Question

It is now the first of February and Genevieve had a very busy January. Genevieve has journalized and posted Januarys transactions, the adjusting entries, and

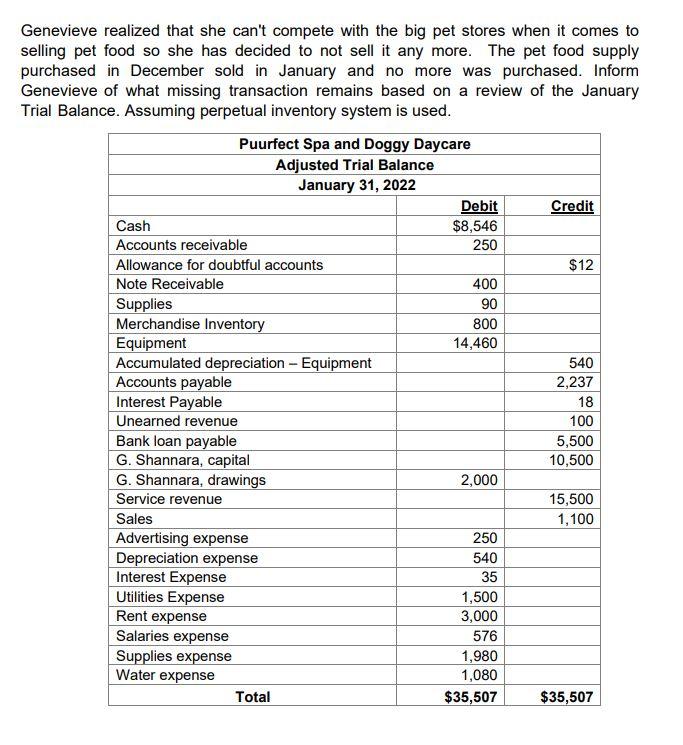

It is now the first of February and Genevieve had a very busy January. Genevieve has journalized and posted Januarys transactions, the adjusting entries, and prepared the January 31 Trial Balance following your instructions and those she found on the internet. On January 28, Genevieve initially recorded some additional equipment purchased on account for $1,500 as supplies expense. After posting the original transaction, she then made an entry to correct this error. Had she not made a correcting entry, would the financial statements have been misstated? How? During January, Geoff Zanetti called asking for a time extension on his $400 Accounts Receivable as he is out of province until Feb 26. Geoff likes to pay in person and was not able to come around in January to settle his account. Genevieve agreed and had him e-mail over a signed, two-month, 6% note. The extension starts January 1 and payment plus interest are due February 28. Genevieve needs your help in preparing the entry to record Geoffs extension.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started