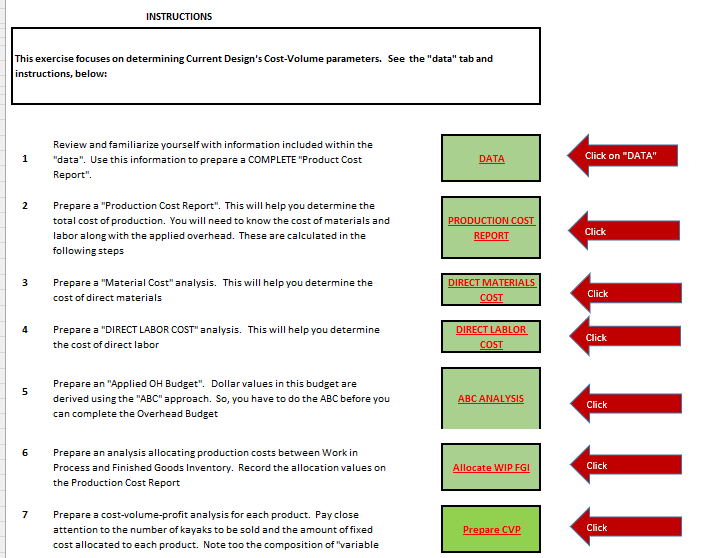

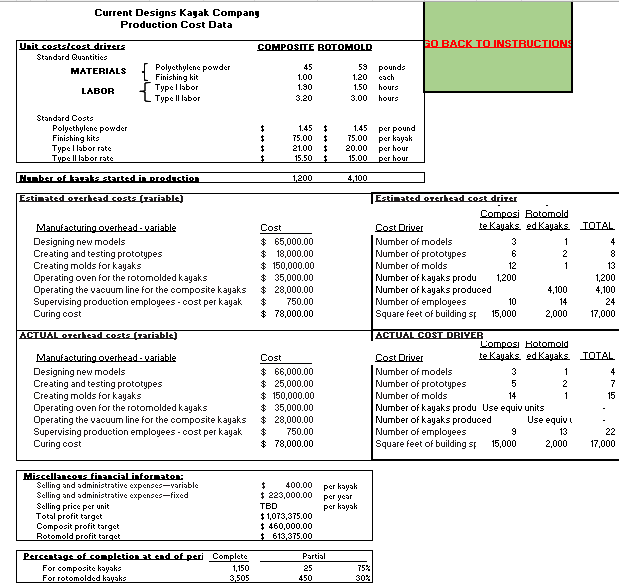

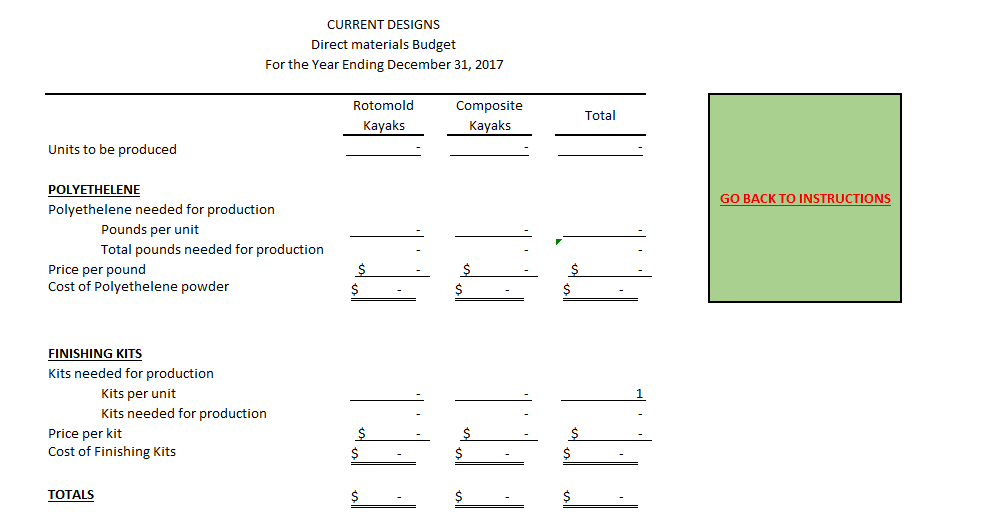

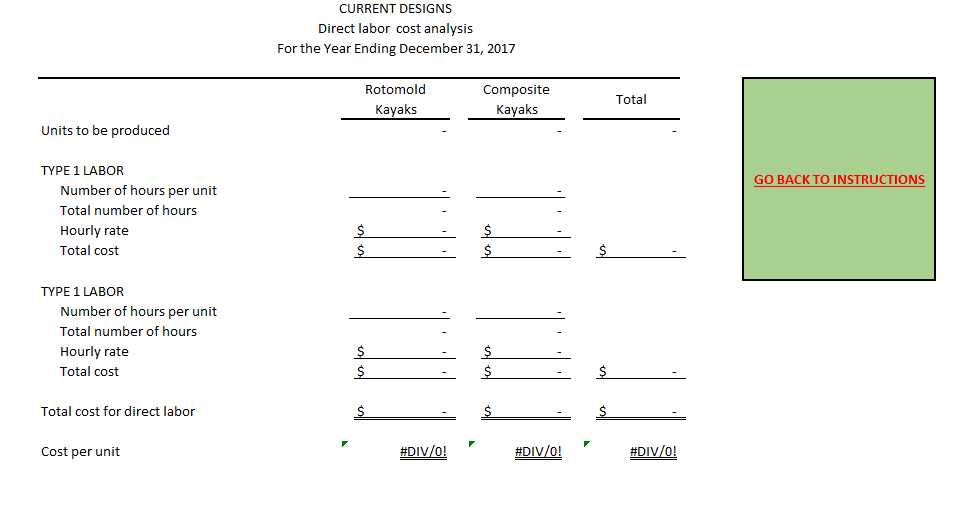

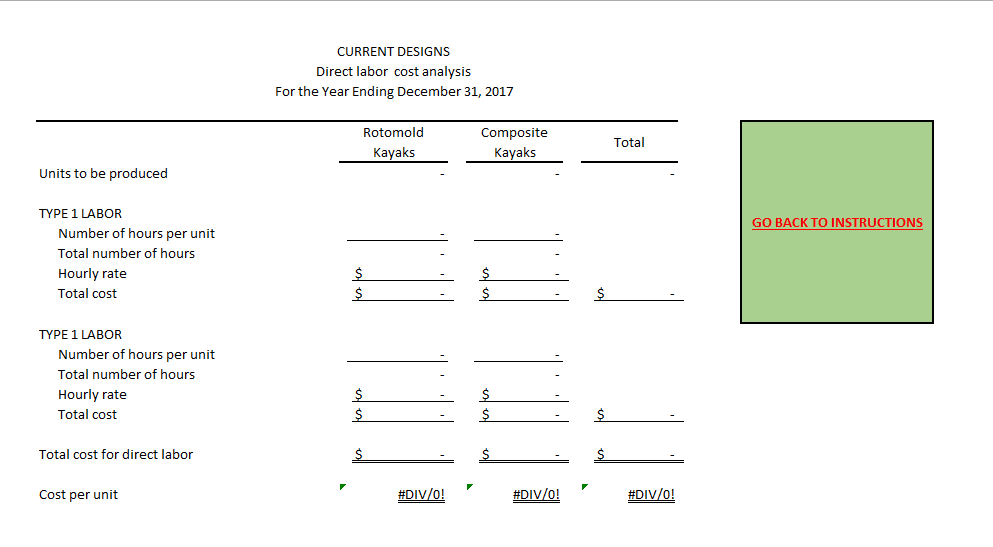

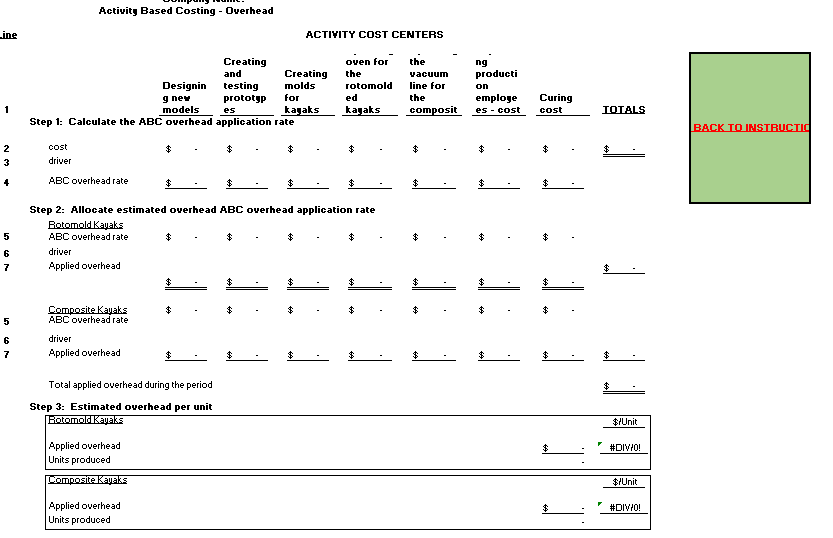

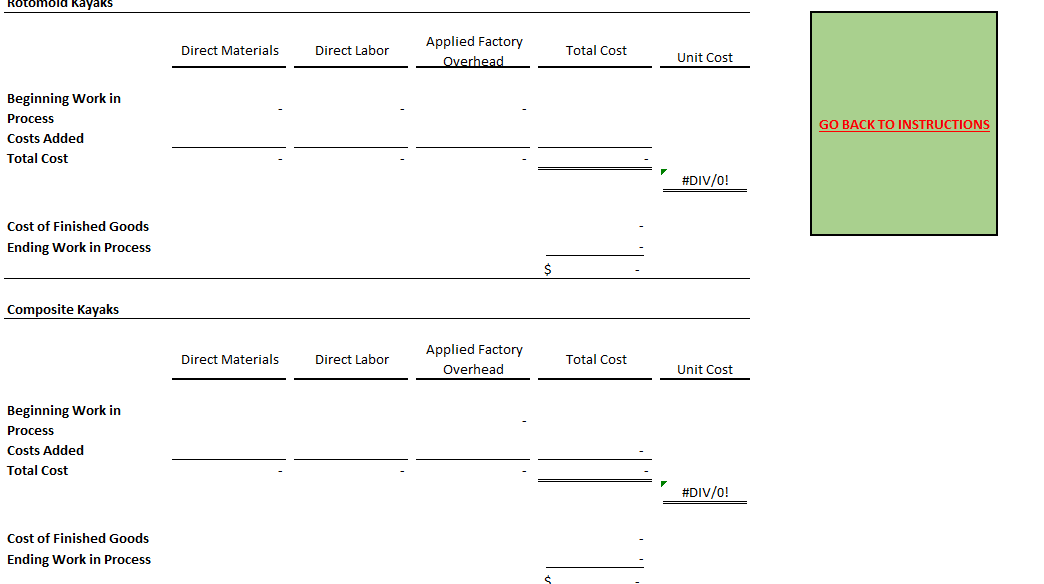

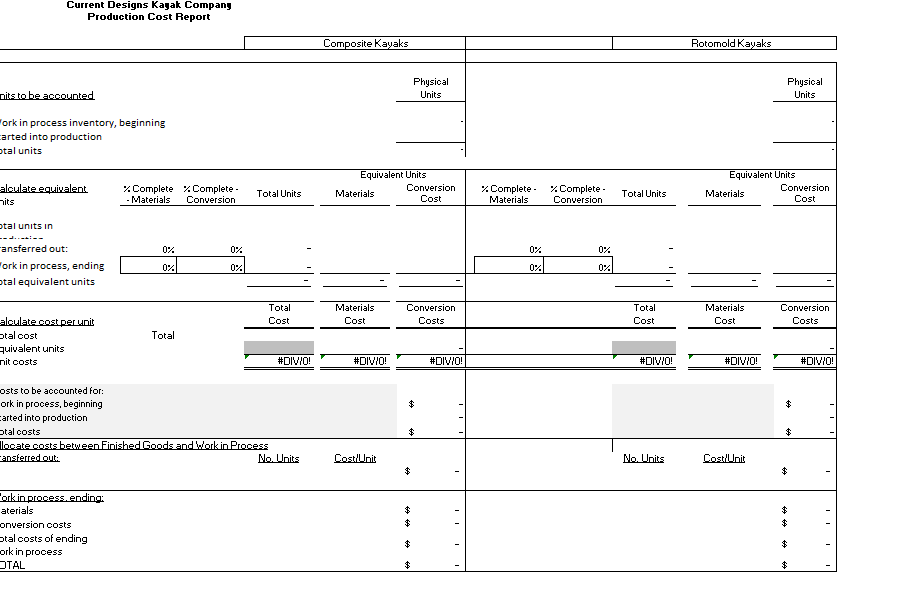

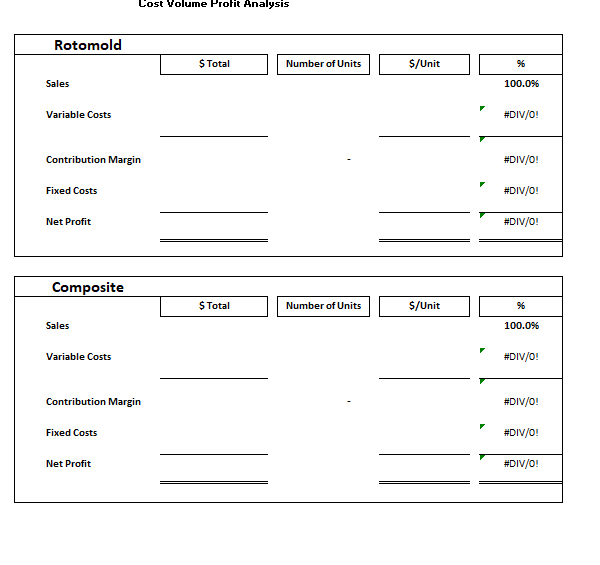

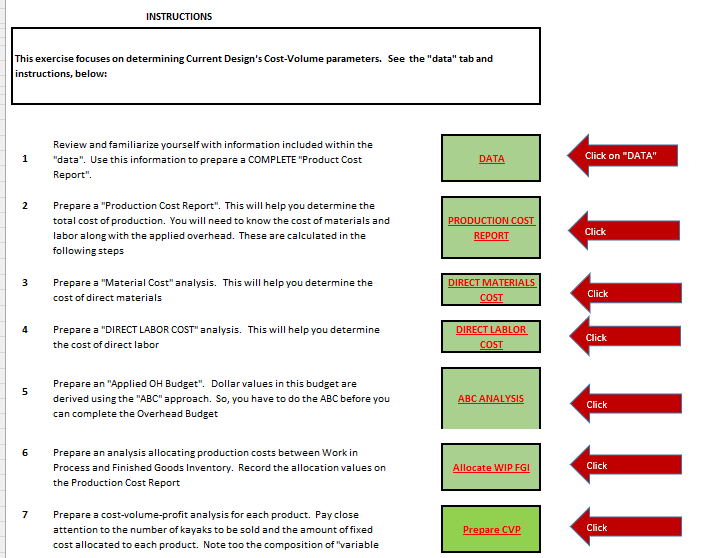

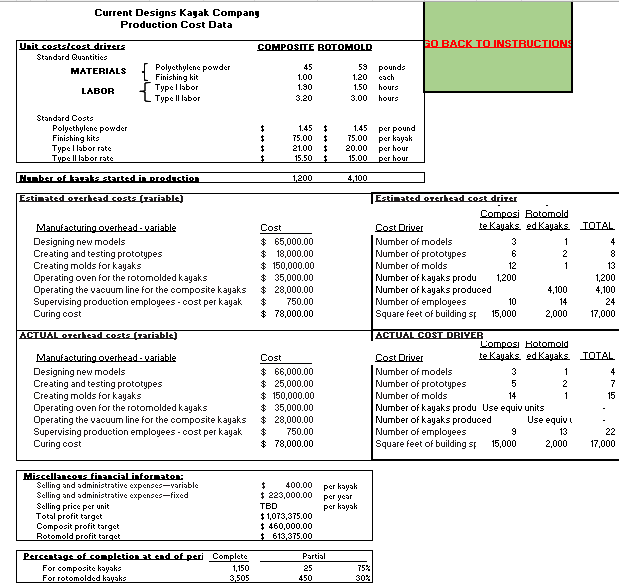

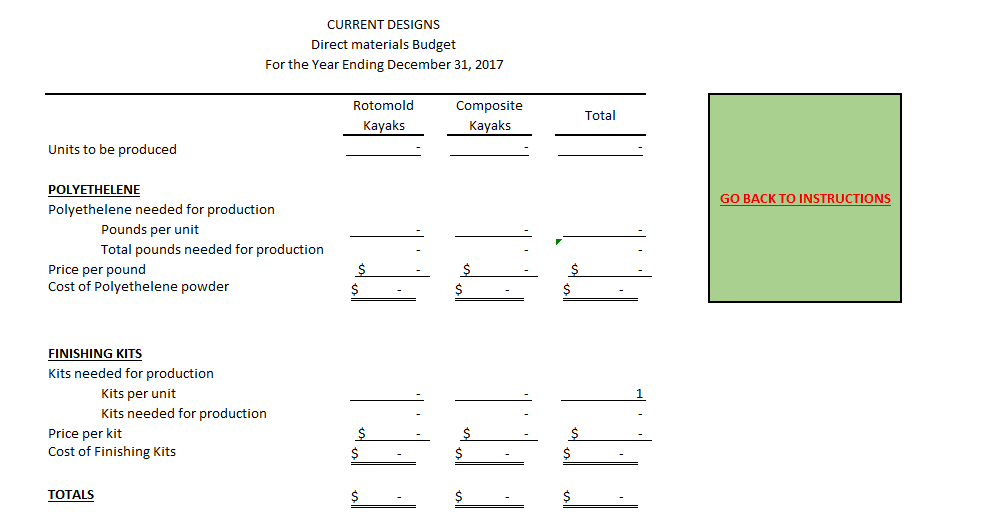

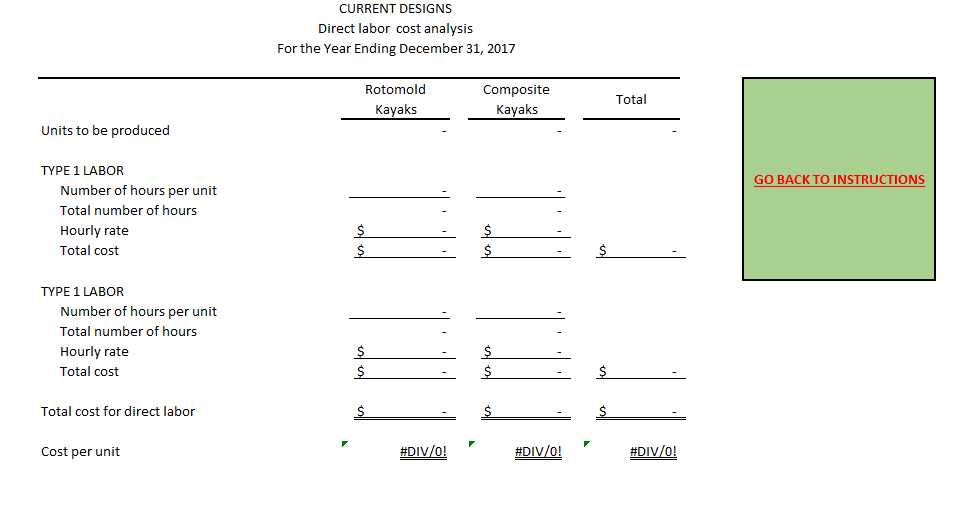

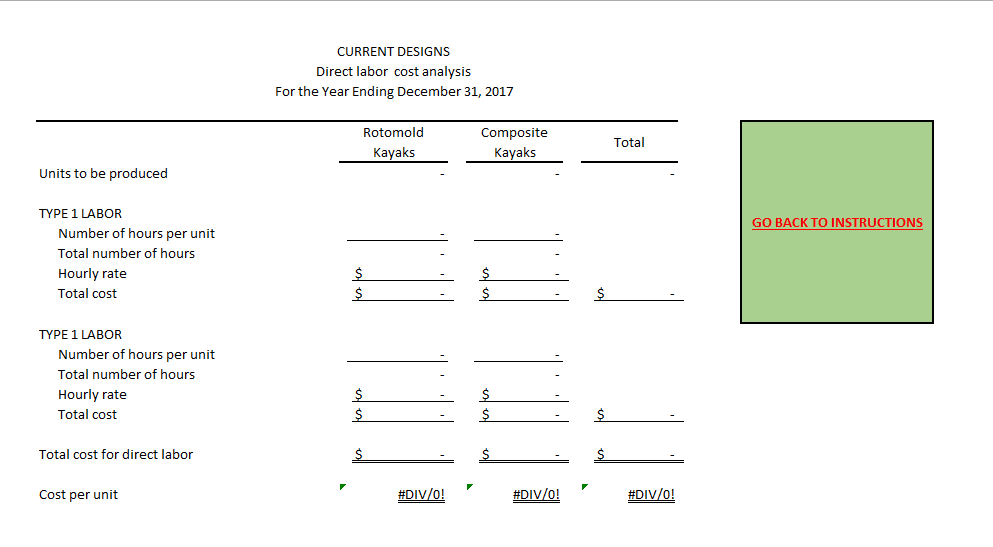

