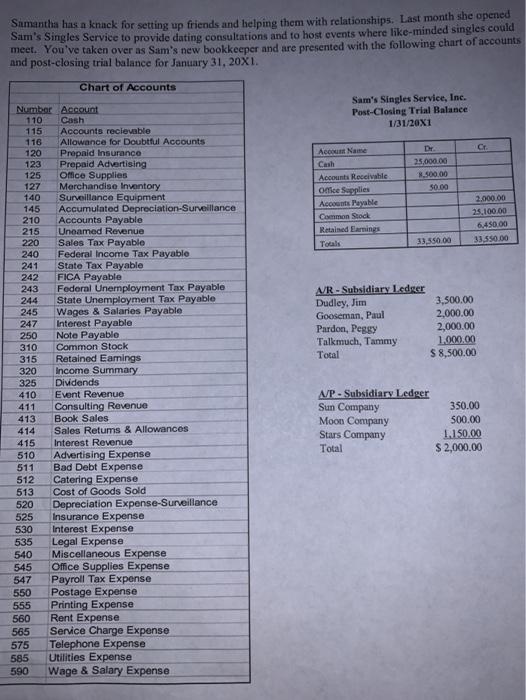

Instructions 1. Enter February transactions in the general journal. 2. Post the transactions to the general ledger. 3. Prepare a trial balance. 4. Joumalize and post adjusting entries. 5. Prepare an adjusted trial balance. 6. Prepare an A/P & A/R schedule to verify ending account balances. (The A/R schedule lists customers' names and balances at the end of February. The total of the A/R schedule should equal the A/R balance on the trial balance. Similarly, the A/P schedule lists creditors and the amount owed to each at the end of February. The total of the A/P schedule should equal the balance of A/P on the trial balance.) 7. Prepare the financial statements. 8. Prepare the closing entries and post to the general ledger Transactions 2/1/X1 Issued check #100 for $111 to Mailhouse for postage and handling on a mass marketing letter Sam sent out that afternoon. 2/2/X1 Signed a 1 year lease for office space and paid February's rent of $999 by issuing check #101 to Kwant Co. 2/2/X1 Issued check # 102 to Spy Co. for $8,900 to purchase electronic surveillance equipment to observe clients' dates and better understand their dating problems. 2/3/X1 Performed a dating consultation for Dinah Toluvia and billed Dinah $5,000. 2/3/X1 Purchased 6 month's liability insurance issuing check #103 to Travelers Insurance for $1,200. 2/4/X1 Sam's Singles Service received $30,000 and issued shares of common stock to Amanda Friend. 2/5/X1 Received 3,500 total for services performed the previous month. (S500 from Jim Dudley, $2,000 from Paul Gooseman, and $1,000 from Tammy Talkmuch.) 2/7/X1 Hosted Ivy League Speed Dating Night where Ivy League graduates paid $60 cach to go on a number of 5 minute "dates." 50 people attended the event and cash was collected from all but five of the participants, who agreed to mail in a check later that week. (The names of the five unpaid participants were: John Good, Brandon Broke, Wendy Jones, Ima Welch, and Skip Townsend.) 2/8/X1 Received an invoice for $500 from SF News & Review for an advertisement that ran in last week's newspapers (invoice # 52A71). 2/8/XI Samantha was approached by Cy Burnette, a successful young internet entrepreneur that can't seem to get a second date. Samantha agreed to observe one of Cy's dates and explain what he's doing wrong. 2/9/X1 Paid outstanding invoices to Sun Company $350; Moon Company S500; and Stars Company $1,150 issuing checks #104-106. (The expenses for these invoices were accrued last month.) Samantha has a knack for setting up friends and helping them with relationships. Last month she opened Sam's Singles Service to provide dating consultations and to host events where like-minded singles could meet. You've taken over as Sam's new bookkeeper and are presented with the following chart of accounts and post-closing trial balance for January 31, 20X1. Chart of Accounts Sam's Singles Service, Inc. Post-Closing Trial Balance 1/31/20X1 Dr. 25,000.00 8.500.00 $0.00 Account Name Cash Accounts Receivable odice Supplies Accounts Payable Common Stock Retained Earnings Total 2.000.00 25,100.00 6.450.00 33.550.00 33,350.00 AR - Subsidiary Lsdeer Dudley, Jim 3,500.00 Gooseman, Paul 2,000.00 Pardon, Peggy 2,000.00 Talkmuch, Tammy 1.000.00 Total $ 8,500.00 Number Account 110 Cash 115 Accounts recievable 116 Allowance for Doubtful Accounts 120 Prepaid Insurance 123 Prepaid Advertising 125 Office Supplies 127 Merchandise Inventory 140 Surveillance Equipment 145 Accumulated Depreciation-Surveillance 210 Accounts Payable 215 Reve 220 Sales Tax Payable 240 Federal Income Tax Payable 241 State Tax Payable 242 FICA Payable 243 Federal Unemployment Tax Payable 244 State Unemployment Tax Payable 245 Wages & Salaries Payable 247 Interest Payable 250 Note Payablo 310 Common Stock 315 Retained Earnings 320 Income Summary 325 Dividends 410 Event Revenue 411 Consulting Revenue 413 Book Sales 414 Sales Retums & Allowances 415 Interest Revenue 510 Advertising Expense 511 Bad Debt Expense 512 Catering Expense 513 Cost of Goods Sold 520 Depreciation Expense-Surveillance 525 Insurance Expense 530 Interest Expense 535 Legal Expense 540 Miscellaneous Expense 545 Office Supplies Expense 547 Payroll Tax Expense 550 Postage Expense 555 Printing Expense 560 Rent Expense 565 Service Charge Expense 575 Telephone Expense 585 Utilities Expense 590 Wage & Salary Expense A/P - Subsidiary Ledger Sun Company Moon Company Stars Company Total 350.00 500.00 1.150.00 $ 2,000.00 Instructions 1. Enter February transactions in the general journal. 