instructions are in the last picture.

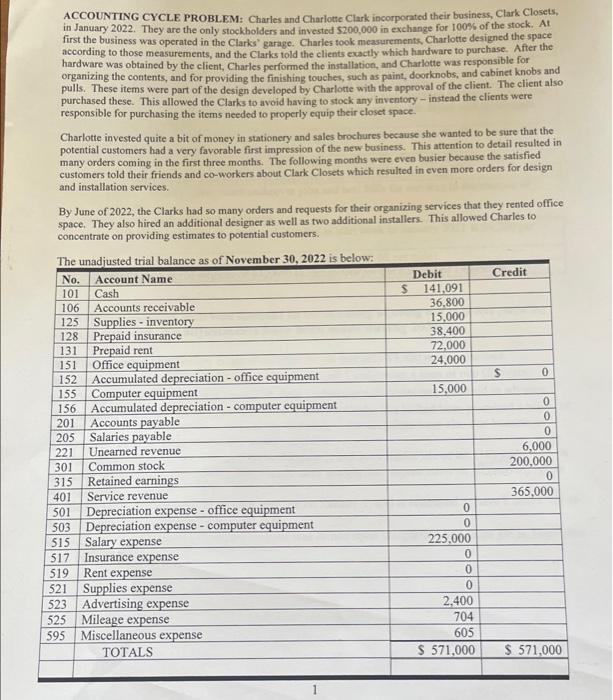

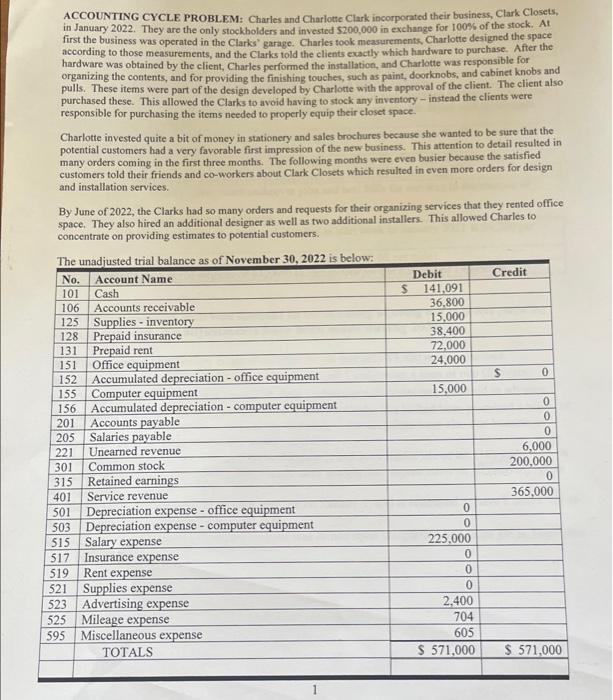

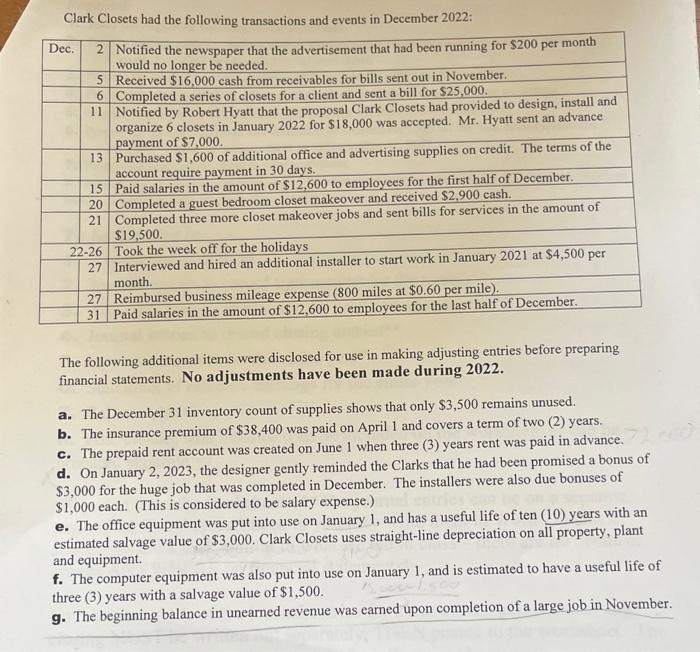

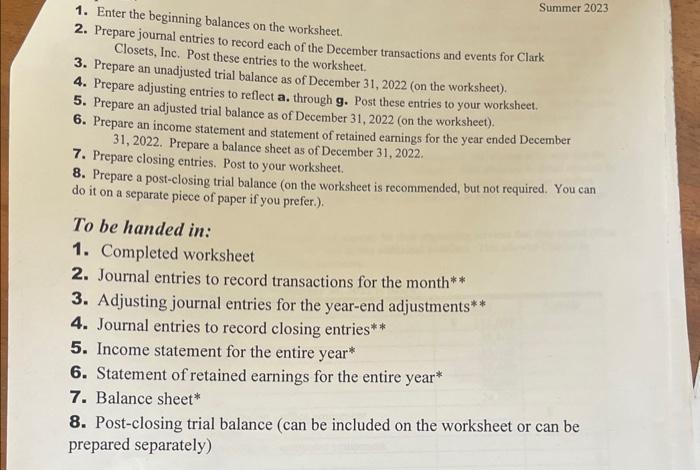

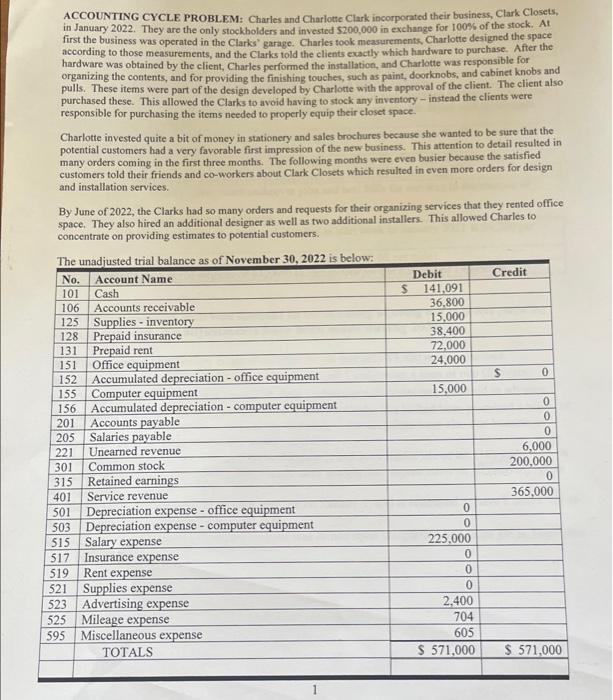

ACCOUNTING CYCLE PROBLEM: Charles and Charlotte Clark incorporated their business, Clark Closets, in January 2022. They are the only stockholders and invested 5200,000 in exchange for 100% of the stock. At first the business was operated in the Clarks' garage. Charles took measurements. Charlotte designed the space according to those measurements, and the Clarks told the clients ecactly which hardware to purchase. After the hardware was obtained by the client, Charles performed the installation, and Charlotte was responsible for organizing the contents, and for providing the finishing touches, such as paint, doorknobs, and cabinet knobs and pulls. These items were part of the design developed by Charlotte with the approval of the client. The elient also purchased these. This allowed the Clarks to avoid having to stock any inventory - instead the clients were responsible for purchasing the items needed to properly equip their closet space. Charlotte invested quite a bit of money in stationery and sales brochures because she wanted to be sure that the potential customers had a very favorable first impression of the new business. This attention to detail resulted in many orders coming in the first three months. The following months were even busier because the satisfied customers told their friends and co-workers about Clark Closets which resulted in even more orders for design and installation services. By June of 2022, the Clarks had so many orders and requests for their organizing services that they rented office space. They also hired an additional designer as well as two additional installers. This allowed Charles to concentrate on providing estimates to potential customers. The unadineted trial halance as of November 30,2022 is below: Clark Closets had the following transactions and events in December 2022: The following additional items were disclosed for use in making adjusting entries before preparing financial statements. No adjustments have been made during 2022. a. The December 31 inventory count of supplies shows that only $3,500 remains unused. b. The insurance premium of $38,400 was paid on April 1 and covers a term of two (2) years. c. The prepaid rent account was created on June 1 when three (3) years rent was paid in advance. d. On January 2,2023, the designer gently reminded the Clarks that he had been promised a bonus of $3,000 for the huge job that was completed in December. The installers were also due bonuses of $1,000 each. (This is considered to be salary expense.) e. The office equipment was put into use on January 1, and has a useful life of ten (10) years with an estimated salvage value of $3,000. Clark Closets uses straight-line depreciation on all property, plant and equipment. f. The computer equipment was also put into use on January 1 , and is estimated to have a useful life of three (3) years with a salvage value of $1,500. g. The beginning balance in unearned revenue was earned upon completion of a large job in November. 