Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IV. Question four (25marks) Hand acquired 70% of the equity shares in Sand in a single transaction, paying $226 million in cash. At the

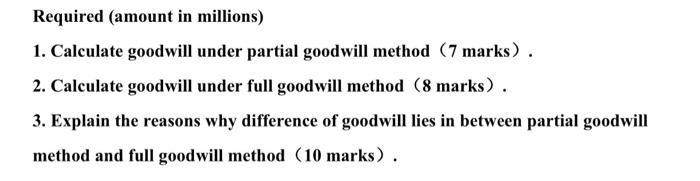

IV. Question four (25marks) Hand acquired 70% of the equity shares in Sand in a single transaction, paying $226 million in cash. At the acquisition date the fair value of the net assets of Sand was $220 million. The fair value of the non-controlling interest at this date was $69 million. At the acquisition date, Hand had $600 million of ordinary shares in issue and reserves of $800 million, and net assets of $1,400 million, including the investment in Sand at cost. It has no other subsidiaries. Required (amount in millions) 1. Calculate goodwill under partial goodwill method (7 marks). 2. Calculate goodwill under full goodwill method (8 marks). 3. Explain the reasons why difference of goodwill lies in between partial goodwill method and full goodwill method (10 marks).

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 Partial Good will Good will 226 million 220 million 69 million Good will 37 million 2 Full ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started