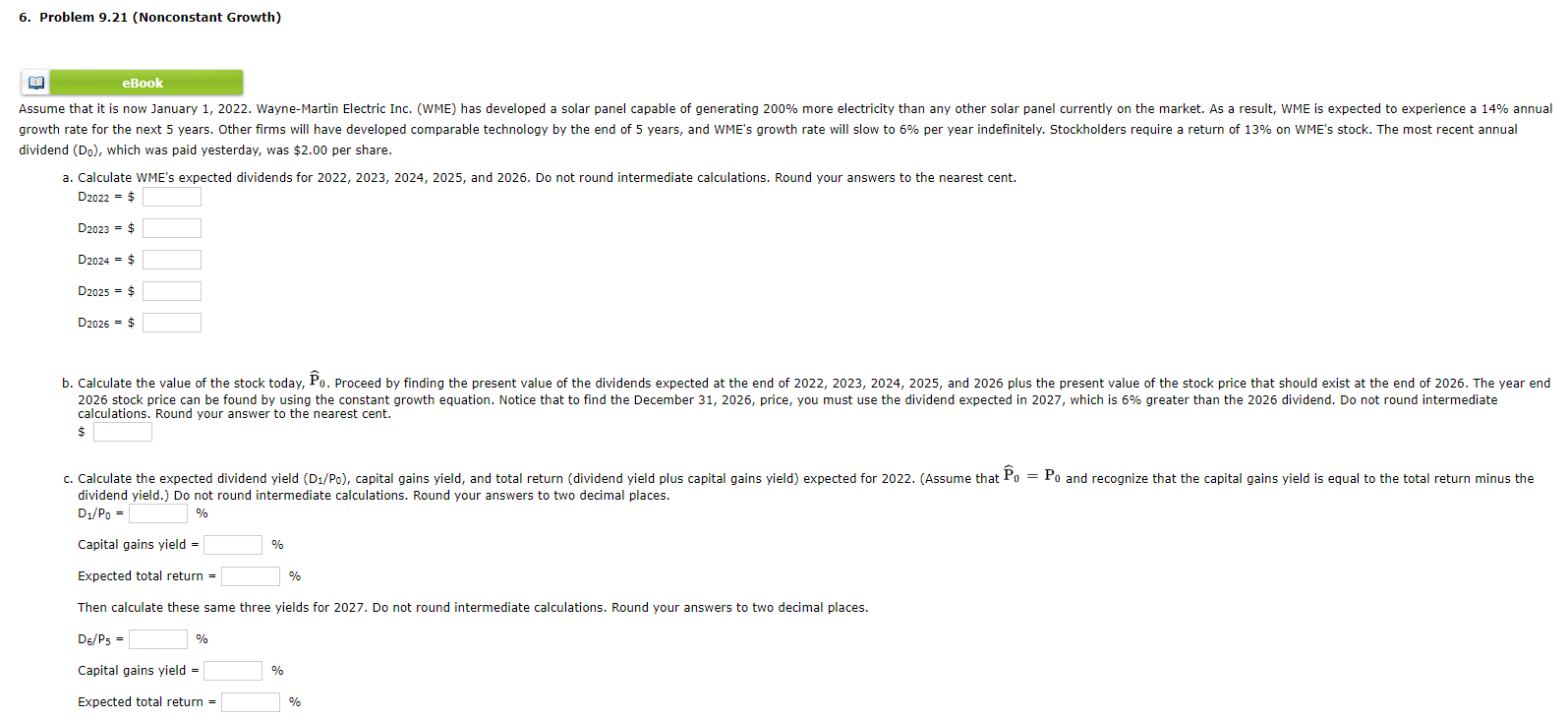

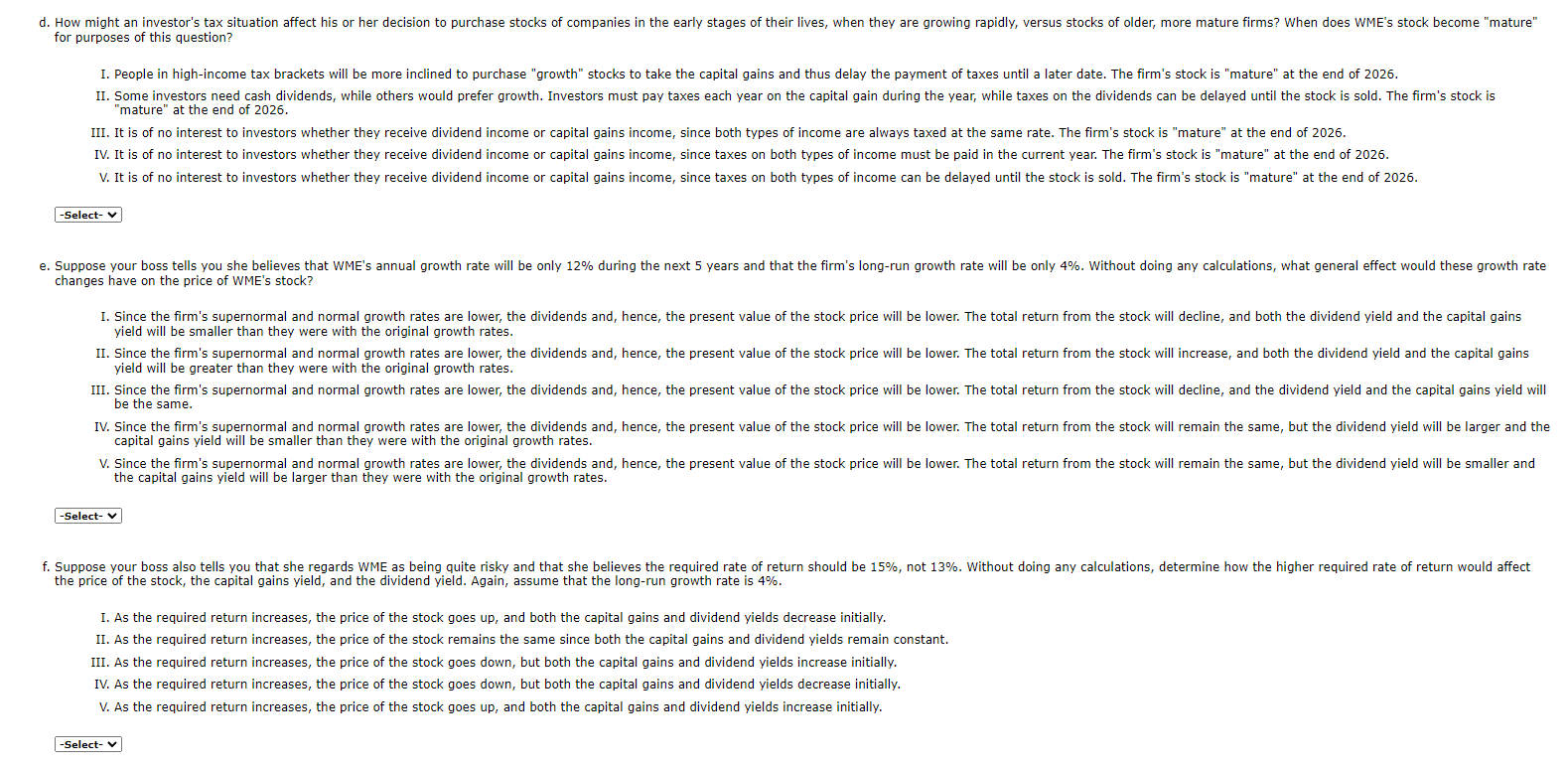

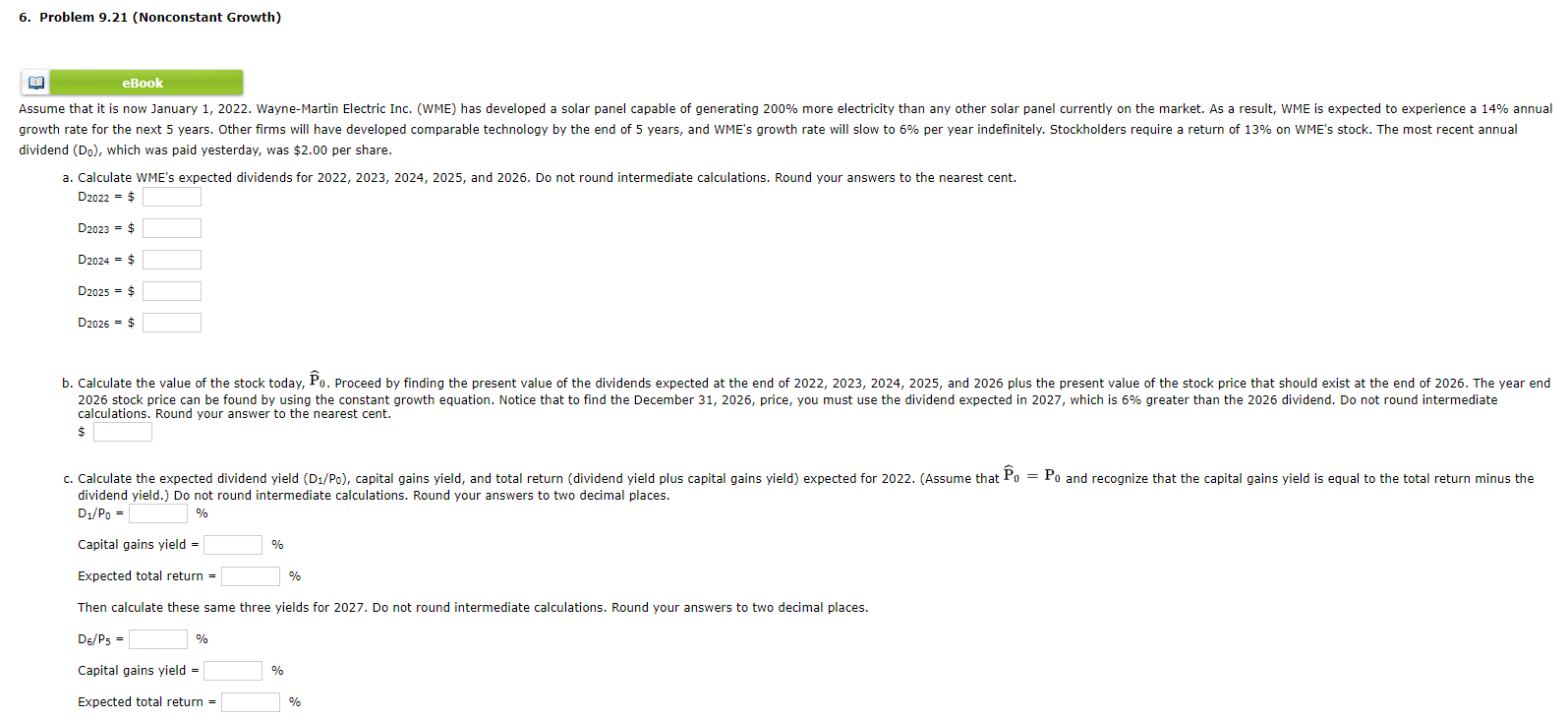

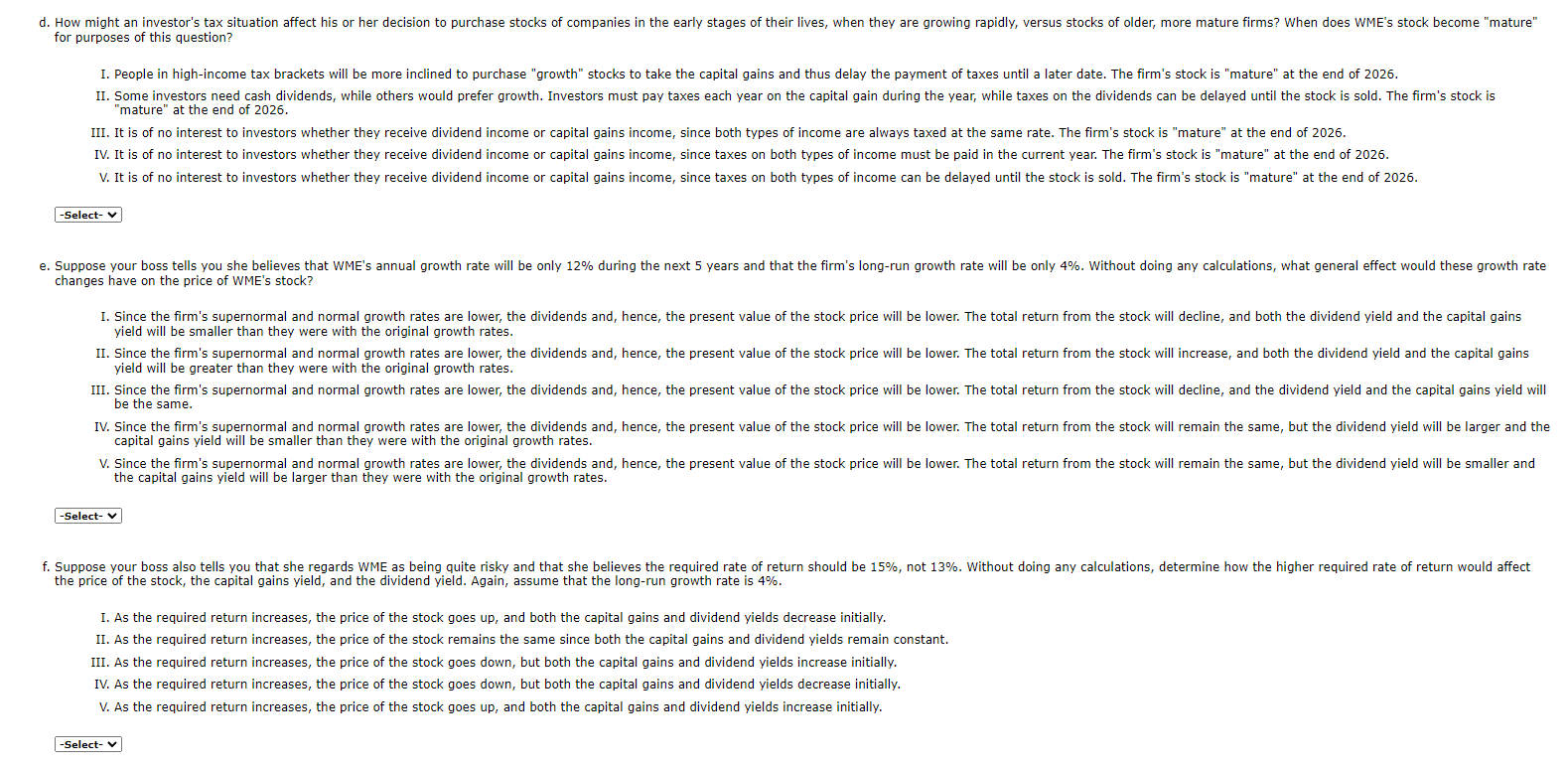

ividend (D0), which was paid yesterday, was $2.00 per share. a. Calculate WME's expected dividends for 2022, 2023, 2024, 2025, and 2026. Do not round intermediate calculations. Round your answers to the nearest cent. D2022=$D2023=$D2024=$D2025=$D2026=$ calculations. Round your answer to the nearest cent. $ dividend yield.) Do not round intermediate calculations. Round your answers to two decimal places. D1/P0= Capital gains yield =% Expected total return =% Then calculate these same three yields for 2027. Do not round intermediate calculations. Round your answers to two decimal places. D6/P5= Capital gains yield = % Expected total return = for purposes of this question? "mature" at the end of 2026 changes have on the price of WME's stock? yield will be smaller than they were with the original growth