Question

Introduction Stock Broker Co. specializes in investment advising for clients interested in creating an investment portfolio with their funds and assets. On March 5th 2022,

Introduction

Stock Broker Co. specializes in investment advising for clients interested in creating an investment portfolio with their funds and assets. On March 5th 2022, Mark Smith, a recent college grad with an investment fund of $10,000 reached out to Stock Broker Co. requesting our assistance in creating his portfolio. He has no experience with financial management but after extensive studying he has decided to invest in three stocks: Alpha, Bravo, and Charlie.

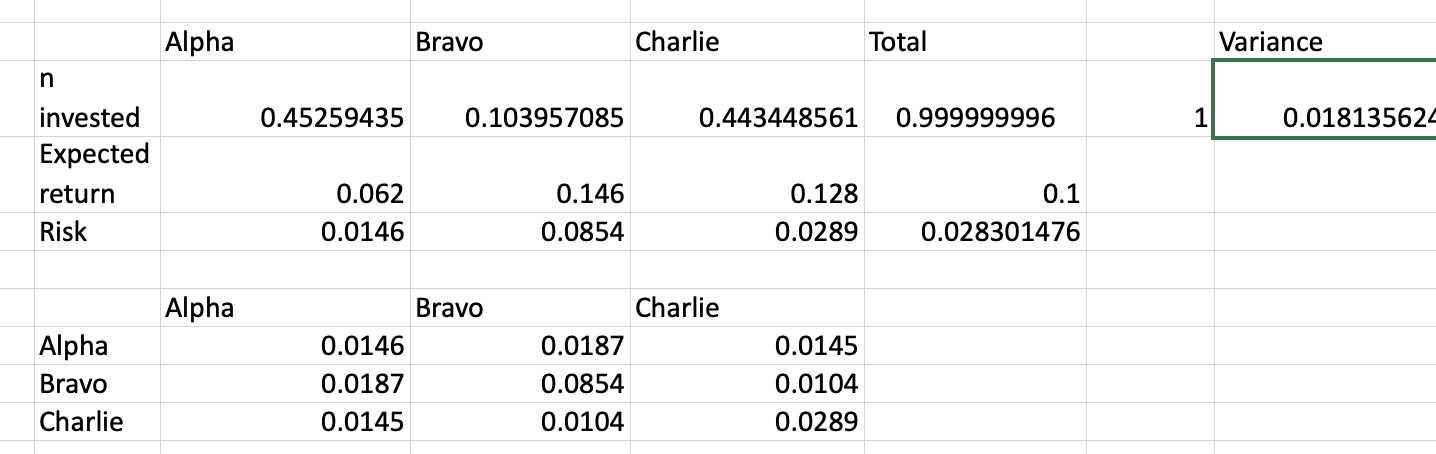

However, he does not know how much he should invest in each stock for the greatest benefit. Moreover, hes expecting returns on a few of his other projects so he wants Stock Broker Co. to find the proportion of each stock that should dominate his portfolio so that he can further invest based on our advice. He is passionate about buying a new house and needs to earn enough money for a big down payment to cover a higher percentage of expected mortgage. Mark has expressed his intentions to minimize as much risk as possible with an expected return of at least 10%. Stock Broker Co. has computed the covariances of the three companies, their individual expected returns and risks. They have a month to propose an optimal portfolio to Mark explaining how to invest the money into these stocks while minimizing risk. They also know that the proportion of portfolio should be x1 + x2 + x3 = 1, according to Markowitz, where x1, x2, and x3 are the proportion of the portfolio invested in Alpha, Bravo, and Charlie, respectively, with

Problem

Mark wants to invest most of his funds in the company with the least amount of risk and a return of 10%.

Decision Variable: x1, x2, x3 that is, the amount invested in each of the three stocks

Constraint:

-

at least 10% return

-

x1 + x2 + x3 = 1

Please create a solution and conclusion to the problem presented

Alpha Bravo Charlie Total Variance n 0.45259435 0.103957085 0.443448561 0.999999996 1 0.018135622 invested Expected return Risk 0.062 0.0146 0.146 0.0854 0.128 0.0289 0.1 0.028301476 Alpha Alpha Bravo Charlie Bravo 0.0146 0.0187 Charlie 0.0187 0.0854 0.0104 0.0145 0.0104 0.0289 0.0145 Alpha Bravo Charlie Total Variance n 0.45259435 0.103957085 0.443448561 0.999999996 1 0.018135622 invested Expected return Risk 0.062 0.0146 0.146 0.0854 0.128 0.0289 0.1 0.028301476 Alpha Alpha Bravo Charlie Bravo 0.0146 0.0187 Charlie 0.0187 0.0854 0.0104 0.0145 0.0104 0.0289 0.0145Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started