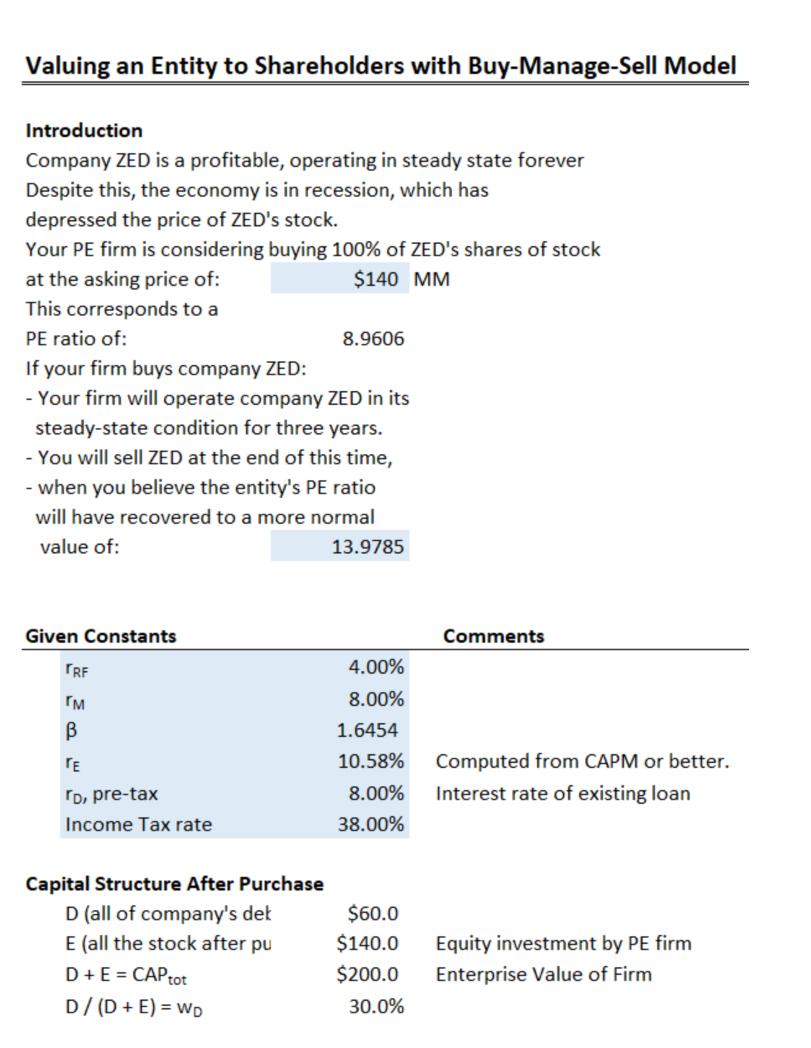

Question: Valuing an Entity to Shareholders with Buy-Manage-Sell Model Introduction Company ZED is a profitable, operating in steady state forever Despite this, the economy is

