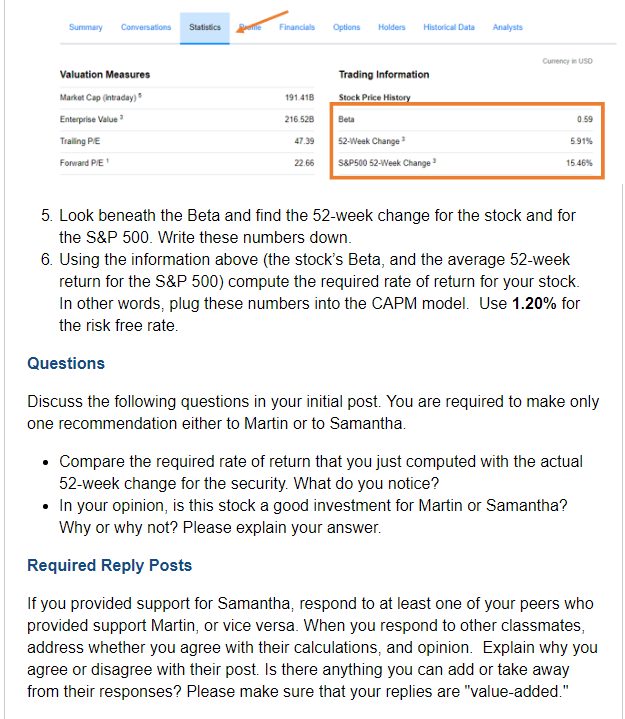

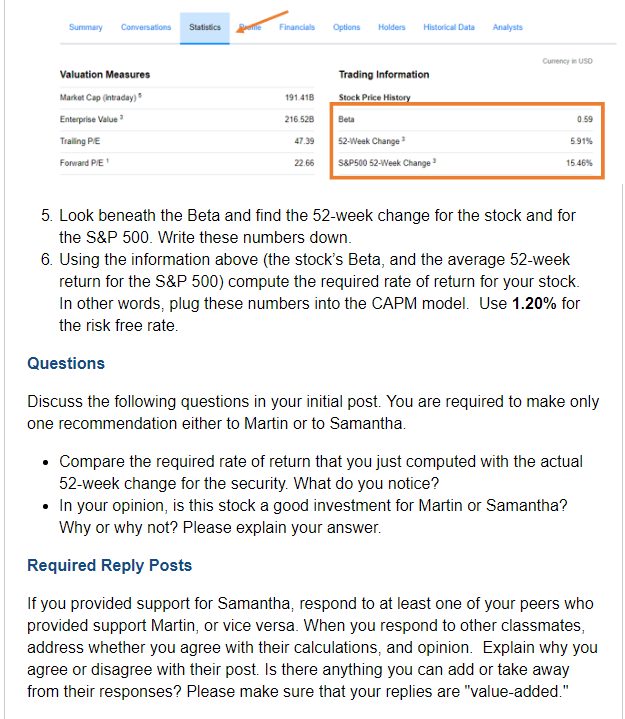

Instructions Martin and Samantha need your help again to determine the best course of action for their company. Please read the following scenario, complete the tasks below, and discuss the questions. Martin and Samantha have been given the responsibility of investing a percentage of their company's money. They need your assistance in selecting an appropriate investment. Apply the Capital Asset Pricing Model (CAPM) and Beta Models to select a stock that best matches their risk tolerance profiles. Remember, Martin is a conservative investor, and Samantha has an above-average tolerance for risk. Tasks Complete the following tasks: 1. Review the lecture on the CAPM. 2. Select a publicly traded company. 3. Go to www.finance.yahoo.com e. Enter the company's stock symbol in the "Get Quotes" box. If you do not know the stock symbol, you can enter the company's name in the search tool. 4. Search for the company's Beta coefficient on the Statistics page. It will be listed under the Trading Information area of this page. Make a note of this number Summary Conversations Statistics me Financials Options Holders Historical Data Analysts Currency in USO Valuation Measures Trading Information Market Cap (intraday) 191.41B Stock Price History Enterprise Value 216.52B Beta 0.59 Trailing PE 52-Week Change 47.39 22.66 5.91% 15.46% Forward PIE S&P500 52-Week Change 5. Look beneath the Beta and find the 52-week change for the stock and for the S&P 500. Write these numbers down. 6. Using the information above (the stock's Beta, and the average 52-week return for the S&P 500) compute the required rate of return for your stock. In other words, plug these numbers into the CAPM model. Use 1.20% for the risk free rate. Questions Discuss the following questions in your initial post. You are required to make only one recommendation either to Martin or to Samantha Compare the required rate of return that you just computed with the actual 52-week change for the security. What do you notice? In your opinion, is this stock a good investment for Martin or Samantha? Why or why not? Please explain your answer. Required Reply Posts If you provided support for Samantha, respond to at least one of your peers who provided support Martin, or vice versa. When you respond to other classmates, address whether you agree with their calculations, and opinion. Explain why you agree or disagree with their post. Is there anything you can add or take away from their responses? Please make sure that your replies are "value-added