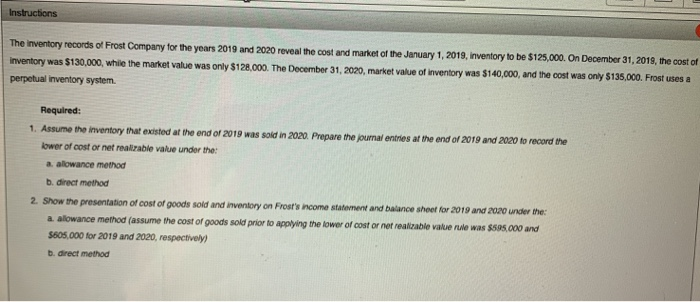

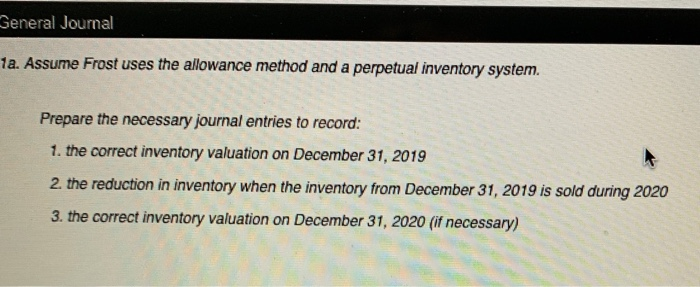

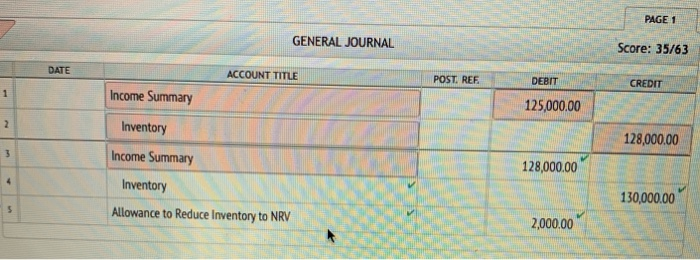

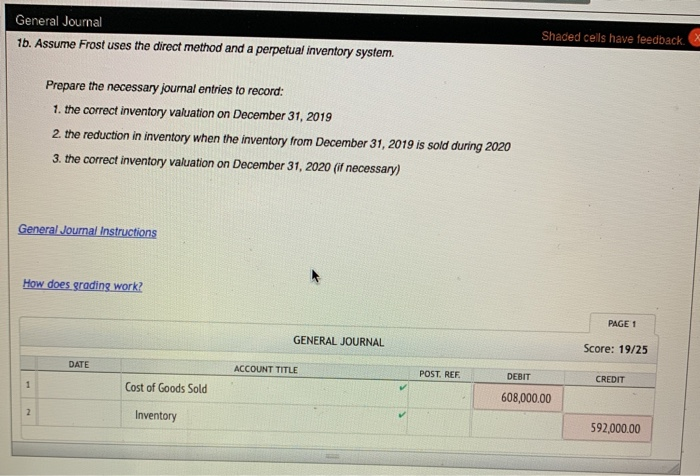

Instructions The inventory records of Frost Company for the years 2019 and 2020 reveal the cost and market of the January 1, 2019, inventory to be $125,000. On December 31, 2019, the cost of Inventory was $130,000, while the market value was only $128,000. The December 31, 2020, market value of inventory was $140,000, and the cost was only $135,000. Frost uses a perpetual inventory system. Required: 1. Assume the inventory that existed at the end of 2019 was sold in 2020. Prepare the journal entries at the end of 2019 and 2020 to record the lower of cost or het realizable value under the a. allowance method b. direct method 2. Show the presentation of cost of poods sold and inventory on Frost's income statement and balance sheet for 2019 and 200 under the a. allowance method (assume the cost of goods sold prior to applying the lower of cost or not realizable value rule was $595.000 and $605,000 for 2019 and 2020, respectively) b. direct method General Journal a. Assume Frost uses the allowance method and a perpetual inventory system. Prepare the necessary journal entries to record: 1. the correct inventory valuation on December 31, 2019 2. the reduction in inventory when the inventory from December 31, 2019 is sold during 2020 3. the correct inventory valuation on December 31, 2020 (if necessary) PAGE 1 GENERAL JOURNAL - Score: 35763 DATE ACCOUNT TITLES POST. REF. CREDIT DEBIT 125,000.00 Income Summary 128,000.00 128,000.00 Inventory Income Summary Inventory Allowance to Reduce Inventory to NRV 130,000.00 2,000.00 Shaded cells have feedback. General Journal 1b. Assume Frost uses the direct method and a perpetual inventory system Prepare the necessary journal entries to record: 1. the correct inventory valuation on December 31, 2019 2. the reduction in inventory when the inventory from December 31, 2019 is sold during 2020 3. the correct inventory valuation on December 31, 2020 (if necessary) General Journal Instructions How does grading work? PAGE 1 GENERAL JOURNAL Score: 19/25 ACCOUNT TITLE POST. REF DEBIT CREDIT Cost of Goods Sold 608,000.00 Inventory 592,000.00