Question

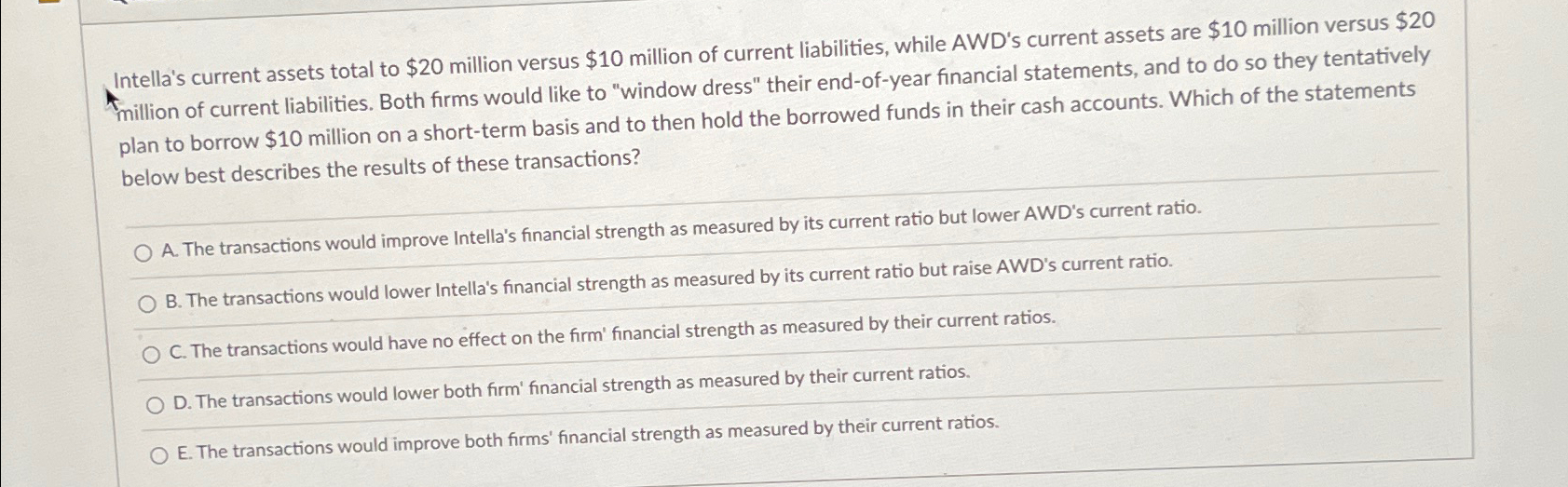

Intella's current assets total to $20 million versus $10 million of current liabilities, while AWD's current assets are $10 million versus $20 million of current

Intella's current assets total to

$20million versus

$10million of current liabilities, while AWD's current assets are

$10million versus

$20million of current liabilities. Both firms would like to "window dress" their end-of-year financial statements, and to do so they tentatively plan to borrow

$10million on a short-term basis and to then hold the borrowed funds in their cash accounts. Which of the statements below best describes the results of these transactions?\ A. The transactions would improve Intella's financial strength as measured by its current ratio but lower AWD's current ratio.\ B. The transactions would lower Intella's financial strength as measured by its current ratio but raise AWD's current ratio.\ C. The transactions would have no effect on the firm' financial strength as measured by their current ratios.\ D. The transactions would lower both firm' financial strength as measured by their current ratios.\ E. The transactions would improve both firms' financial strength as measured by their current ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started