Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INVESTMENTS & ANALYSIS-Page 3 13. The average number of days to sel1 the inventory during the year a. 91 days b. 61 days . 46

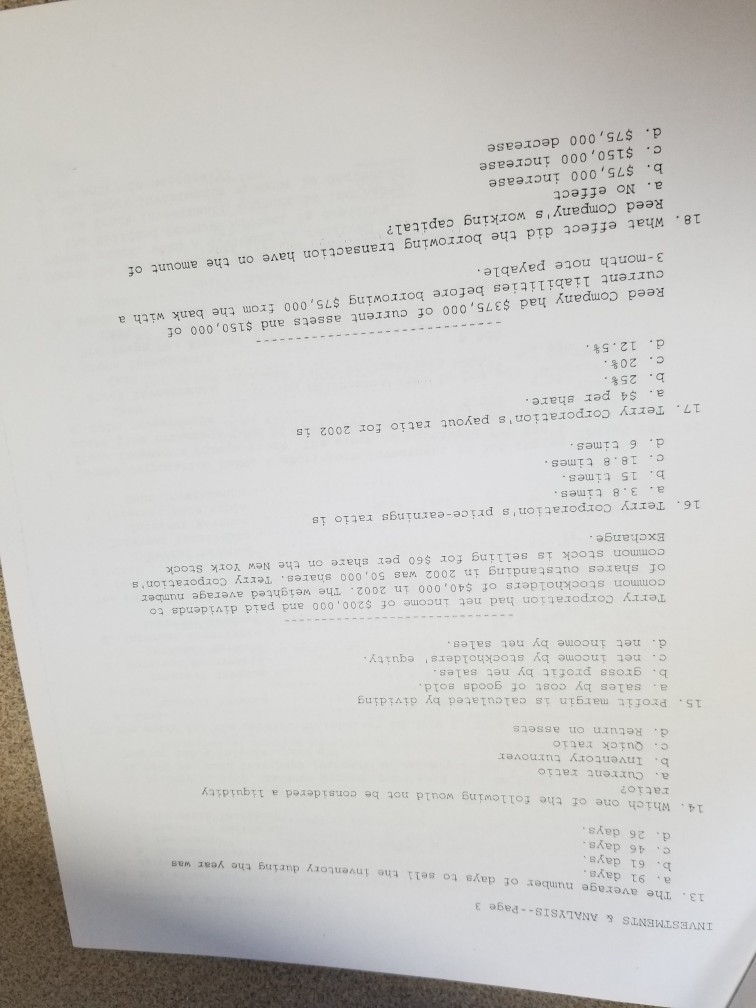

INVESTMENTS & ANALYSIS-Page 3 13. The average number of days to sel1 the inventory during the year a. 91 days b. 61 days . 46 days d. 26 days was 14. Which one of the following would not be considered a liquidity ratio? a. Current ratio b. Inventory turnover c. Quick ratiO d. Return on assets 15. Profit margin is calculated by dividing a. sales by cost of goods sold b. gross profit by net sales c. net income by stockholders' equity d. net income by net sales Terry Corporation had net income of $200,000 and paid dividends to common stockholders of $40, 000 in 2002. The weighted average number of shares outstanding in 2002 was 50,000 shares. Terry Corporation's common stock is selling for $60 per share on the New York Stock Exchange 16. Terry Corporation's price-earnings ratio is a. 3.8 times. b. 15 times c. 18.8 times. d. 6 times. 17. Terry Corporation's payout ratio for 2002 1s a. $4 per share. b. 25 . 208. d. 12.5%. Reed Company had $375, 000 of current assets and $150,000 of current liabilities before borrowing $75,000 from the bank with a 3-month note payable Reed Company's working capital? a. No effect b. $75,000 increase c. $150,000 increase d. $75,000 decrease 18. What effect did the borrowing transaction have on the amount of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started