Interview Notes Isabela is single and turned 72 years old on October 1, 2022. Isabela worked as a librarian at the local library and

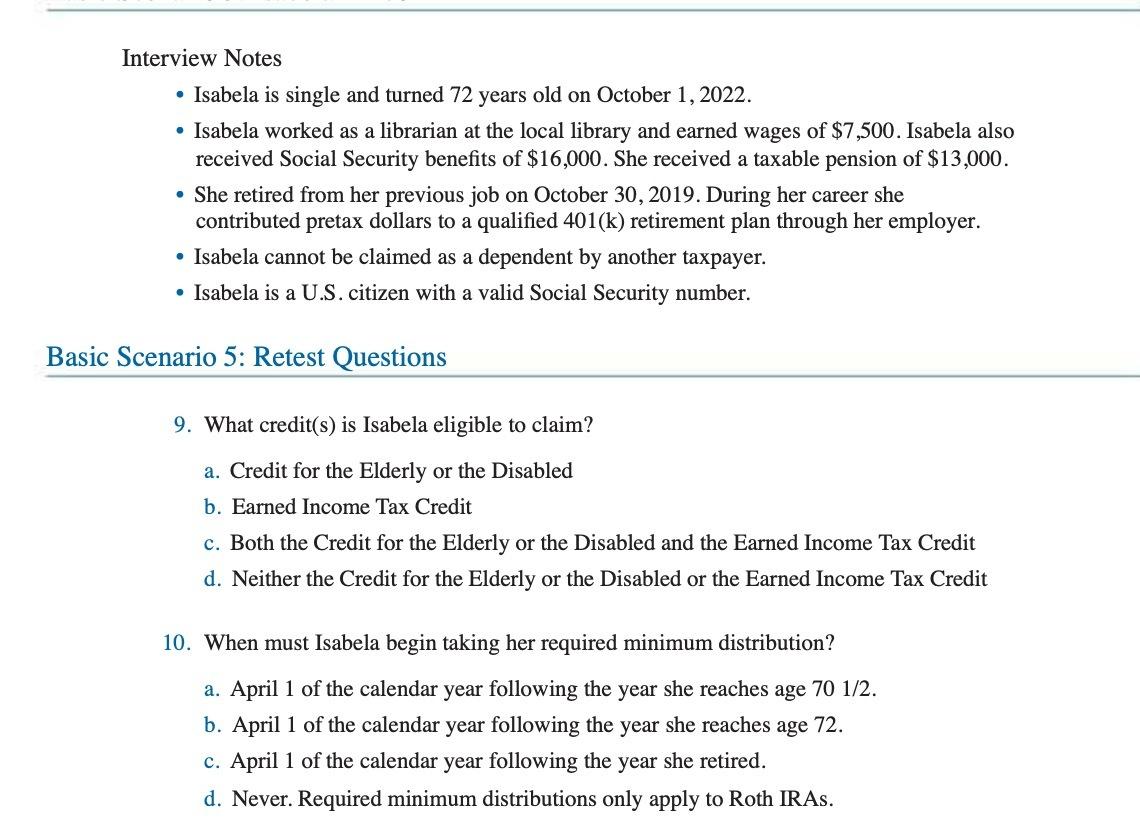

Interview Notes Isabela is single and turned 72 years old on October 1, 2022. Isabela worked as a librarian at the local library and earned wages of $7,500. Isabela also received Social Security benefits of $16,000. She received a taxable pension of $13,000. She retired from her previous job on October 30, 2019. During her career she contributed pretax dollars to a qualified 401(k) retirement plan through her employer. Isabela cannot be claimed as a dependent by another taxpayer. Isabela is a U.S. citizen with a valid Social Security number. Basic Scenario 5: Retest Questions 9. What credit(s) is Isabela eligible to claim? a. Credit for the Elderly or the Disabled b. Earned Income Tax Credit c. Both the Credit for the Elderly or the Disabled and the Earned Income Tax Credit d. Neither the Credit for the Elderly or the Disabled or the Earned Income Tax Credit 10. When must Isabela begin taking her required minimum distribution? a. April 1 of the calendar year following the year she reaches age 70 1/2. b. April 1 of the calendar year following the year she reaches age 72. c. April 1 of the calendar year following the year she retired. d. Never. Required minimum distributions only apply to Roth IRAS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer 9 c Both the Credit for the Elde...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started