Question

It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne to Europe. This has

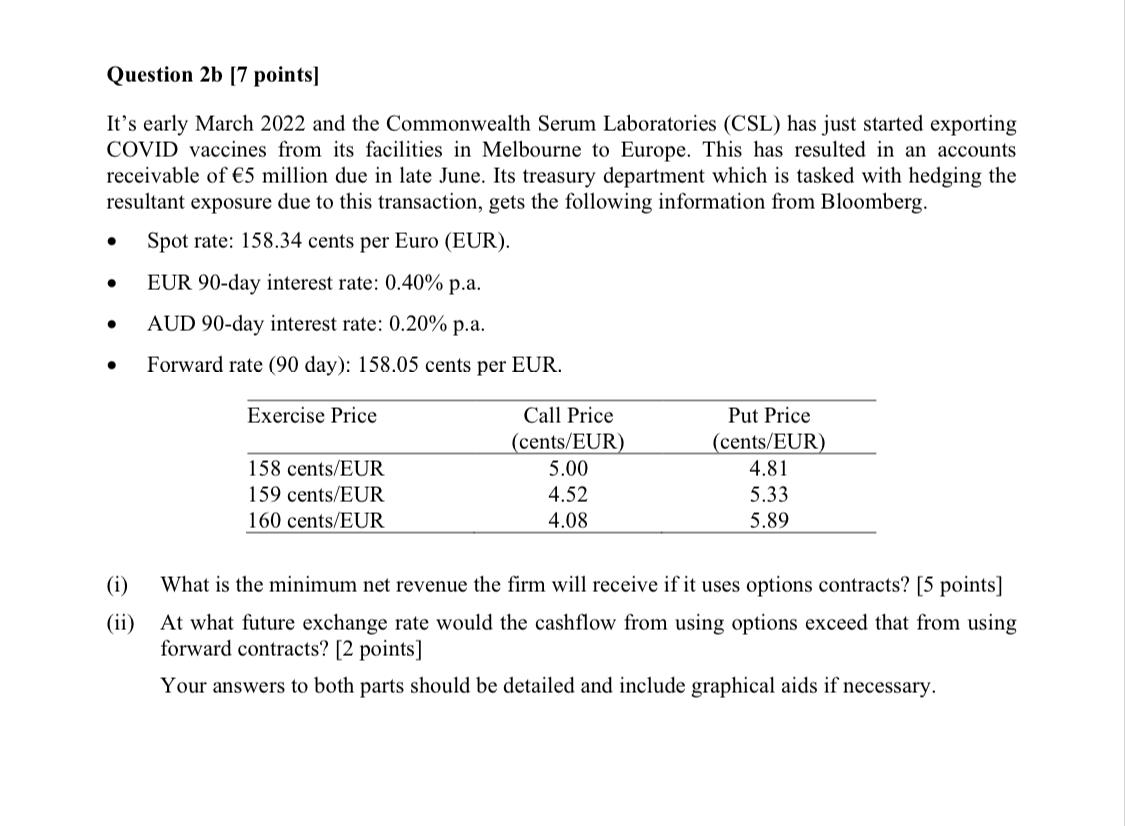

It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne to Europe. This has resulted in an accounts receivable of E5 million du in late June Its treasury department which is tasked with hedging the resultant exposure due to this transaction, gets the following information from Bloomberg. (i) What is the minimum net revenue the firm will receive if it uses options contracts?[5 points] (ii) At what future exchange rate would the cashflow from using options exceed that from using forward contracts?[2 points] Your answers to both parts should be detailed and include graphical aids if necessary.

It's early March 2022 and the Commonwealth Serum Laboratories (CSL) has just started exporting COVID vaccines from its facilities in Melbourne to Europe. This has resulted in an accounts receivable of E5 million du in late June Its treasury department which is tasked with hedging the resultant exposure due to this transaction, gets the following information from Bloomberg. (i) What is the minimum net revenue the firm will receive if it uses options contracts?[5 points] (ii) At what future exchange rate would the cashflow from using options exceed that from using forward contracts?[2 points] Your answers to both parts should be detailed and include graphical aids if necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started