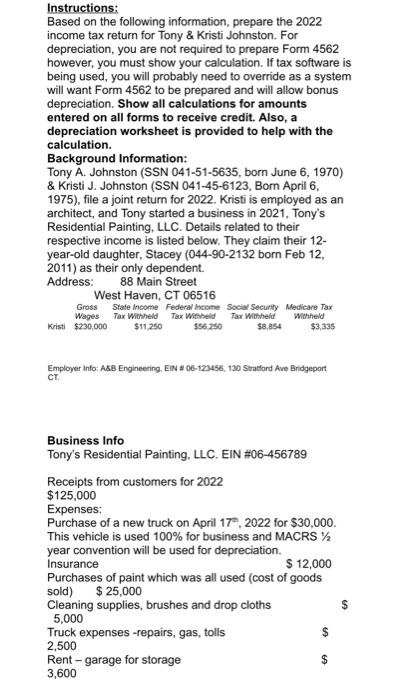

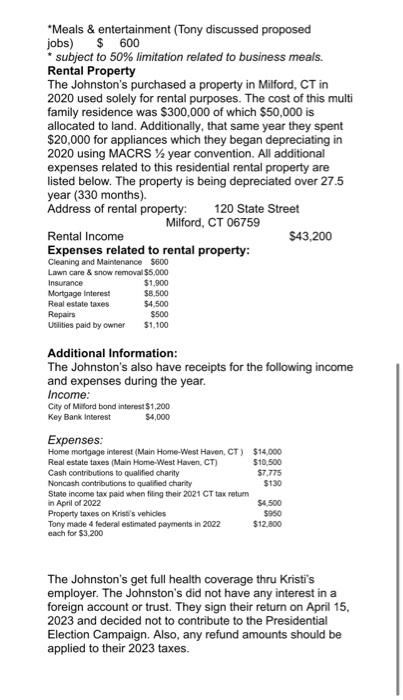

Instructions: Based on the following information, prepare the 2022 income tax return for Tony \& Kristi Johnston. For depreciation, you are not required to prepare Form 4562 however, you must show your calculation. If tax software is being used, you will probably need to override as a system will want Form 4562 to be prepared and will allow bonus depreciation. Show all calculations for amounts entered on all forms to receive credit. Also, a depreciation worksheet is provided to help with the calculation. Background Information: Tony A. Johnston (SSN 041-51-5635, born June 6, 1970) \& Kristi J. Johnston (SSN 041-45-6123, Bom April 6, 1975), file a joint return for 2022 . Kristi is employed as an architect, and Tony started a business in 2021, Tony's Residential Painting, LLC. Details related to their respective income is listed below. They claim their 12year-old daughter, Stacey (044-90-2132 born Feb 12, 2011) as their only dependent. Address: 88 Main Street West Havan. CT n6.516 Employer Info: ASB Engineering. ElN A 06.123456, 130 Stradond Ave Eridgeport CT. Business Info Tony's Residential Painting, LLC. EIN \#06-456789 Receipts from customers for 2022 $125,000 Expenses: Purchase of a new truck on April 17 , 2022 for $30,000. This vehicle is used 100% for business and MACRS 1/2 year convention will be used for depreciation. Insurance $12,000 Purchases of paint which was all used (cost of goods sold) $25,000 Cleaning supplies, brushes and drop cloths 5,000 Truck expenses -repairs, gas, tolls 2,500 Rent - garage for storage 3,600 "Meals \& entertainment (Tony discussed proposed jobs) \$ 600 * subject to 50% limitation related to business meals. Rental Property The Johnston's purchased a property in Milford, CT in 2020 used solely for rental purposes. The cost of this multi family residence was $300,000 of which $50,000 is allocated to land. Additionally, that same year they spent $20,000 for appliances which they began depreciating in 2020 using MACRS 1/2 year convention. All additional expenses related to this residential rental property are listed below. The property is being depreciated over 27.5 year ( 330 months). Address of rental property: 120 State Street Milford, CT 06759 Rental Income $43,200 Expenses related to rental property: Cleaning and Mairvenance $600 Additional Information: The Johnston's also have receipts for the following income and expenses during the year. Income: City of Miford bond interest $1,200 Key Bank interest 54,000 The Johnston's get full health coverage thru Kristi's employer. The Johnston's did not have any interest in a foreign account or trust. They sign their return on April 15 . 2023 and decided not to contribute to the Presidential Election Campaign. Also, any refund amounts should be applied to their 2023 taxes. Instructions: Based on the following information, prepare the 2022 income tax return for Tony \& Kristi Johnston. For depreciation, you are not required to prepare Form 4562 however, you must show your calculation. If tax software is being used, you will probably need to override as a system will want Form 4562 to be prepared and will allow bonus depreciation. Show all calculations for amounts entered on all forms to receive credit. Also, a depreciation worksheet is provided to help with the calculation. Background Information: Tony A. Johnston (SSN 041-51-5635, born June 6, 1970) \& Kristi J. Johnston (SSN 041-45-6123, Bom April 6, 1975), file a joint return for 2022 . Kristi is employed as an architect, and Tony started a business in 2021, Tony's Residential Painting, LLC. Details related to their respective income is listed below. They claim their 12year-old daughter, Stacey (044-90-2132 born Feb 12, 2011) as their only dependent. Address: 88 Main Street West Havan. CT n6.516 Employer Info: ASB Engineering. ElN A 06.123456, 130 Stradond Ave Eridgeport CT. Business Info Tony's Residential Painting, LLC. EIN \#06-456789 Receipts from customers for 2022 $125,000 Expenses: Purchase of a new truck on April 17 , 2022 for $30,000. This vehicle is used 100% for business and MACRS 1/2 year convention will be used for depreciation. Insurance $12,000 Purchases of paint which was all used (cost of goods sold) $25,000 Cleaning supplies, brushes and drop cloths 5,000 Truck expenses -repairs, gas, tolls 2,500 Rent - garage for storage 3,600 "Meals \& entertainment (Tony discussed proposed jobs) \$ 600 * subject to 50% limitation related to business meals. Rental Property The Johnston's purchased a property in Milford, CT in 2020 used solely for rental purposes. The cost of this multi family residence was $300,000 of which $50,000 is allocated to land. Additionally, that same year they spent $20,000 for appliances which they began depreciating in 2020 using MACRS 1/2 year convention. All additional expenses related to this residential rental property are listed below. The property is being depreciated over 27.5 year ( 330 months). Address of rental property: 120 State Street Milford, CT 06759 Rental Income $43,200 Expenses related to rental property: Cleaning and Mairvenance $600 Additional Information: The Johnston's also have receipts for the following income and expenses during the year. Income: City of Miford bond interest $1,200 Key Bank interest 54,000 The Johnston's get full health coverage thru Kristi's employer. The Johnston's did not have any interest in a foreign account or trust. They sign their return on April 15 . 2023 and decided not to contribute to the Presidential Election Campaign. Also, any refund amounts should be applied to their 2023 taxes