Answered step by step

Verified Expert Solution

Question

1 Approved Answer

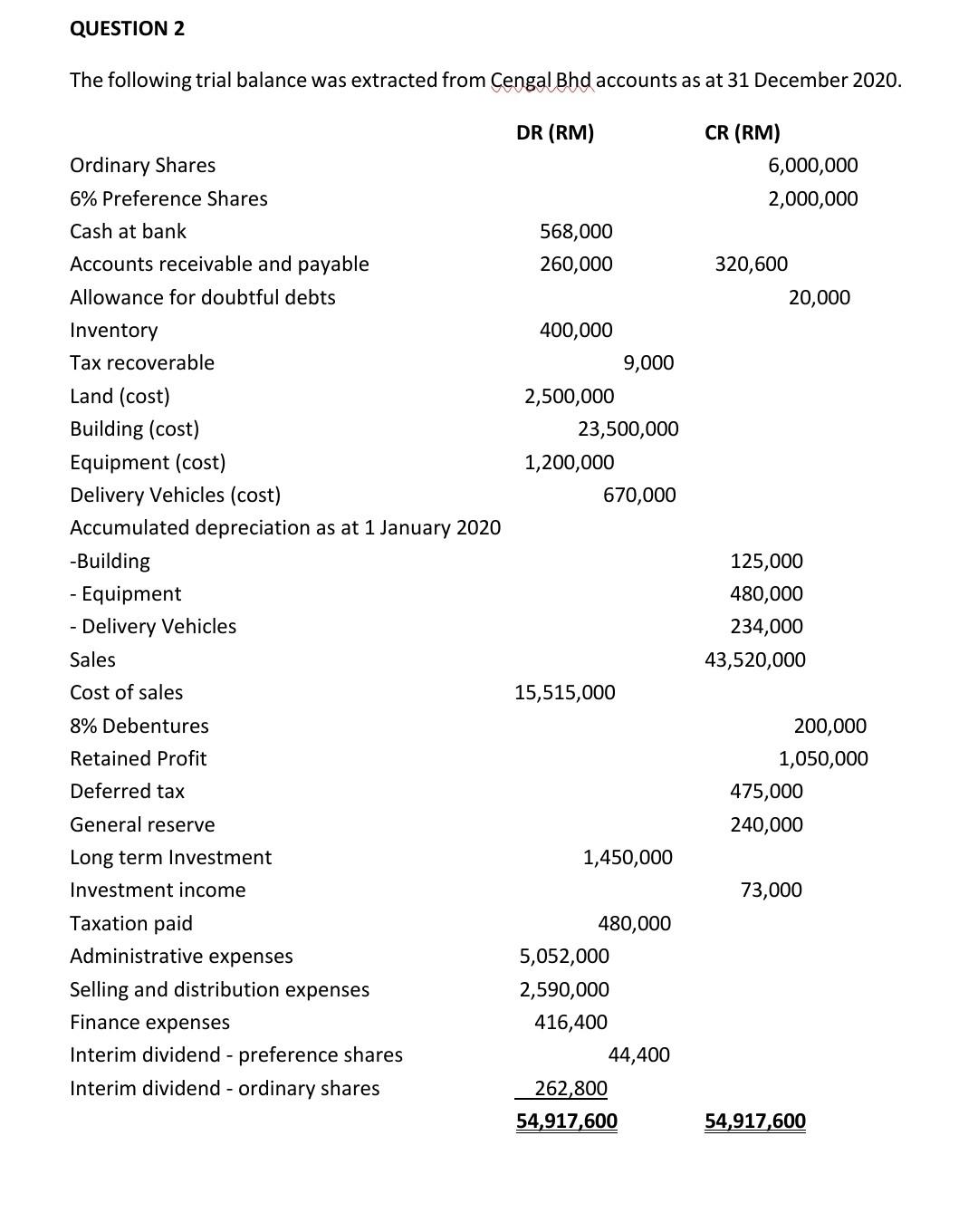

Intermediate Financial Accounting QUESTION 2 The following trial balance was extracted from Cengal Bhd accounts as at 31 December 2020. DR (RM) CR (RM) 6,000,000