2. Post the transactions to the general ledger. 3. Prepare a trial balance. 4. Joumalize and post adjusting entries. 5. Prepare an adjusted trial balance. 6. Prepare an A/P & A/R schedule to verify ending account balances. (The A/R schedule lists customers' names and balances at the end of February. The total of the A/R schedule should equal the A/R balance on the trial balance. Similarly, the A/P schedule lists creditors and the amount owed to each at the end of February. The total of the A/P schedule should equal the balance of A/P on the trial balance.) 7. Prepare the financial statements. 8. Prepare the closing entries and post to the general ledger Transactions 2/1/X1 Issued check #100 for $111 to Mailhouse for postage and handling on a mass marketing letter Sam sent out that afternoon. 2/2/X1 Signed a 1 year lease for office space and paid February's rent of $999 by issuing check #101 to Kwant Co. 2/2/X1 Issued check # 102 to Spy Co. for $8,900 to purchase electronic surveillance equipment to observe clients' dates and better understand their dating problems. 2/3/X1 Performed a dating consultation for Dinah Toluvia and billed Dinah $5,000. 2/3/X1 Purchased 6 month's liability insurance issuing check #103 to Travelers Insurance for $1,200. 2/4/X1 Sam's Singles Service received $30,000 and issued shares of common stock to Amanda Friend. 2/5/X1 Received 3,500 total for services performed the previous month. (S500 from Jim Dudley, $2,000 from Paul Gooseman, and $1,000 from Tammy Talkmuch.) 2/7/X1 Hosted Ivy League Speed Dating Night where Ivy League graduates paid $60 cach to go on a number of 5 minute "dates." 50 people attended the event and cash was collected from all but five of the participants, who agreed to mail in a check later that week. (The names of the five unpaid participants were: John Good, Brandon Broke, Wendy Jones, Ima Welch, and Skip Townsend.) 2/8/X1 Received an invoice for $500 from SF News & Review for an advertisement that ran in last week's newspapers (invoice # 52A71). 2/8/XI Samantha was approached by Cy Burnette, a successful young internet entrepreneur that can't seem to get a second date. Samantha agreed to observe one of Cy's dates and explain what he's doing wrong. 2/9/X1 Paid outstanding invoices to Sun Company $350; Moon Company S500; and Stars Company $1,150 issuing checks #104-106. (The expenses for these invoices were accrued last month.) Samantha has a knack for setting up friends and helping them with relationships. Last month she opened Sam's Singles Service to provide dating consultations and to host events where like-minded singles could meet. You've taken over as Sam's new bookkeeper and are presented with the following chart of accounts and post-closing trial balance for January 31, 20X1. Chart of Accounts Sam's Singles Service, Inc. Post-Closing Trial Balance 1/31/20X1 Dr. 25,000.00 8.500.00 $0.00 Account Name Cash Accounts Receivable odice Supplies Accounts Payable Common Stock Retained Earnings Total 2.000.00 25,100.00 6.450.00 33.550.00 33,350.00 AR - Subsidiary Lsdeer Dudley, Jim 3,500.00 Gooseman, Paul 2,000.00 Pardon, Peggy 2,000.00 Talkmuch, Tammy 1.000.00 Total $ 8,500.00 Number Account 110 Cash 115 Accounts recievable 116 Allowance for Doubtful Accounts 120 Prepaid Insurance 123 Prepaid Advertising 125 Office Supplies 127 Merchandise Inventory 140 Surveillance Equipment 145 Accumulated Depreciation-Surveillance 210 Accounts Payable 215 Reve 220 Sales Tax Payable 240 Federal Income Tax Payable 241 State Tax Payable 242 FICA Payable 243 Federal Unemployment Tax Payable 244 State Unemployment Tax Payable 245 Wages & Salaries Payable 247 Interest Payable 250 Note Payablo 310 Common Stock 315 Retained Earnings 320 Income Summary 325 Dividends 410 Event Revenue 411 Consulting Revenue 413 Book Sales 414 Sales Retums & Allowances 415 Interest Revenue 510 Advertising Expense 511 Bad Debt Expense 512 Catering Expense 513 Cost of Goods Sold 520 Depreciation Expense-Surveillance 525 Insurance Expense 530 Interest Expense 535 Legal Expense 540 Miscellaneous Expense 545 Office Supplies Expense 547 Payroll Tax Expense 550 Postage Expense 555 Printing Expense 560 Rent Expense 565 Service Charge Expense 575 Telephone Expense 585 Utilities Expense 590 Wage & Salary Expense A/P - Subsidiary Ledger Sun Company Moon Company Stars Company Total 350.00 500.00 1.150.00 $ 2,000.00