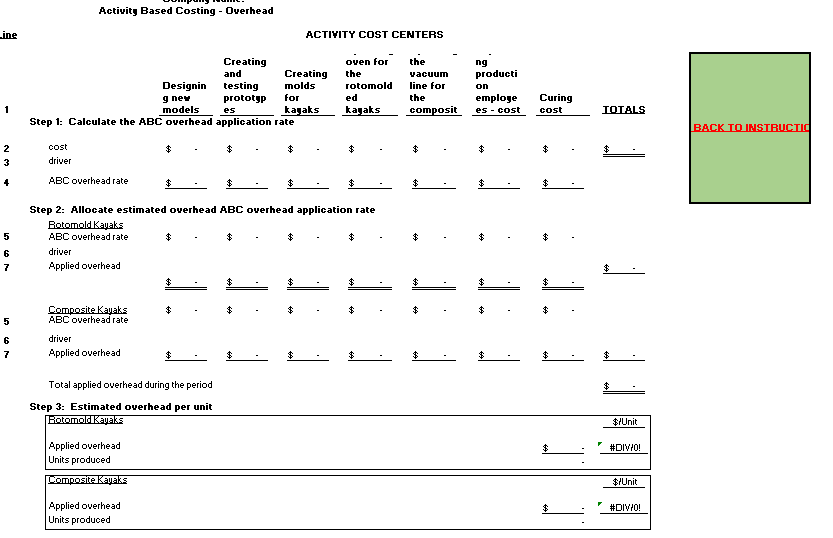

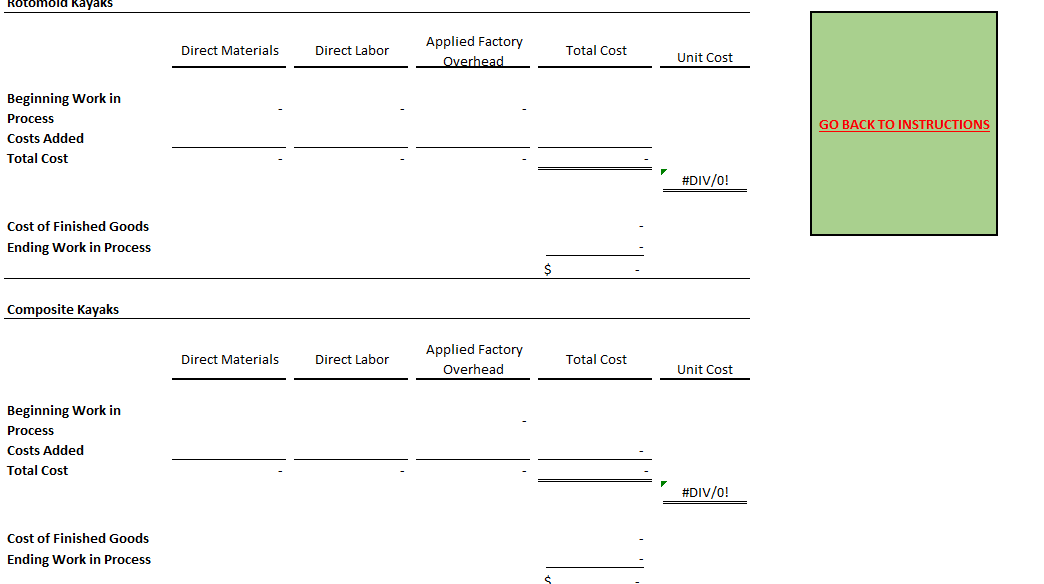

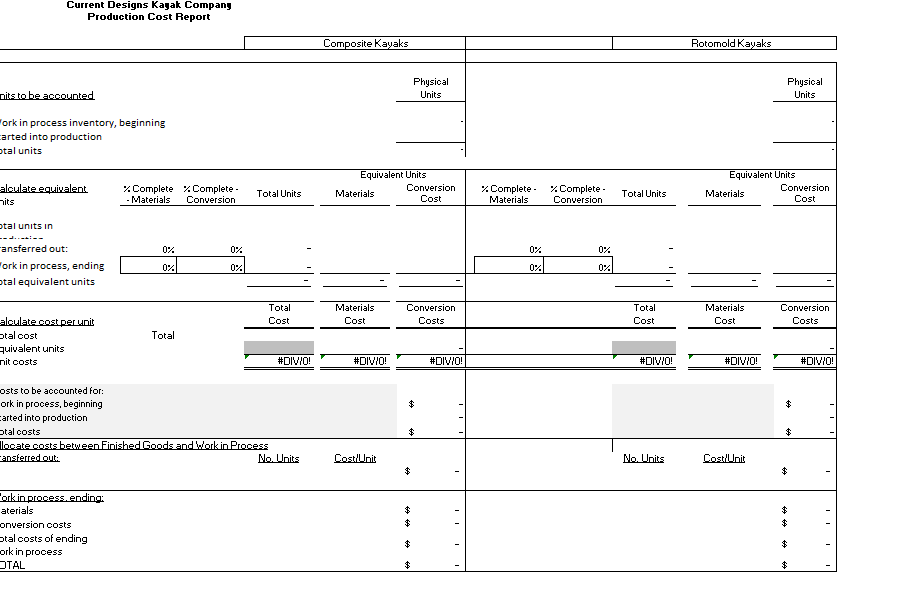

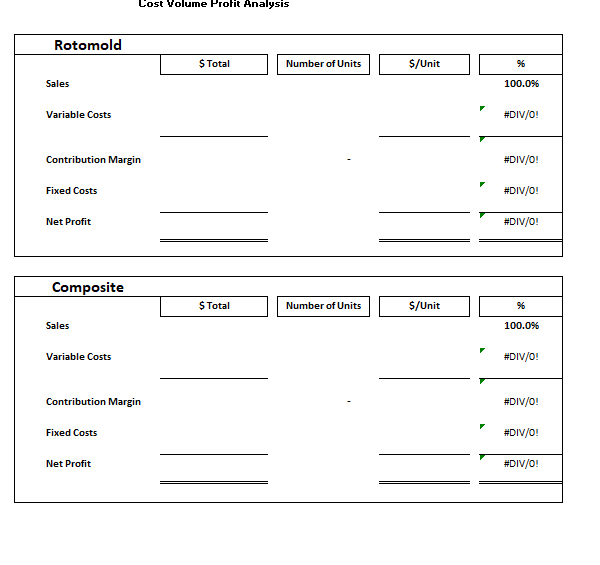

INSTRUCTIONS Review and familiarize yourself with information included within the 1 "data". Use this information to prepare a COMPLETE "Product Cost Report". 2 Prepare a "Production Cost Report". This will help you determine the total cost of production. You will need to know the cost of materials and labor along with the applied overhead. These are calculated in the following steps 3 Prepare