Answered step by step

Verified Expert Solution

Question

1 Approved Answer

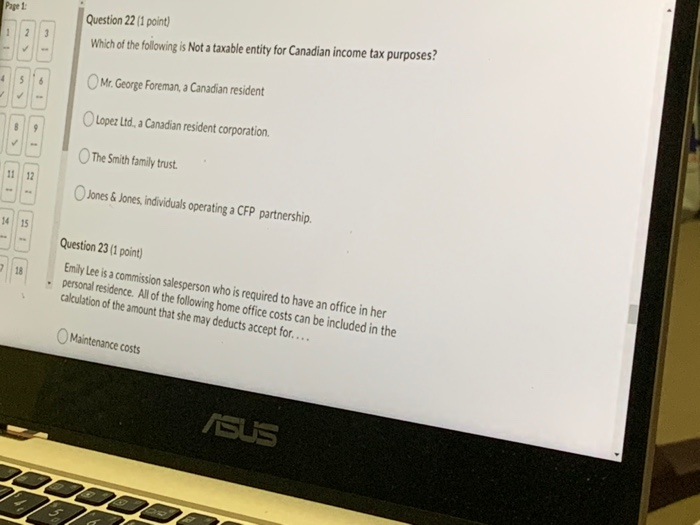

introduction to taxation Page 1 Question 22 (1 point) Which of the following is Not a taxable entity for Canadian income tax purposes? 4 Mr.

