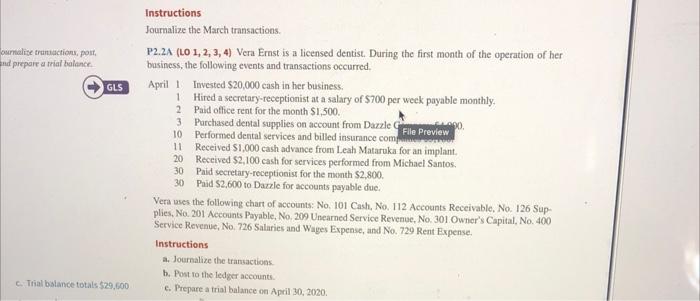

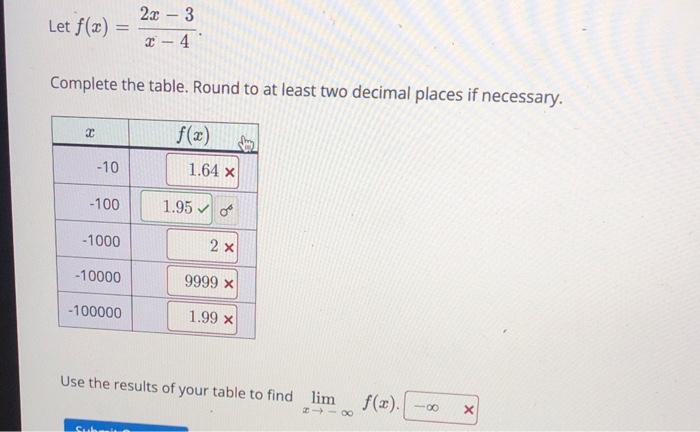

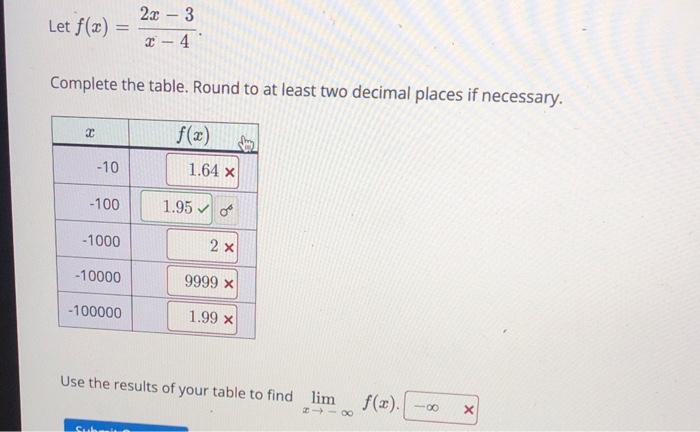

Instructions Journalize the March transactions. P2.2A (LO 1, 2, 3, 4) Vera Ernst is a licensed dentist. During the first month of the operation of her aurmalizetramactions,poif,indpeparearrialbulance.P2.2A(LO1,2,3,4)VeraEristisalicenseddentist.Dbasiness,thefollowingeventsandtransactionsoccurred. GL5 April 1 Invested $20,000 cash in her business. 1 Hired a secretary-receptionist at a salary of $700 per week payable monthly. 2 Paid office tent for the month $1,500. 3. Purchased dental supplies on account from Dazzle Gille Preview 11. Performed dental services and billed insurance comp pila Previourer. 20 Received $2,100 cash for services performod from Michael Santos. 30 Paid secretary-receptionis for the month $2,800. 30) Paid $2,600 to Dazzle for accounts payable due. Vera uses the following chart of accounts: No, 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No, 209 Unearned Service Revenue, No. 301 .Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions a. Journalize the tramsactions. b. Post to the ledger accounte. c. Trial bstance totals 529,600 e. Prepare a trial balance on April 30, 2020. Let f(x)=x42x3 Complete the table. Round to at least two decimal places if necessary. Use the results of your table to find limxf(x). Instructions Journalize the March transactions. P2.2A (LO 1, 2, 3, 4) Vera Ernst is a licensed dentist. During the first month of the operation of her aurmalizetramactions,poif,indpeparearrialbulance.P2.2A(LO1,2,3,4)VeraEristisalicenseddentist.Dbasiness,thefollowingeventsandtransactionsoccurred. GL5 April 1 Invested $20,000 cash in her business. 1 Hired a secretary-receptionist at a salary of $700 per week payable monthly. 2 Paid office tent for the month $1,500. 3. Purchased dental supplies on account from Dazzle Gille Preview 11. Performed dental services and billed insurance comp pila Previourer. 20 Received $2,100 cash for services performod from Michael Santos. 30 Paid secretary-receptionis for the month $2,800. 30) Paid $2,600 to Dazzle for accounts payable due. Vera uses the following chart of accounts: No, 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No, 209 Unearned Service Revenue, No. 301 .Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions a. Journalize the tramsactions. b. Post to the ledger accounte. c. Trial bstance totals 529,600 e. Prepare a trial balance on April 30, 2020. Let f(x)=x42x3 Complete the table. Round to at least two decimal places if necessary. Use the results of your table to find limxf(x)