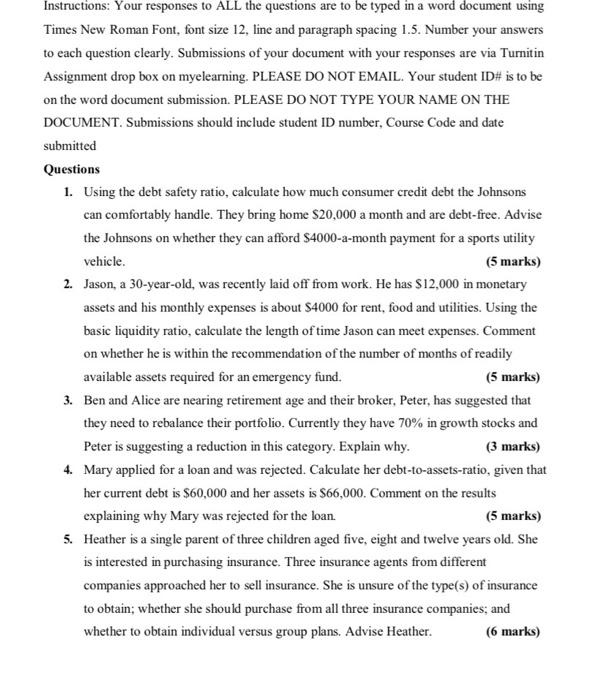

Instructions: Your responses to ALL the questions are to be typed in a word document using Times New Roman Font, font size 12, line and paragraph spacing 1.5. Number your answers to each question clearly. Submissions of your document with your responses are via Turnitin Assignment drop box on myelearning. PLEASE DO NOT EMAIL. Your student ID# is to be on the word document submission. PLEASE DO NOT TYPE YOUR NAME ON THE DOCUMENT. Submissions should include student ID number, Course Code and date submitted Questions 1. Using the debt safety ratio, calculate how much consumer credit debt the Johnsons can comfortably handle. They bring home $20,000 a month and are debt-free. Advise the Johnsons on whether they can afford $4000-a-month payment for a sports utility vehicle. (5 marks) 2. Jason, a 30-year-old, was recently laid off from work. He has $12,000 in monetary assets and his monthly expenses is about S4000 for rent, food and utilities. Using the basic liquidity ratio, calculate the length of time Jason can meet expenses. Comment on whether he is within the recommendation of the number of months of readily available assets required for an emergency fund. (5 marks) 3. Ben and Alice are nearing retirement age and their broker, Peter, has suggested that they need to rebalance their portfolio. Currently they have 70% in growth stocks and Peter is suggesting a reduction in this category. Explain why. (3 marks) 4. Mary applied for a loan and was rejected. Calculate her debt-to-assets-ratio, given that her current debt is $60,000 and her assets is $66,000. Comment on the results explaining why Mary was rejected for the loan. (5 marks) 5. Heather is a single parent of three children aged five, eight and twelve years old. She is interested in purchasing insurance. Three insurance agents from different companies approached her to sell insurance. She is unsure of the type(s) of insurance to obtain; whether she should purchase from all three insurance companies; and whether to obtain individual versus group plans. Advise Heather. (6 marks)