a "Material Cost" analysis. This will help you determine the cost of direct materials 4 Prepare a "DIRECT LABOR COST" analysis. This will help you determine the cost of direct labor 5 Prepare an "Applied OH Budget". Dollar values in this budget are derived using the "ABC" approach. So, you have to do the ABC before you can complete the Overhead Budget 6 Prepare an analysis allocating production costs between Work in Process and Finished Goods Inventory. Record the allocation values on the Production Cost Report 7 Prepare a cost-volume-profit analysis for each product. Pay close Click attention to the number of kayaks to be sold and the amount of fixed cost allocated to each product. Note too the composition of "variable Click \begin{tabular}{|crrr|} \hline Percentzge of conpletion at end of peri & Complete & \multicolumn{3}{c|}{ Partisl } \\ \cline { 2 - 5 } For composite kayskz & 1,150 & 25 & 75% \\ For rotomolded kayskz & 3,505 & 450 & 308 \\ \hline \end{tabular} CURRENT DESIGNS Direct materials Budget For the Year Ending December 31, 2017 CURRENT DESIGNS Direct labor cost analysis For the Year Ending December 31, 2017 CURRENT DESIGNS Direct labor cost analysis For the Year Ending December 31, 2017 ACTIYITY COST CENTERS \begin{tabular}{llll} \hline & Direct Materials & & Direct Labor \end{tabular} Ending Work in Process Composite Kayaks Direct Materials Beginning Work in Process Costs Added Total Cost Cost of Finished Goods Ending Work in Process Current Designs Kagak Company Lost Volume Protit Analysis INSTRUCTIONS Review and familiarize yourself with information included within the 1 "data". Use this information to prepare a COMPLETE "Product Cost Report". 