introduction to taxation

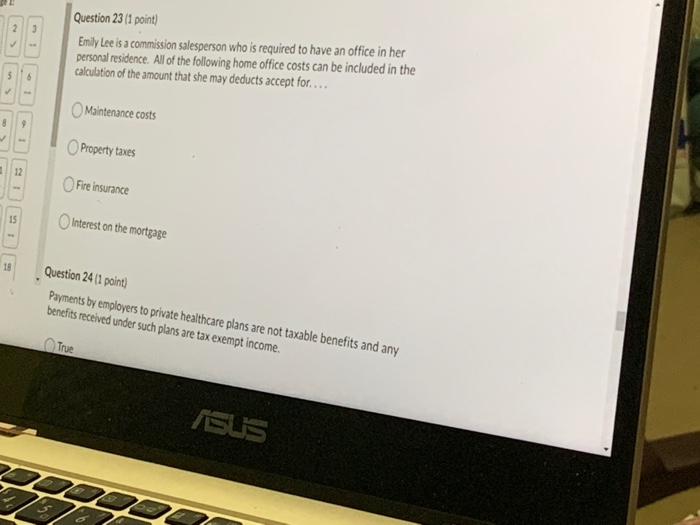

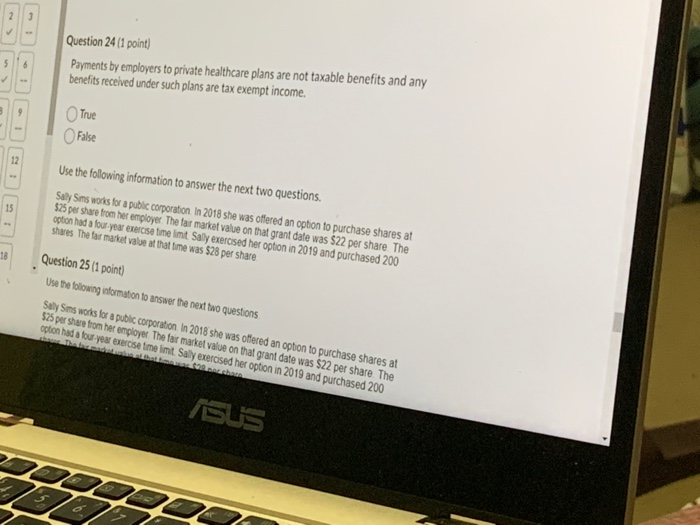

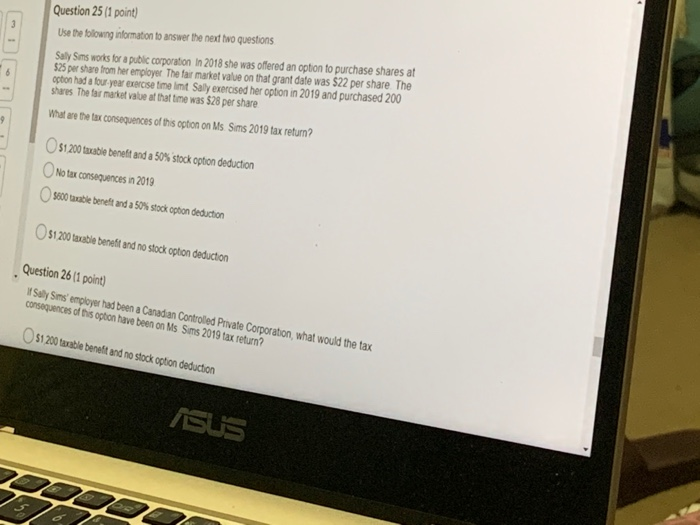

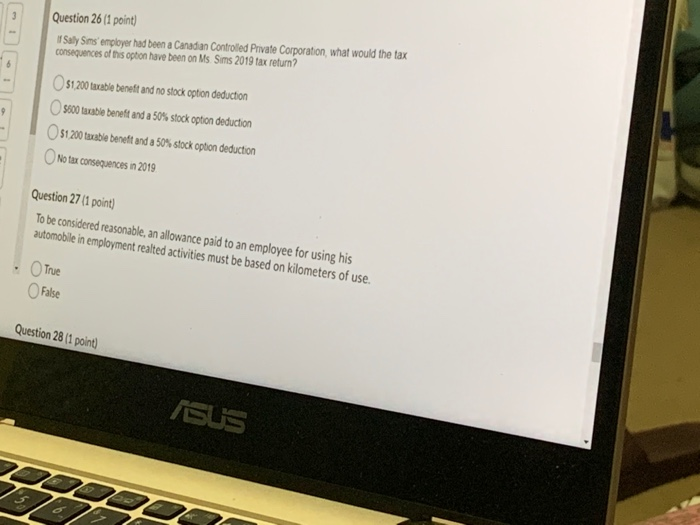

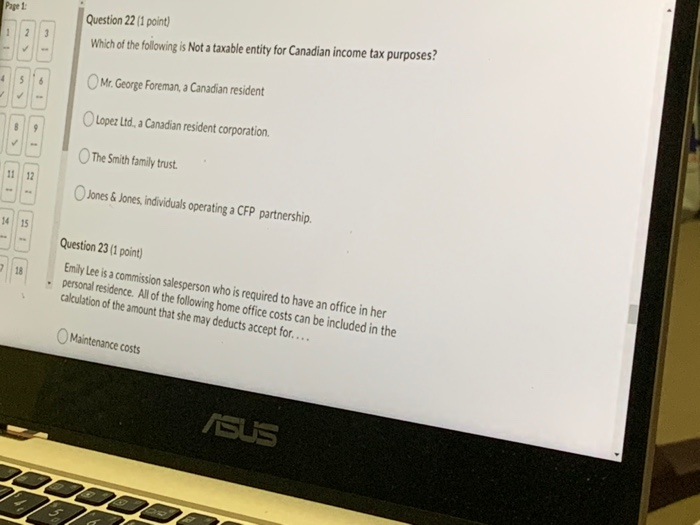

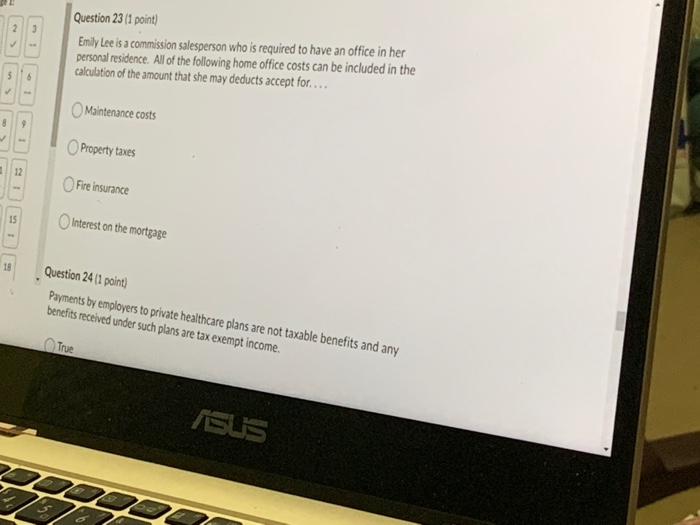

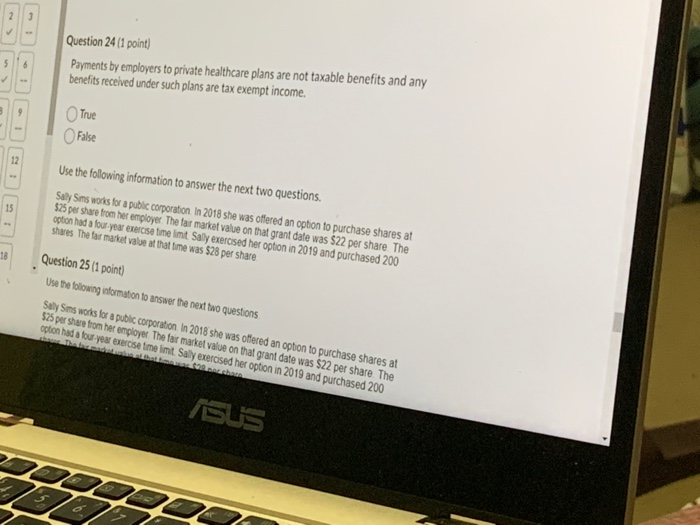

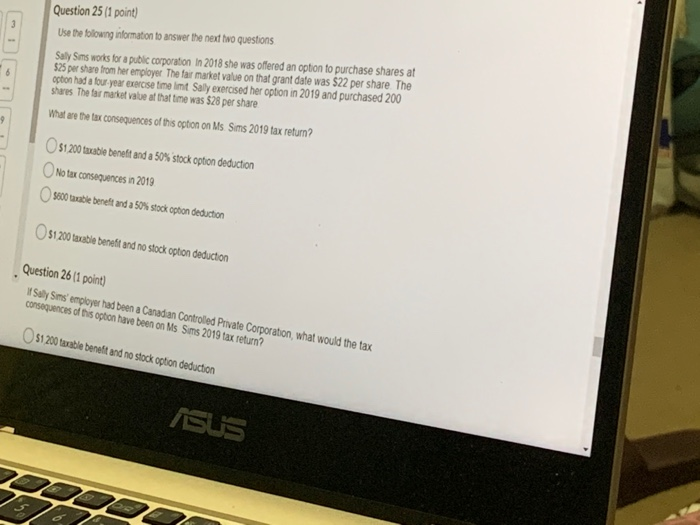

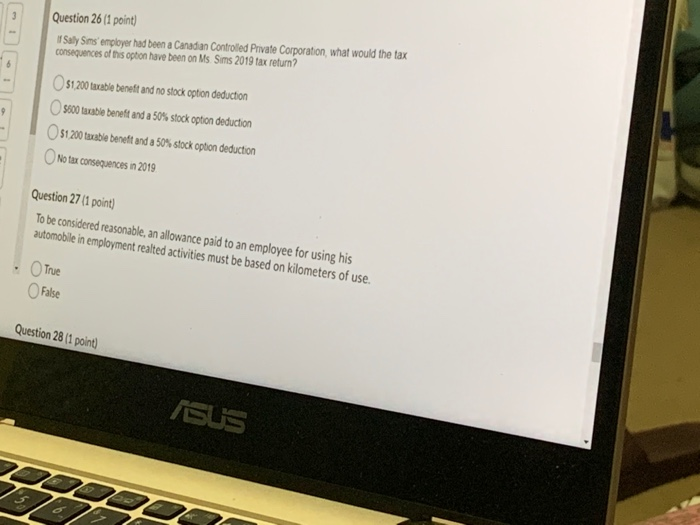

Page 1 Question 22 (1 point) Which of the following is Not a taxable entity for Canadian income tax purposes? 4 Mr. George Foreman, a Canadian resident Lopez Ltd, a Canadian resident Corporation. The Smith family trust 11 12 O Jones & Jones, individuals operating a CFP partnership. 14 15 18 Question 23 (1 point) Emily Lee is a commission salesperson who is required to have an office in her personal residence. All of the following home office costs can be included in the calculation of the amount that she may deducts accept for.... Maintenance costs ASUS Question 23 (1 point) Emily Lee is a commission salesperson who is required to have an office in her personal residence. All of the following home office costs can be included in the calculation of the amount that she may deducts accept for.... Maintenance costs Property taxes Fire insurance Interest on the mortgage Question 24 (1 point) Payments by employers to private healthcare plans are not taxable benefits and any benefits received under such plans are tax exempt income. O True ISUS Question 24 (1 point) Payments by employers to private healthcare plans are not taxable benefits and any benefits received under such plans are tax exempt income. True False 18 Use the following information to answer the next two questions. Saly Sims works for a public corporation. In 2018 she was offered an option to purchase shares at 525 per share from her employer The far market value on that grant date was $22 per share The opton had a four year exercise time int Sally exercised her option in 2019 and purchased 200 shares The far