I've been working on this tax problem for 2 days, I need help making sure my answers are correct.

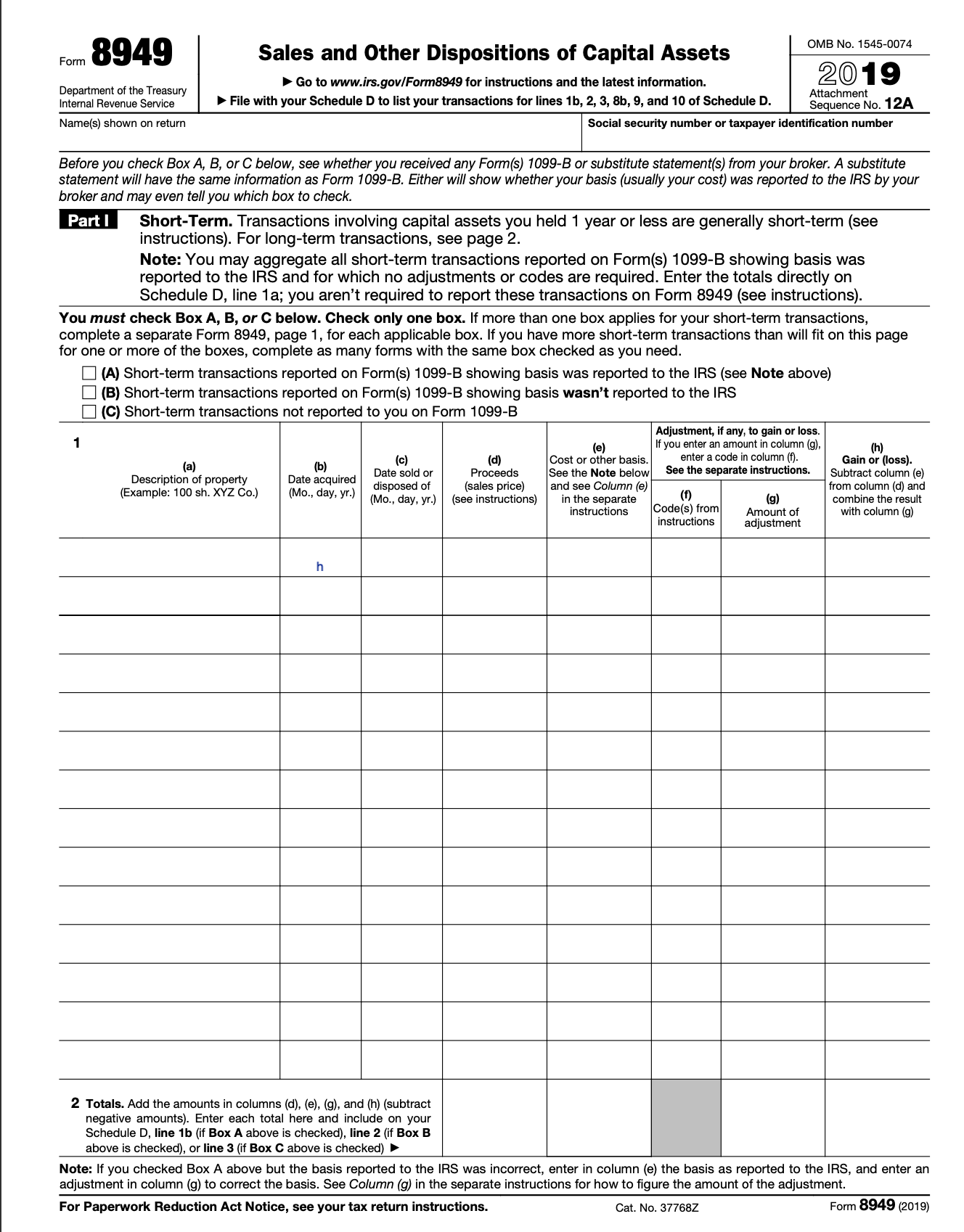

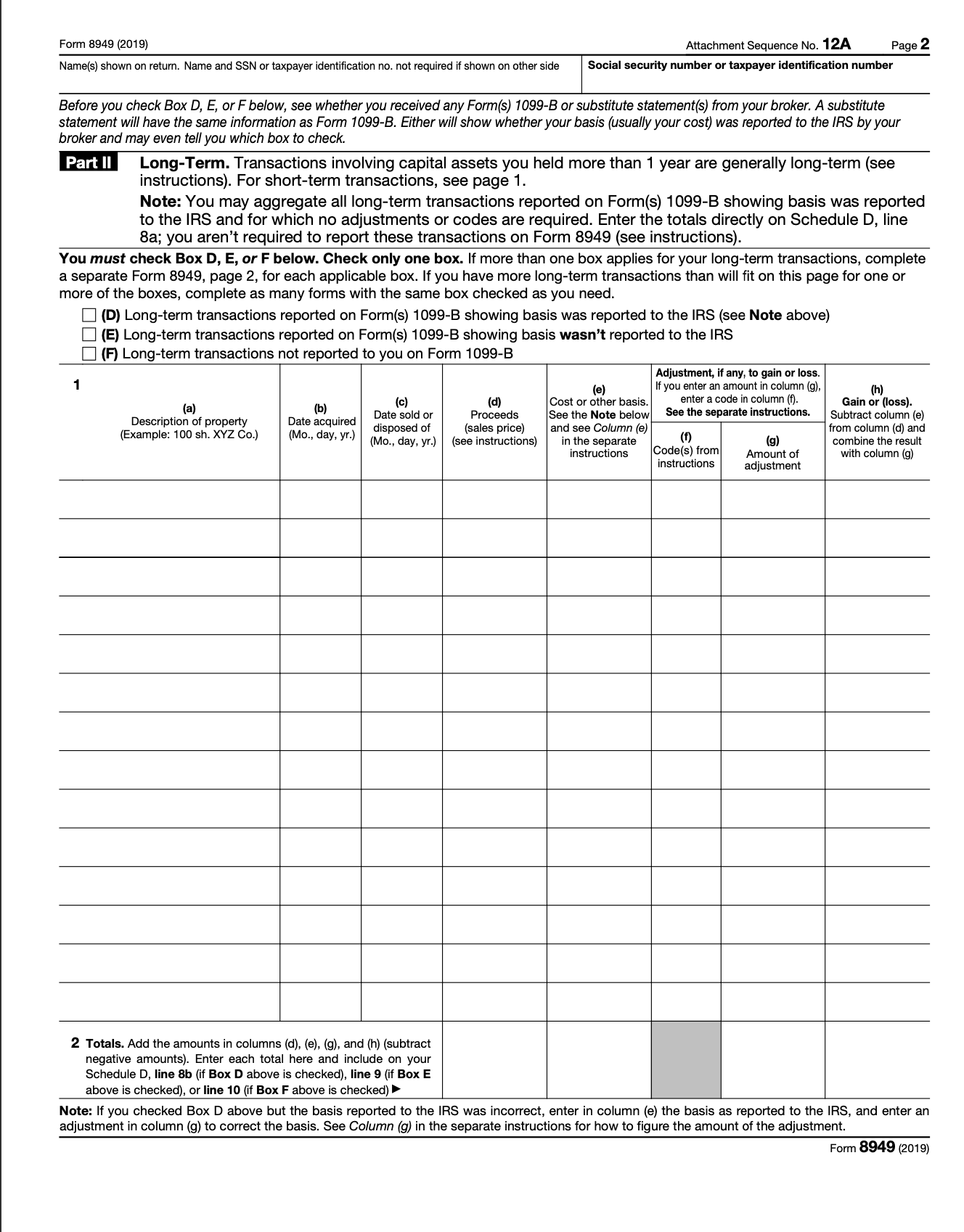

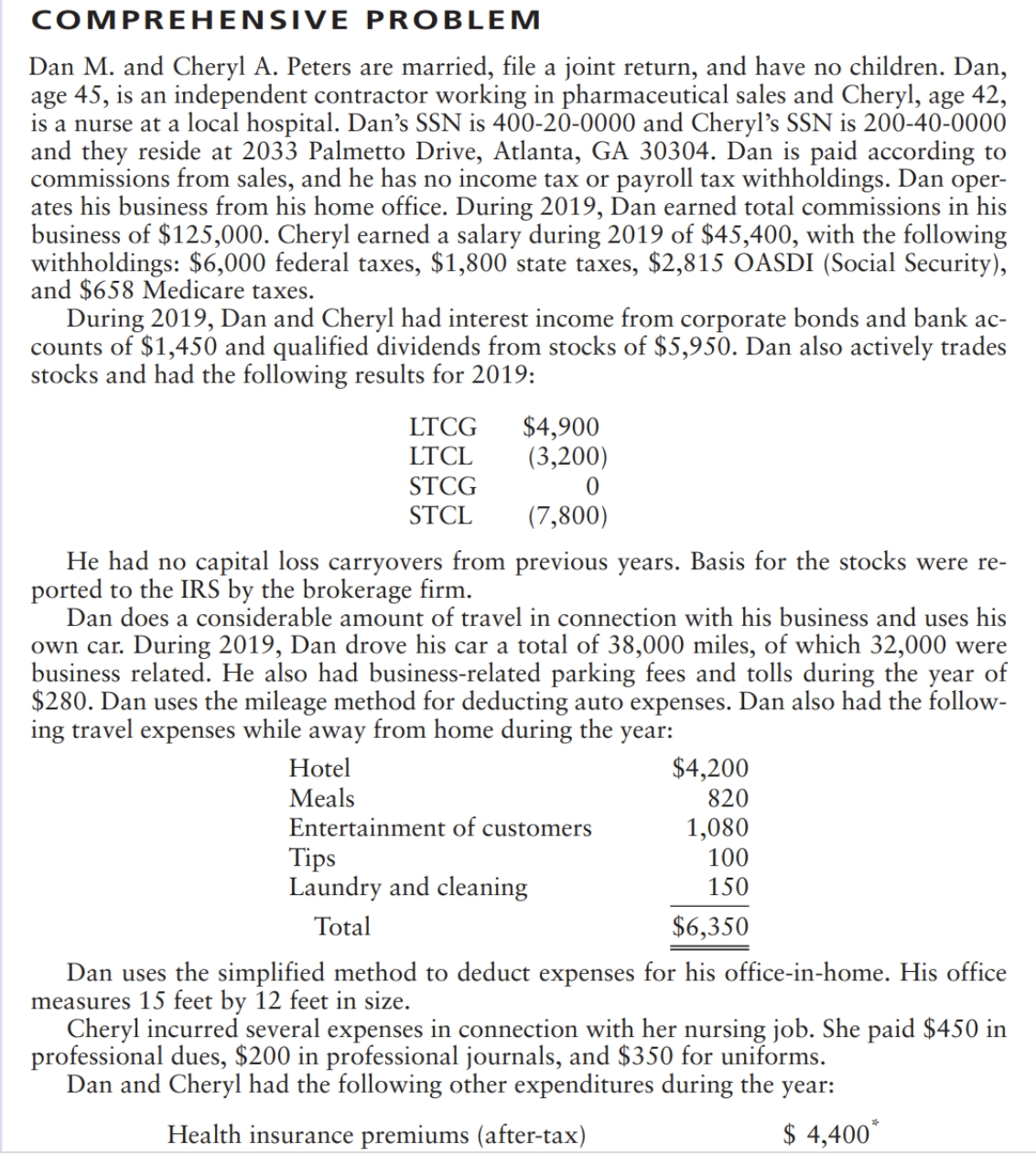

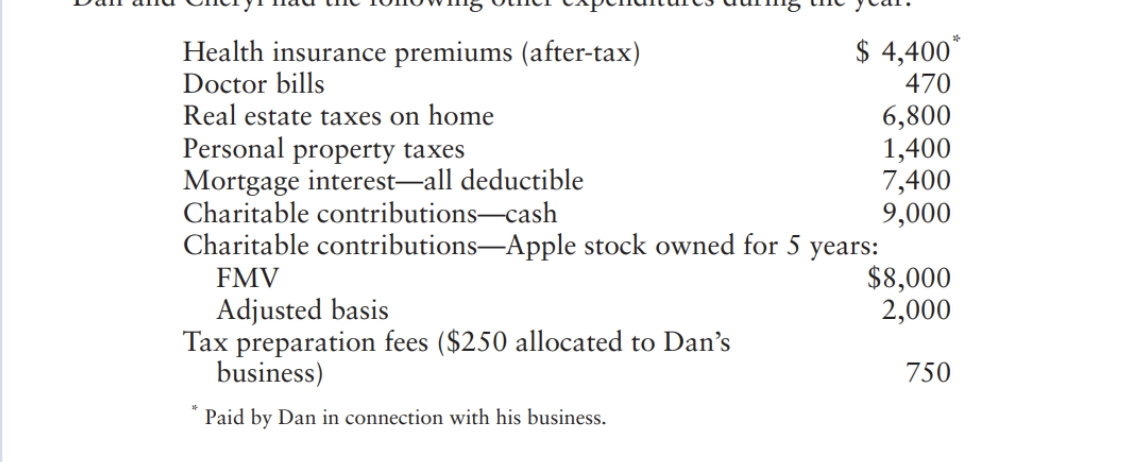

. . . . 0MB N . 1545-oo74 Fm 8949 Sales and Other Dispositions of Capital Assets D Go to www.irs.govlForm8949 for Instructions and the latest Information. 2 1 9 mt\" '9' II M the TVSBSUW Attachment Internal Revenue Service I File with your Schedule D to list your transactions for lines 1!), 2, 3, 3b, 9, and 10 ot Schedule D. Sequence No. 1 2A Name(s) shown on return Social security number or taxpayer identication number Before you check Box A, B, or C below, see whether you received any Form(s) 1099-8 or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-3. Either will show whether your basis (usually your cost) was reported to the lRS by your broker and may even tell you which box to check. IEII Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions. see page 2. Note: You may aggregate all short-term transactions reported on Form(s) 1099-3 showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B. or C below. Check only one box. If more than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for each applicable box. If you have more short-ten'n transactions than will t on this page for one or more of the boxes, complete as many fame with the same box checked as you need. [I (A) Short-term transactions reported on Form(s) 1099-3 showing basis was reported to the IRS (see Note above) D (B) Short-term transactions reported on Form(s) 1099-3 showing basis wasn't reported to the IRS El (0) Short-term transactions not reported to you on Form 1099-3 Adjust-hem, itany, to gin or loss. 1 l8) Ifyou enter an amount in column (9). N (a) (hi to) Id) Cost or other basis. 59:31!\" 9 901:1: Foams?- Gain or [loss]. . . . Date sold or Proceeds See the Note below 9 \"Pa \"15 u \"'19- Subtract column (a) (EEaarchtroryghprgzgo) 3:? auirerc; disposed of {sales price) and see Column (9) from column [cl] and p ' ' ' " y. y ' {Mo., clay, yr.) (see instructions} in the separate m (9} combine the result instructions OWNS) from Amount of with column (9) instmctions adjustment 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule DI line 1b (if Box A above is checked)I line 2 (if Box B above is checked)I or line 3 (if Box G above is checked) P Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column to) the basis as reported to the IRS, and enter an adjustment in column {9) to correct the basis. See Column (9) in the separate instructions for how to gure the amount of the adjustment. For Papennrork Reduction Act Notice, see your tax return Instructions. Cat. No. 377682 Form 8949 (2019) Form 8949 (2019) Attachment Sequence No. 12A Page 2 Name(s) shown on return. Name and SSN or taxpayer identification no. not required if shown on other side Social security number or taxpayer identification number Before you check Box D, E, or F below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check. Part II|Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need (D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to you on Form 1099-B Adjustment, if any, to gain or loss. (e) If you enter an amount in column (9) (h) (c) (d) Cost or other basis. enter a code in column (f). (a) (b) Gain or (loss). Description of property Date acquired Date sold or Proceeds See the Note below See the separate instructions. Subtract column (e) Example: 100 sh. XYZ Co.) (Mo., day, yr.) disposed of (sales price) and see Column (e from column (d) and (Mo., day, yr.) (see instructions) in the separate (f) (9) combine the result instructions Code(s) from Amount of with column (9) instructions adjustment 2 Totals. Add the amounts in columns (d), (e), (9), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 (if Box F above is checked) Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (9) to correct the basis. See Column (9) in the separate instructions for how to figure the amount of the adjustment. Form 8949 (2019)COMPREHENSIVE PROBLEM Dan M. and Cheryl A. Peters are married, file a joint return, and have no children. Dan, age 45, is an independent contractor working in pharmaceutical sales and Cheryl, age 42, is a nurse at a local hospital. Dan's SSN is 400-20-0000 and Cheryl's SSN is 200-40-0000 and they reside at 2033 Palmetto Drive, Atlanta, GA 30304. Dan is paid according to commissions from sales, and he has no income tax or payroll tax withholdings. Dan oper- ates his business from his home office. During 2019, Dan earned total commissions in his business of $125,000. Cheryl earned a salary during 2019 of $45,400, with