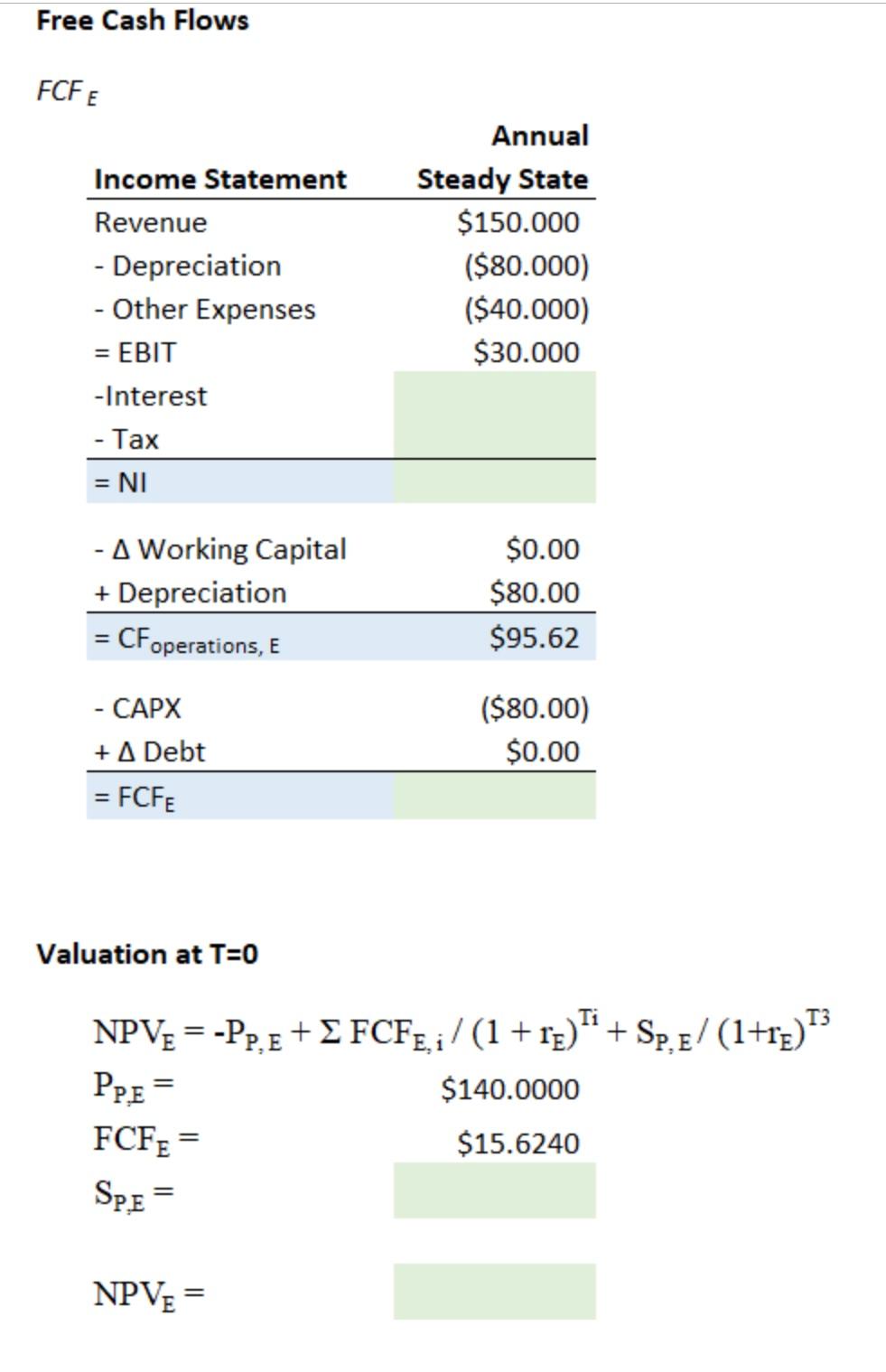

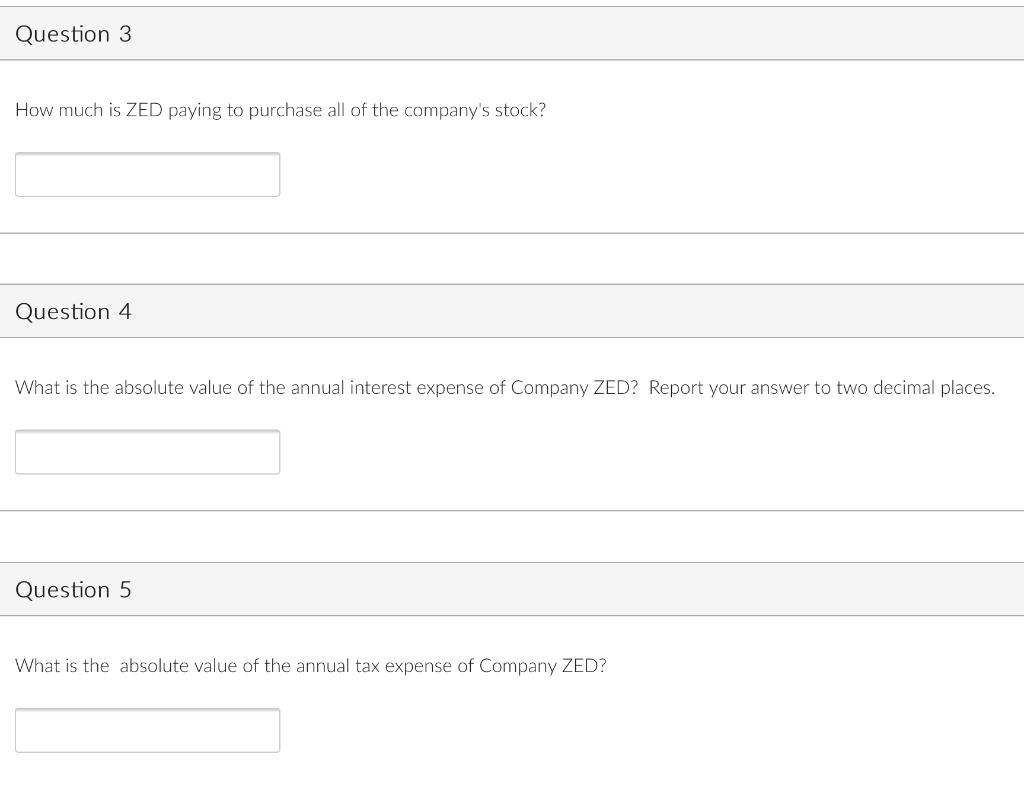

Valuing an Entity to Shareholders with Buy-Manage-Sell Model Introduction Company ZED is a profitable, operating in steady state forever Despite this, the economy is in recession, which has depressed the price of ZED's stock. Your PE firm is considering buying 100% of ZED's shares of stock at the asking price of: $140 MM This corresponds to a PE ratio of: If your firm buys company ZED: 8.9606 -Your firm will operate company ZED in its steady-state condition for three years. - You will sell ZED at the end of this time, - when you believe the entity's PE ratio will have recovered to a more normal value of: 13.9785 Given Constants Comments TRF 4.00% B 8.00% 1.6454 TE TD, pre-tax Income Tax rate 10.58% 8.00% Computed from CAPM or better. Interest rate of existing loan 38.00% Capital Structure After Purchase D (all of company's det $60.0 E (all the stock after pu $140.0 Equity investment by PE firm D + E = CAP tot $200.0 Enterprise Value of Firm D/(D+ E) = WD 30.0% Free Cash Flows FCF E Annual Income Statement Steady State Revenue $150.000 - Depreciation ($80.000) - Other Expenses ($40.000) = EBIT $30.000 -Interest - Tax = NI - A Working Capital $0.00 + Depreciation $80.00 = CF operations, E $95.62 - CAPX ($80.00) + A Debt $0.00 = FCFE Valuation at T=0 Ti T3 NPV = -Pe + FCF / (1 + 1) + SP,E/ (1+TE) 1 PP.E= FCFE= SP.E = NPVE= $140.0000 $15.6240 Question 3 How much is ZED paying to purchase all of the company's stock? Question 4 What is the absolute value of the annual interest expense of Company ZED? Report your answer to two decimal places. Question 5 What is the absolute value of the annual tax expense of Company ZED?

Step by Step Solution

There are 3 Steps involved in it

To solve these questions we need to find the absolute values of the annual interest expense and the ... View full answer

Get step-by-step solutions from verified subject matter experts