Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It has been a tragic year for Alicia. Alicia's divorce from her husband Peter became final on December 3 0 of 2 0 2 4

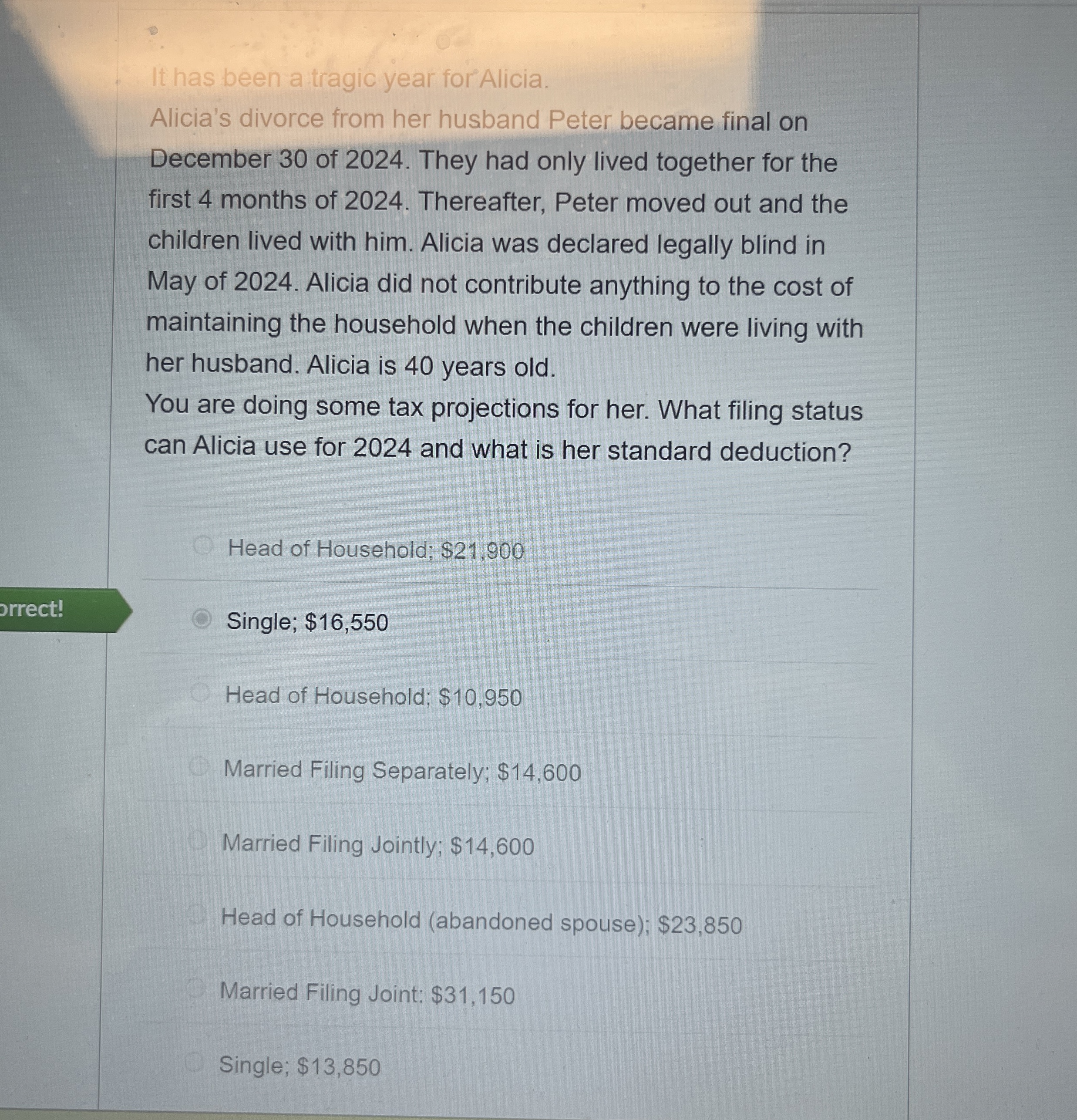

It has been a tragic year for Alicia.

Alicia's divorce from her husband Peter became final on

December of They had only lived together for the

first months of Thereafter, Peter moved out and the

children lived with him. Alicia was declared legally blind in

May of Alicia did not contribute anything to the cost of

maintaining the household when the children were living with

her husband. Alicia is years old.

You are doing some tax projections for her. What filing status

can Alicia use for and what is her standard deduction?

Head of Household; $

Single; $

Head of Household; $

Married Filing Separately; $

Married Filing Jointly; $

Head of Household abandoned spouse; $

Married Filing Joint: $

Single; $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started