the following withholdings: $6,000 federal taxes, $1,800 state taxes, $2,815 OASDI (Social Security), and $658 Medicare taxes. During 2019, Dan and Cheryl had interest income from corporate bonds and bank ac- counts of $1,450 and qualified dividends from stocks of $5,950. Dan also actively trades stocks and had the following results for 2019: LTCG $4,900 LTCL (3,200) STCG STCL (7,800) He had no capital loss carryovers from previous years. Basis for the stocks were re- ported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2019, Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of $280. Dan uses the mileage method for deducting auto expenses. Dan also had the follow- ing travel expenses while away from home during the year: Hotel $4,200 Meals 820 Entertainment of customers 1,080 Tips 100 Laundry and cleaning 150 Total $6,350 Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 feet in size. Cheryl incurred several expenses in connection with her nursing job. She paid $450 in professional dues, $200 in professional journals, and $350 for uniforms. Dan and Cheryl had the following other expenditures during the year: Health insurance premiums (after-tax) $ 4,400*Health insurance premiums (after-tax) $ 4,400 Doctor bills 470 Real estate taxes on home 6,800 Personal property taxes 1,400 Mortgage interest-all deductible 7,400 Charitable contributions-cash 9,000 Charitable contributions-Apple stock owned for 5 years: FMV $8,000 Adjusted basis 2,000 Tax preparation fees ($250 allocated to Dan's business) 750 * Paid by Dan in connection with his business