1. Enter the beginning balances on the worksheet. Summer 2023 2. Prepare journal entries to record each of the December transactions and events for Clark Closets, Inc. Post these entries to the worksheet. 3. Prepare an unadjusted trial balance as of December 31,2022 (on the worksheet). 4. Prepare adjusting entries to reflect a. through g. Post these entries to your worksheet. 5. Prepare an adjusted trial balance as of December 31,2022 (on the worksheet). 6. Prepare an income statement and statement of retained earnings for the year ended December 31, 2022. Prepare a balance sheet as of December 31, 2022. 7. Prepare closing entries. Post to your worksheet. 8. Prepare a post-closing trial balance (on the worksheet is recommended, but not required. You can do it on a separate piece of paper if you prefer.). To be handed in: 1. Completed worksheet 2. Journal entries to record transactions for the month** 3. Adjusting journal entries for the year-end adjustments** 4. Journal entries to record closing entries** 5. Income statement for the entire year* 6. Statement of retained earnings for the entire year* 7. Balance sheet* 8. Post-closing trial balance (can be included on the worksheet or can be prepared separately) ACCOUNTING CYCLE PROBLEM: Charles and Charlotte Clark incorporated their business, Clark Closets, in January 2022. They are the only stockholders and invested 5200,000 in exchange for 100% of the stock. At first the business was operated in the Clarks' garage. Charles took measurements. Charlotte designed the space according to those measurements, and the Clarks told the clients ecactly which hardware to purchase. After the hardware was obtained by the client, Charles performed the installation, and Charlotte was responsible for organizing the contents, and for providing the finishing touches, such as paint, doorknobs, and cabinet knobs and pulls. These items were part of the design developed by Charlotte with the approval of the client. The elient also purchased these. This allowed the Clarks to avoid having to stock any inventory - instead the clients were responsible for purchasing the items needed to properly equip their closet space. Charlotte invested quite a bit of money in stationery and sales brochures because she wanted to be sure that the potential customers had a very favorable first impression of the new business. This attention to detail resulted in many orders coming in the first three months. The following months were even busier because the satisfied customers told their friends and co-workers