Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its being so i posted that can any one answer ???? Abini Associates, Inc., had 2,000 outstanding shares of 11%, $50 par value preferred stock

its being so i posted that can any one answer ????

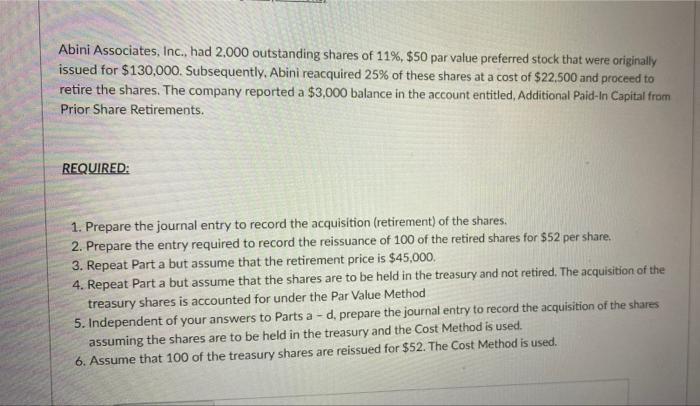

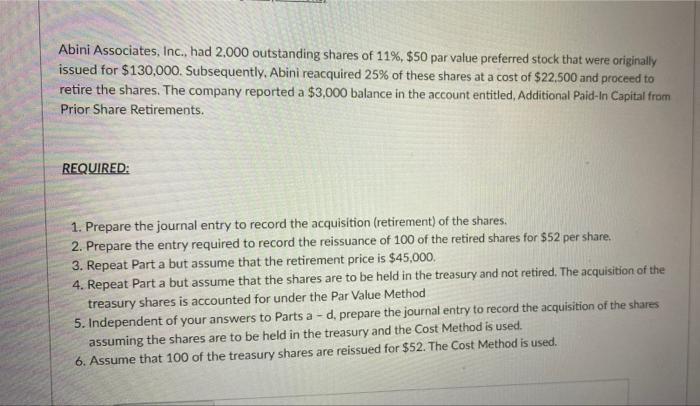

Abini Associates, Inc., had 2,000 outstanding shares of 11%, $50 par value preferred stock that were originally issued for $130,000. Subsequently Abini reacquired 25% of these shares at a cost of $22,500 and proceed to retire the shares. The company reported a $3,000 balance in the account entitled, Additional Paid-In Capital from Prior Share Retirements. REQUIRED: 1. Prepare the journal entry to record the acquisition (retirement) of the shares. 2. Prepare the entry required to record the reissuance of 100 of the retired shares for $52 per share. 3. Repeat Part a but assume that the retirement price is $45,000 4. Repeat Part a but assume that the shares are to be held in the treasury and not retired. The acquisition of the treasury shares is accounted for under the Par Value Method 5. Independent of your answers to Parts a - d prepare the journal entry to record the acquisition of the shares assuming the shares are to be held in the treasury and the Cost Method is used. 6. Assume that 100 of the treasury shares are reissued for $52. The Cost Method is used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started