Intermediate Financial Accounting

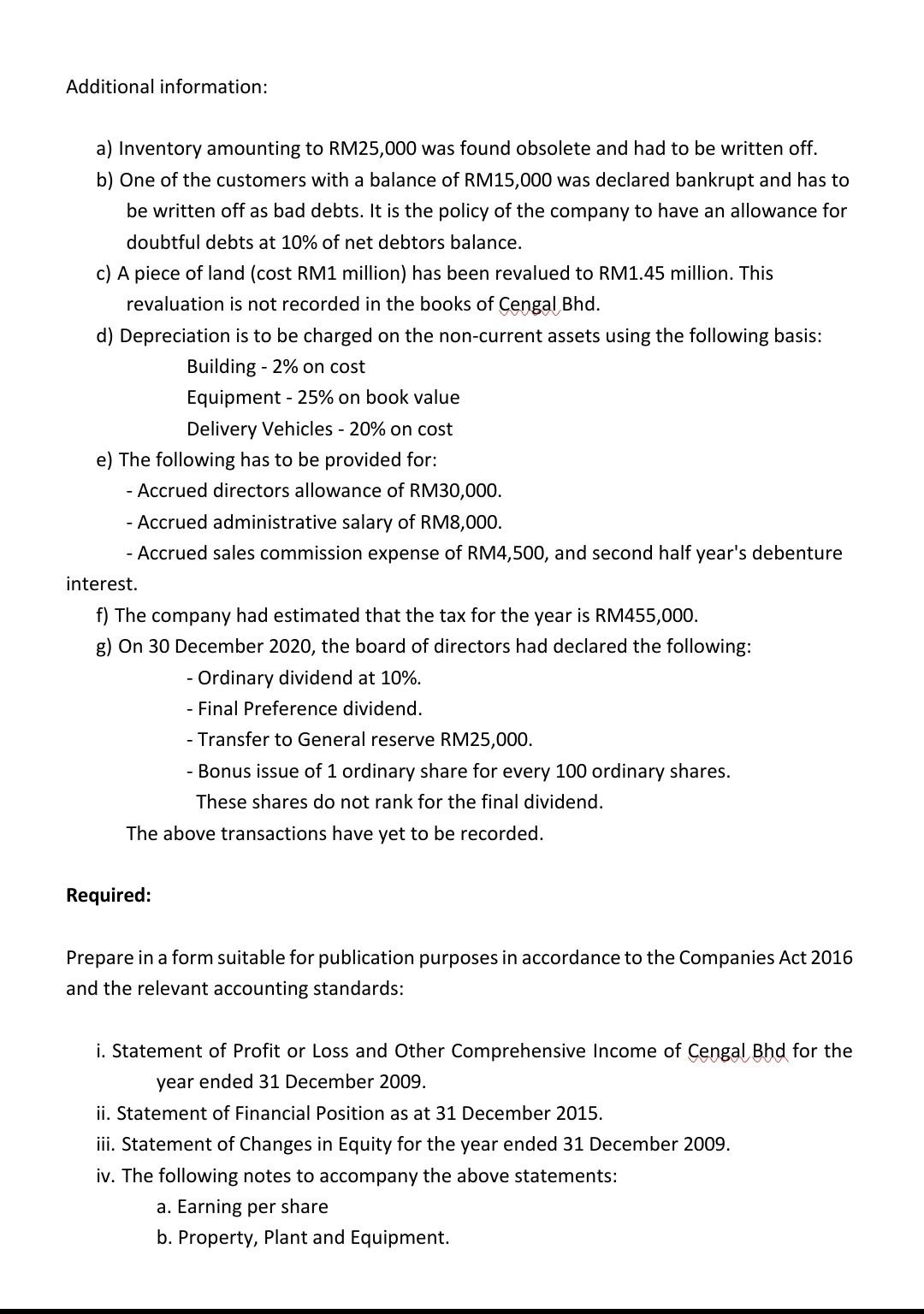

QUESTION 2 The following trial balance was extracted from Cengal Bhd accounts as at 31 December 2020. DR (RM) CR (RM) 6,000,000 2,000,000 568,000 260,000 320,600 20,000 Ordinary Shares 6% Preference Shares Cash at bank Accounts receivable and payable Allowance for doubtful debts Inventory Tax recoverable Land (cost) Building (cost) Equipment (cost) Delivery Vehicles (cost) Accumulated depreciation as at 1 January 2020 -Building - Equipment - Delivery Vehicles Sales Cost of sales 8% Debentures Retained Profit 400,000 9,000 2,500,000 23,500,000 1,200,000 670,000 125,000 480,000 234,000 43,520,000 15,515,000 200,000 1,050,000 475,000 240,000 Deferred tax 1,450,000 73,000 General reserve Long term Investment Investment income Taxation paid Administrative expenses Selling and distribution expenses Finance expenses Interim dividend - preference shares Interim dividend - ordinary shares 480,000 5,052,000 2,590,000 416,400 44,400 262,800 54,917,600 54,917,600 Additional information: a) Inventory amounting to RM25,000 was found obsolete and had to be written off. b) One of the customers with a balance of RM15,000 was declared bankrupt and has to be written off as bad debts. It is the policy of the company to have an allowance for doubtful debts at 10% of net debtors balance. c) A piece of land (cost RM1 million) has been revalued to RM1.45 million. This revaluation is not recorded in the books of Cengal Bhd. d) Depreciation is to be charged on the non-current assets using the following basis: Building - 2% on cost Equipment - 25% on book value Delivery Vehicles - 20% on cost e) The following has to be provided for: - Accrued directors allowance of RM30,000. - Accrued administrative salary of RM8,000. - Accrued sales commission expense of RM4,500, and second half year's debenture interest. f) The company had estimated that the tax for the year is RM455,000. g) On 30 December 2020, the board of directors had declared the following: - Ordinary dividend at 10%. - Final Preference dividend. - Transfer to General reserve RM25,000. - Bonus issue of 1 ordinary share for every 100 ordinary shares. These shares do not rank for the final dividend. The above transactions have yet to be recorded. Required: Prepare in a form suitable for publication purposes in accordance to the Companies Act 2016 and the relevant accounting standards: i. Statement of Profit or Loss and Other Comprehensive Income of Cengal Bhd for the year ended 31 December 2009. ii. Statement of Financial Position as at 31 December 2015. iii. Statement of Changes in Equity for the year ended 31 December 2009. iv. The following notes to accompany the above statements: a. Earning per share b. Property, plant and