Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IV . Refer back to the information in Part III. Assume that Carson's year end financial statement date is March 3 1 , 2 0

IV Refer back to the information in Part III. Assume that Carson's year end financial statement date is March

A Prepare the adjusting journal entry at March to record the accrual of interest and related amortization.

B Prepare the journal entry to pay the first interest payment on December assuming reversing journal entries were posted at the beginning of the new year April

C Prepare the journal entry to pay the first interest payment on December assuming NO reversing journal entries were posted at the beginning of the new year April

IV Refer back to the information in Part III. Assume that Carson's year end financial statement date is March

A Prepare the adjusting journal entry at March to record the accrual of interest and related amortization.

B Prepare the journal entry to pay the first interest payment on December assuming reversing journal entries were posted at the beginning of the new year April

C Prepare the journal entry to pay the first interest payment on December assuming NO reversing journal entries were posted at the beginning of the new year April

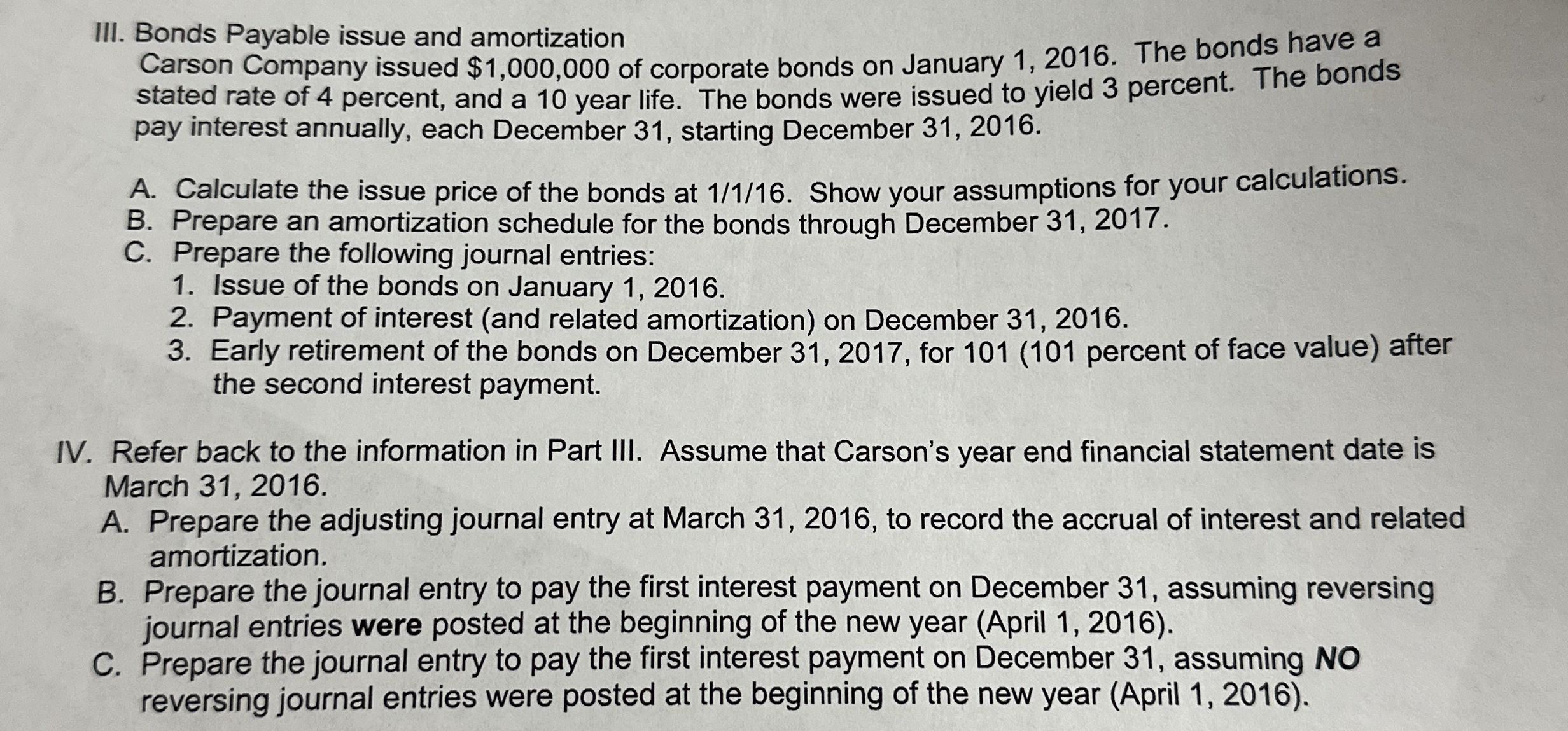

III. Bonds Payable issue and amortization

Carson Company issued $ of corporate bonds on January The bonds have a stated rate of percent, and a year life. The bonds were issued to yield percent. The bonds pay interest annually, each December starting December

A Calculate the issue price of the bonds at Show your assumptions for your calculations.

B Prepare an amortization schedule for the bonds through December

C Prepare the following journal entries:

Issue of the bonds on January

Payment of interest and related amortization on December

Early retirement of the bonds on December for percent of face value after the second interest payment.

IV Refer back to the information in Part III. Assume that Carson's year end financial statement date is March

A Prepare the adjusting journal entry at March to record the accrual of interest and related amortization.

B Prepare the journal entry to pay the first interest payment on December assuming reversing journal entries were posted at the beginning of the new year April

C Prepare the journal entry to pay the first interest payment on December assuming NO reversing journal entries were posted at the beginning of the new year April

I NEED QUESTION IV COMPLETED. Question IV uses information from question III!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started