rates. yield will be greater than they were with the original growth rates. be the same. capital gains yield will be smaller than they were with the original growth rates. the capital gains yield will be larger than they were with the original growth rates. the price of the stock, the capital gains yield, and the dividend yield. Again, assume that the long-run growth rate is 4%. I. As the required return increases, the price of the stock goes up, and both the capital gains and dividend yields decrease initially. II. As the required return increases, the price of the stock remains the same since both the capital gains and dividend yields remain constant. III. As the required return increases, the price of the stock goes down, but both the capital gains and dividend yields increase initially. IV. As the required return increases, the price of the stock goes down, but both the capital gains and dividend yields decrease initially. V. As the required return increases, the price of the stock goes up, and both the capital gains and dividend yields increase initially. ividend (D0), which was paid yesterday, was $2.00 per share. a. Calculate WME's expected dividends for 2022, 2023, 2024, 2025, and 2026. Do not round intermediate calculations. Round your answers to the nearest cent. D2022=$D2023=$D2024=$D2025=$D2026=$ calculations. Round your answer to the nearest cent. $ dividend yield.) Do not round intermediate calculations. Round your answers to two decimal places. D1/P0= Capital gains yield =% Expected total return =% Then calculate these same three yields for 2027. Do not round intermediate calculations. Round your answers to two decimal places. D6/P5= Capital gains yield = % Expected total return = for purposes of this question? "mature" at the end of 2026 changes have on the price of WME's stock? yield will be smaller than they were with the original growth rates. yield will be greater than they were with the original growth rates. be the same. capital gains yield will be smaller than they were with the original growth rates. the capital gains yield will be larger than they were with the original growth rates. the price of the stock, the capital gains yield, and the dividend yield. Again, assume that the long-run growth rate is 4%. I. As the required return increases, the price of the stock goes up, and both the capital gains and dividend yields decrease initially. II. As the required return increases, the price of the stock remains the same since both the capital gains and dividend yields remain constant. III. As the required return increases, the price of the stock goes down, but both the capital gains and dividend yields increase initially. IV. As the required return increases, the price of the stock goes down, but both the capital gains and dividend yields decrease initially. V. As the required return increases, the price of the stock goes up, and both the capital gains and dividend yields increase initially