Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jade works full-time as a librarian at the Giblin Eunson Library at The University of Melbourne. Jade's salary income during the year ended 30

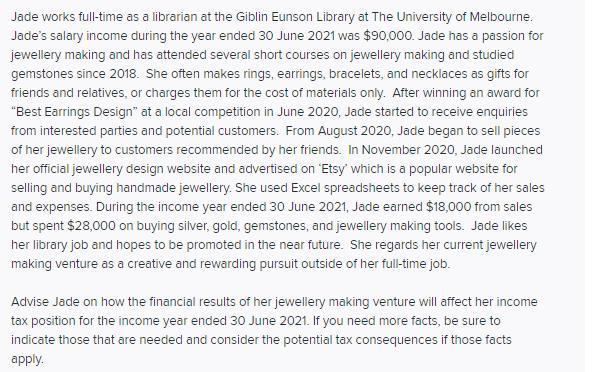

Jade works full-time as a librarian at the Giblin Eunson Library at The University of Melbourne. Jade's salary income during the year ended 30 June 2021 was $90,000. Jade has a passion for jewellery making and has attended several short courses on jewellery making and studied gemstones since 2018. She often makes rings, earrings, bracelets, and necklaces as gifts for friends and relatives, or charges them for the cost of materials only. After winning an award for "Best Earrings Design" at a local competition in June 2020, Jade started to receive enquiries from interested parties and potential customers. From August 2020, Jade began to sell pieces of her jewellery to customers recommended by her friends. In November 2020, Jade launched her official jewellery design website and advertised on Etsy' which is a popular website for selling and buying handmade jewellery. She used Excel spreadsheets to keep track of her sales and expenses. During the income year ended 30 June 2021, Jade earned $18,000 from sales but spent $28,000 on buying silver, gold, gemstones, and jewellery making tools. Jade likes her library job and hopes to be promoted in the near future. She regards her current jewellery making venture as a creative and rewarding pursuit outside of her full-time job. Advise Jade on how the financial results of her jewellery making venture will affect her income tax position for the income year ended 30 June 2021. If you need more facts, be sure to indicate those that are needed and consider the potential tax consequences if those facts apply.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Jades Jewellery Making and Its Impact on her Income Tax for 20202021 Potential Taxability Business v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started