about Clark Closets which resulted in even more orders for design and installation services. By June of 2022, the Clarks had so many orders and requests for their organizing services that they rented office space. They also hired an additional designer as well as two additional installers. This allowed Charles to concentrate on providing estimates to potential customers. The unadineted trial halance as of November 30,2022 is below: Clark Closets had the following transactions and events in December 2022: The following additional items were disclosed for use in making adjusting entries before preparing financial statements. No adjustments have been made during 2022. a. The December 31 inventory count of supplies shows that only $3,500 remains unused. b. The insurance premium of $38,400 was paid on April 1 and covers a term of two (2) years. c. The prepaid rent account was created on June 1 when three (3) years rent was paid in advance. d. On January 2,2023, the designer gently reminded the Clarks that he had been promised a bonus of $3,000 for the huge job that was completed in December. The installers were also due bonuses of $1,000 each. (This is considered to be salary expense.) e. The office equipment was put into use on January 1, and has a useful life of ten (10) years with an estimated salvage value of $3,000. Clark Closets uses straight-line depreciation on all property, plant and equipment. f. The computer equipment was also put into use on January 1 , and is estimated to have a useful life of three (3) years with a salvage value of $1,500. g. The beginning balance in unearned revenue was earned upon completion of a large job in November. 1. Enter the beginning balances on the worksheet. Summer 2023 2. Prepare journal entries to record each of the December transactions and events for Clark Closets, Inc. Post these entries to the worksheet. 3. Prepare an unadjusted trial balance as of December 31,2022 (on the worksheet). 4. Prepare adjusting entries to reflect a. through g. Post these entries to your worksheet. 5. Prepare an adjusted trial balance as of December 31,2022 (on the worksheet). 6. Prepare an income statement and statement of retained earnings for the year ended December 31, 2022. Prepare a balance sheet as of December 31, 2022. 7. Prepare closing entries. Post to your worksheet. 8. Prepare a post-closing trial balance (on the worksheet is recommended, but not required. You can do it on a separate piece of paper if you prefer.). To be handed in: 1. Completed worksheet 2. Journal entries to record transactions for the month** 3. Adjusting journal entries for the year-end adjustments** 4. Journal entries to record closing entries** 5. Income statement for the entire year* 6. Statement of retained earnings for the entire year* 7. Balance sheet* 8. Post-closing trial balance (can be included on the worksheet or can be prepared separately)