Equipment. QUESTION 2 The following trial balance was extracted from Cengal Bhd accounts as at 31 December 2020. DR (RM) CR (RM) 6,000,000 2,000,000 568,000 260,000 320,600 20,000 Ordinary Shares 6% Preference Shares Cash at bank Accounts receivable and payable Allowance for doubtful debts Inventory Tax recoverable Land (cost) Building (cost) Equipment (cost) Delivery Vehicles (cost) Accumulated depreciation as at 1 January 2020 -Building - Equipment - Delivery Vehicles Sales Cost of sales 8% Debentures Retained Profit 400,000 9,000 2,500,000 23,500,000 1,200,000 670,000 125,000 480,000 234,000 43,520,000 15,515,000 200,000 1,050,000 475,000 240,000 Deferred tax 1,450,000 73,000 General reserve Long term Investment Investment income Taxation paid Administrative expenses Selling and distribution expenses Finance expenses Interim dividend - preference shares Interim dividend - ordinary shares 480,000 5,052,000 2,590,000 416,400 44,400 262,800 54,917,600 54,917,600 Additional information: a) Inventory amounting to RM25,000 was found obsolete and had to be written off. b) One of the customers with a balance of RM15,000 was declared bankrupt and has to be written off as bad debts. It is the policy of the company to have an allowance for doubtful debts at 10% of net debtors balance. c) A piece of land (cost RM1 million) has been revalued to RM1.45 million. This revaluation is not recorded in the books of Cengal Bhd. d) Depreciation is to be charged on the non-current assets using the following basis: Building - 2% on cost Equipment - 25% on book value Delivery Vehicles - 20% on cost e) The following has to be provided for: - Accrued directors allowance of RM30,000. - Accrued administrative salary of RM8,000. - Accrued sales commission expense of RM4,500, and second half year's debenture interest. f) The company had estimated that the tax for the year is RM455,000. g) On 30 December 2020, the board of directors had declared the following: - Ordinary dividend at 10%. - Final Preference dividend. - Transfer to General reserve RM25,000. - Bonus issue of 1 ordinary share for every 100 ordinary shares. These shares do not rank for the final dividend. The above transactions have yet to be recorded. Required: Prepare in a form suitable for publication purposes in accordance to the Companies Act 2016 and the relevant accounting standards: i. Statement of Profit or Loss and Other Comprehensive Income of Cengal Bhd for the year ended 31 December 2009. ii. Statement of Financial Position as at 31 December 2015. iii. Statement of Changes in Equity for the year ended 31 December 2009. iv. The following notes to accompany the above statements: a. Earning per share b. Property, plant and EquipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started