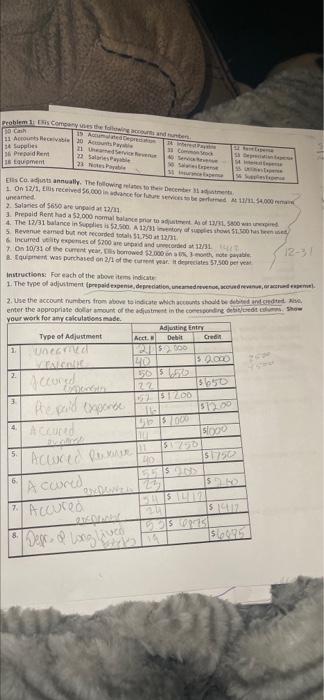

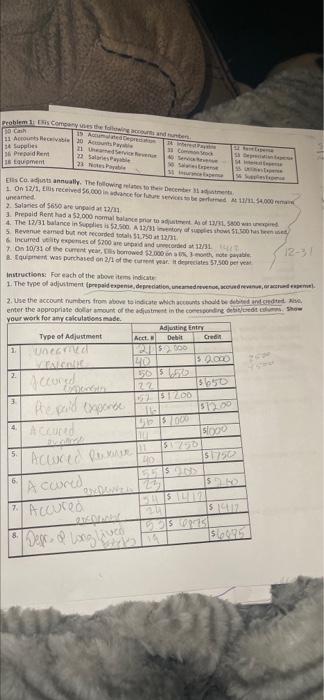

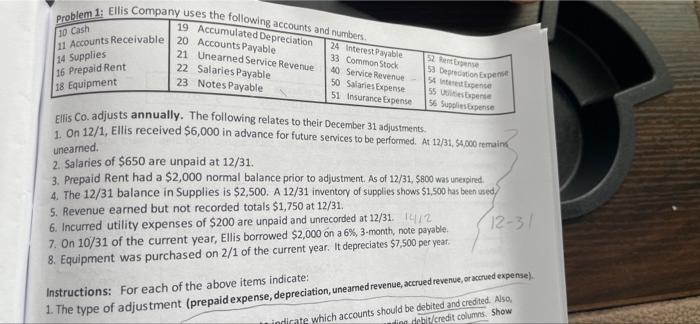

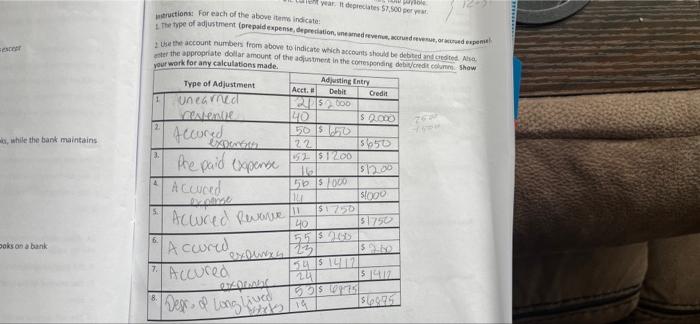

problems. Concepts and atten 1 Suportes 16 Preden 15 Eument 23 Colly. The owner 1 On 12/3. se56.000 fori bered 4.000 unamed 2. Slanes of 5650 are unpaidat 3. Prepeld Rent had a $2.000 nomal balance of 4. The 12/31 balance in Solies 2.500 A 12/31 story show these 5 Revenue came but not recorded as $1.750 Incarred velit ess of $200 ured under 3/4 7. On 10/31 of the current year, som $2.000 monthle Aquipment was purchased on 2/3 of the current year. It deprecates 57.500 per yet 12-31 Instructions for each of the above ter indicate 1. The type of adjustment prepaid expense, depreciation, and to reveal 2. Use the account members from above to indicate which should be bed and enter the appropriate collar amount of the adjustment in the corespondire de Show your work for a calculations de Adjusting Entry Type of Adjustment het Debi Grein 1 TURECTIVA SUSO Le 520.000 2. 550 screve 3 ESTUDO IST 000 A Accord 150 5 6 Acured priser Accored Accured F 1550 ISSN S SSL 15 029509723 7 Degou a long Problem 1: Ellis Company uses the following accounts and numbers 11 Accounts Receivable 20 Accounts Payable 10 Cash 19 Accumulated Depreciation 52 Rent 14 Supplies 16 Prepaid Rent 18 Equipment 21 Unearned Service Revenue 22 Salaries Payable 23 Notes Payable 24 Interest Payable 33 Common Stock 40 Service Revenue 50 Salaries Expense 51 Insurance Expense 53 Detion Expert 54 55 espere 56 Sestapense Ellis Co. adjusts annually. The following relates to their December 31 adjustments. 1 on 12/1, Ellis received $6,000 in advance for future services to be performed. At 12/31, 54,000 rermaina uneared, 2. Salaries of $650 are unpaid at 12/31. 3. Prepaid Rent had a $2,000 normal balance prior to adjustment. As of 12/31, 5800 was unexpired. 4. The 12/31 balance in Supplies is $2,500. A 12/31 inventory of supplies shows $1,500 has been used 5. Revenue earned but not recorded totals $1,750 at 12/31. 6. Incurred utility expenses of $200 are unpaid and unrecorded at 12/31 1412 (12-31 7. On 10/31 of the current year, Ellis borrowed $2,000 on a 6%, 3-month, note payable, 8. Equipment was purchased on 2/1 of the current year. It depreciates $7,500 per year. Instructions: For each of the above items indicate: 1. The type of adjustment (prepaid expense, depreciation, uneamed revenue, accrued revenue, or accrued expense). In indicate which accounts should be debited and credited. Also, in de credit columns Show year it deprecates Sport wtructions for each of the above indicate Acct. Debit Credit 1 hepe of adjustment Corepad expense, depreciation, interna drevenon, crudos, arvad semel Use the account numbers from aborto indicate with accounts should be debted and condited Aia er the appropriate dollar amount of the adjustment in the componding debitoreditch Show your work for any calculations made. Adjusting Entry Type of Adjustment unearned SS 000 YOLLAND LO S 0000 Accurred 50 5.50 22 15656 LS1.00 Prepaid expense to 151200 Acceed 50.000 5000 Report 5170 Actured Revarne 15750 555 2 s, while the bank maintains 3. 4 5 40 6. boks on a bank 7. Accured Accured Des of Longlived 5425 24 7:] liat