2 Prepare a "Production Cost Report". This will help you determine the total cost of production. You will need to know the cost of materials and labor along with the applied overhead. These are calculated in the following steps 3 Prepare a "Material Cost" analysis. This will help you determine the cost of direct materials 4 Prepare a "DIRECT LABOR COST" analysis. This will help you determine the cost of direct labor 5 Prepare an "Applied OH Budget". Dollar values in this budget are derived using the "ABC" approach. So, you have to do the ABC before you can complete the Overhead Budget 6 Prepare an analysis allocating production costs between Work in Process and Finished Goods Inventory. Record the allocation values on the Production Cost Report 7 Prepare a cost-volume-profit analysis for each product. Pay close Click attention to the number of kayaks to be sold and the amount of fixed cost allocated to each product. Note too the composition of "variable Click \begin{tabular}{|crrr|} \hline Percentzge of conpletion at end of peri & Complete & \multicolumn{3}{c|}{ Partisl } \\ \cline { 2 - 5 } For composite kayskz & 1,150 & 25 & 75% \\ For rotomolded kayskz & 3,505 & 450 & 308 \\ \hline \end{tabular} CURRENT DESIGNS Direct materials Budget For the Year Ending December 31, 2017 CURRENT DESIGNS Direct labor cost analysis For the Year Ending December 31, 2017 CURRENT DESIGNS Direct labor cost analysis For the Year Ending December 31, 2017 ACTIYITY COST CENTERS \begin{tabular}{llll} \hline & Direct Materials & & Direct Labor \end{tabular} Ending Work in Process Composite Kayaks Direct Materials Beginning Work in Process Costs Added Total Cost Cost of Finished Goods Ending Work in Process Current Designs Kagak Company Lost Volume Protit Analysis