market value at that time was $28 per share Question 25 (1 point) Use the following information to answer the next two questions Saly Sims works for a public corporation in 2018 she was offered an option to purchase shares at 525 per share from her employer. The fair market value on that grant date was $22 per share. The option had a tour yeu exercise ime imt. Sally exercised her option in 2019 and purchased 200 din.ch SUS Question 25 (1 point) Use the blowng information to answer the next two questions Saly Sms works for a public corporation in 2018 she was offered an option to purchase shares at $25 per share from her employer The far market value on that grant date was $22 per share The oston had a four year exercise time imt Sally exercised her option in 2019 and purchased 200 shares the far market value at that time was $28 per share What are the tax consequences of this option on Ms Sims 2019 tax retur? 51 200 taxable benefit and a 50% stock option deduction No tax consequences in 2013 S600 table benefit and a 50% stock opton deduction Os1 200 taxable benefit and no stock opton deduction Question 26 [1 point) Saly Sims' employer had been a Canadian Controlled Private Corporation, what would the tax consequences of this option have been on Ms Sims 2019 tax return? Os1200 taxable benefit and no stock option deduction SUS Question 26 (1 point) 1 Saly Sins employer had been a Canadian Controlled Private Corporation, what would the tax consequences of this option have been on Ms Sims 2019 tax retur? 9 O $1.200 taxable benefit and no stock option deduction S800 taxable benefit and a 50% stock option deduction $1.200 taxable beneft and a 50% stock option deduction No tax consequences in 2019 Question 27 (1 point) To be considered reasonable, an allowance paid to an employee for using his automobile in employment realted activities must be based on kilometers of use. O True False Question 28 (1 point) SUS 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started